Start your US business from anywhere and keep it 100% compliant

Digital Trader and doola are proud to provide company formation services in the US!

We’ll form your company, get your EIN, and help you open your business bank account. Get your LLC or C-Corp started in any of the 50 states, including Wyoming or Delaware.

Backed by the best

Start your U.S. business

from anywhere in the world

From Business Formation to Bookkeeping and Tax Filings, we’ve got your back at every step.

All-in-one company formation services

U.S. Business Formation Filings

We handle all required paperwork to register your business officially in the U.S., ensuring compliance from day one.

Business Documentation

We help you get the business documents needed for banking, taxes, and hiring employees.

Registered Agent Service

We provide a trusted Registered Agent to receive important government documents on your behalf, keeping your business compliant.

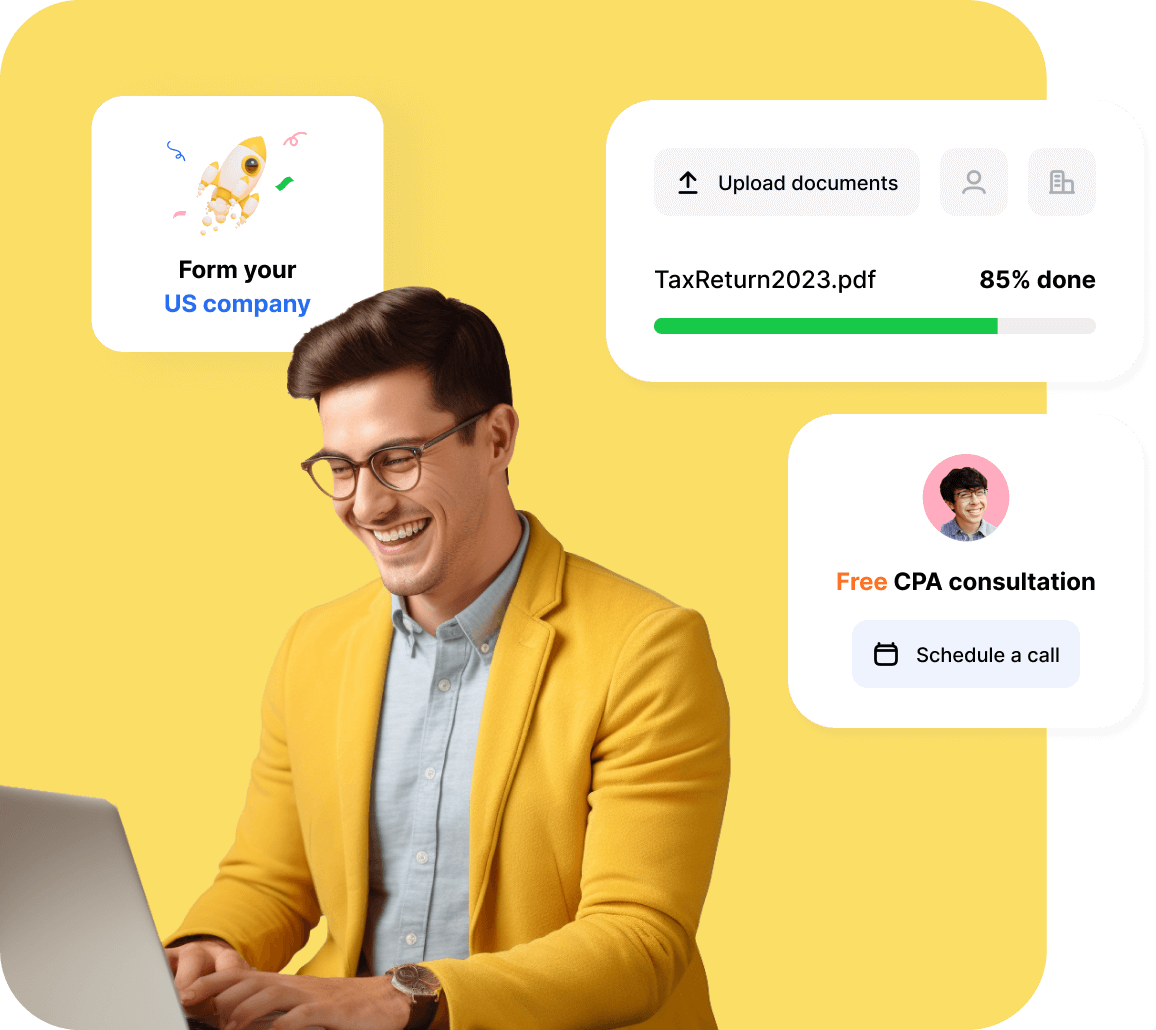

Dedicated Bookkeeping

We manage your books while our software syncs with your bank accounts and Stripe, tracking and categorizing every transaction.

Tax Filings

We handle your annual tax filings with our in-house tax and CPA teams to maintain good standings and avoid hefty penalties.

Operating Agreement & Articles of Organization

We prepare and file foundational documents to legally establish your business structure and operations.

The quick path to forming your business

Step 1

Submit your information through our user-friendly Dashboard

To kick off the process, you’ll need to provide some basic information about your future business.

- Company information (Preferred name, entity type, state, and a few other basics)

- Members information (Legal name, address, ownership, and a few additional details)

15 minutes

Step 2

Register your

U.S. company in any of

the 50 states

We handle all the essential legal steps to officially establish your business.

- Company Formation in any U.S. state

- Operating Agreement & Articles of Organization

- Registered Agent Service for secure document handling

1 week (on average)

Step 3

Secure your Business

Documentation

We secure your Business Documents needed for opening a business bank account, hiring employees, and filing taxes.

- Essential Business Documents

1 – 2 business days (US residents)

4-6 weeks (on average) (non-US residents)

Step 4

Set up your

U.S. bank account

Once you get your business documents, you can apply for a U.S. bank account through our partner portal

- Business Documents required

- Passport required (for international clients)

3 – 5 business days

Step 5

Run & grow

your business

Your business is fully set up and compliant, so you’re ready to dive into your work with confidence.

- Additional Services Keep your company on track with our bookkeeping and tax services.

- Stay Compliant For full compliance support, consider starting with Total Compliance.

Siddharth is an

Amazon Seller who

started a US LLC

from India.

Limited Liability Companies (LLC)

A Limited Liability Company (LLC) is a flexible business structure in the U.S. that offers personal liability protection and can have one or multiple owners (called members). It’s popular among small business owners and entrepreneurs for its simplicity and tax flexibility.

- Limited liability protection for owners

- Simple management structure and easy to operate

- Unlimited owners (U.S. and international)

- LLCs cannot issue stock

- Ownership represented by members

Sam & Melina are

Co-founders

who started

a C-Corp

from France.

C-Corporation (C-Corp)

A C-Corporation (C-Corp) is a type of business entity that is legally separate from its owners, providing strong liability protection. It’s the default corporation type in the U.S. and is often chosen by businesses that plan to grow and attract investors.

- Limited liability protection for owners

- Ability to raise capital by issuing stock

- Ownership represented by shareholders

- Management structure with more operating requirements

Jessica is a

Software Engineer

who started an

S-Corp from

New York.

S-Corporation (S-Corp)

Only U.S. citizens or residents can be shareholders.

An S-Corporation (S-Corp) is a business structure that offers limited liability like a corporation but with the tax benefits of a pass-through entity. Profits and losses pass directly to the owners’ personal income, avoiding double taxation.

- Limited liability protection for owners

- Pass-through taxation

- Ability to raise capital by issuing stock

- Only U.S. citizens or residents can be shareholders

- Limited to 100 shareholders or fewer

Empowering your business beyond formation

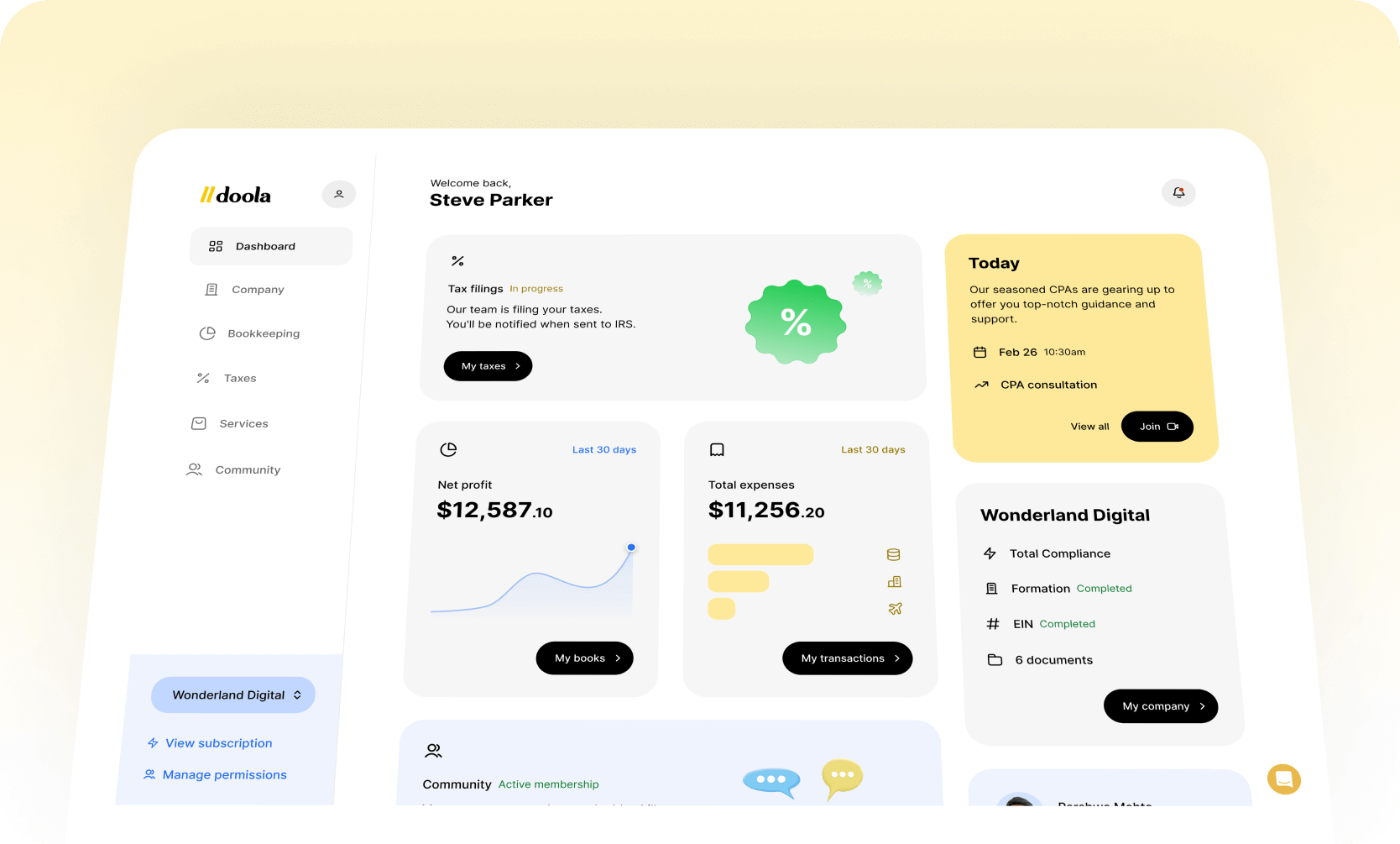

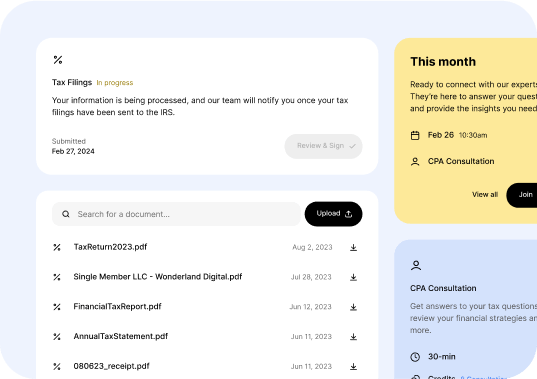

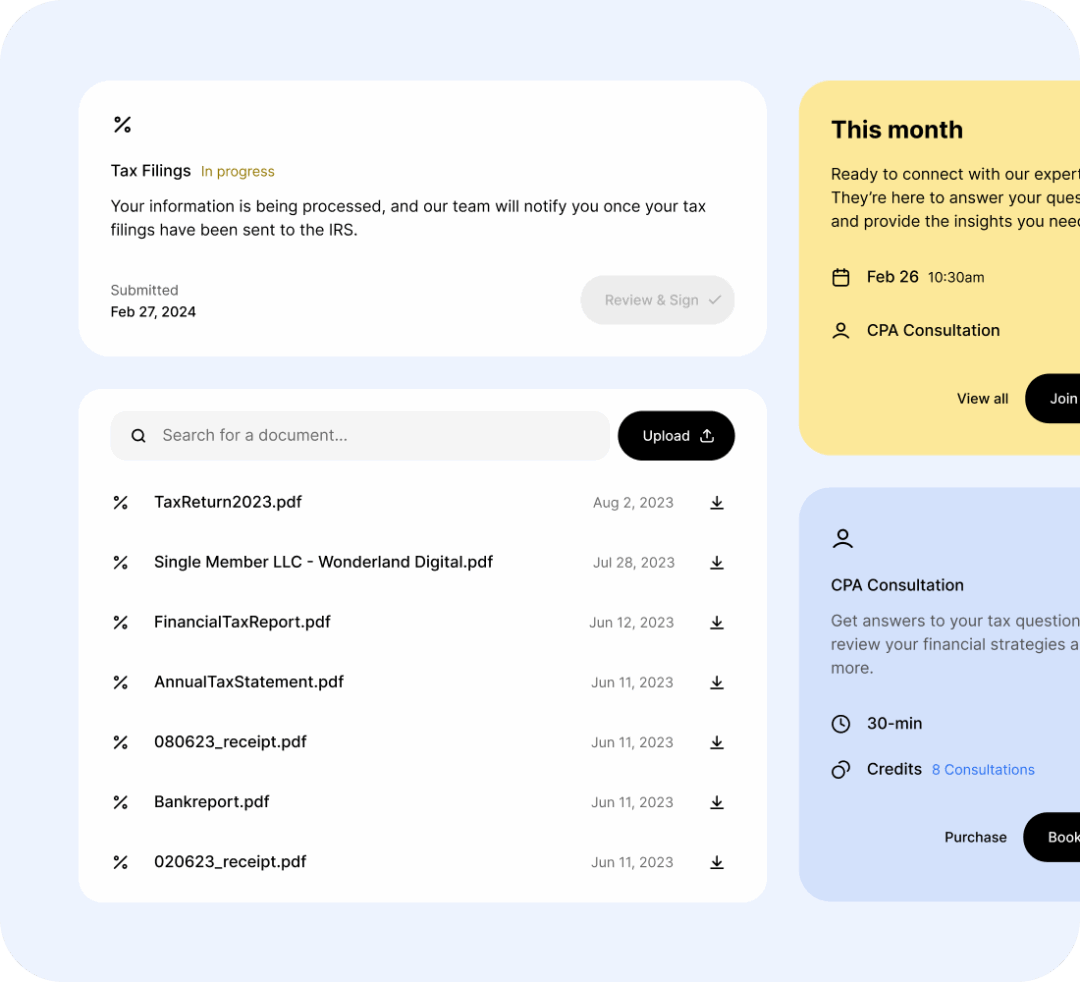

Bookkeeping

Our Bookkeeping software lets you track and categorize transactions, send invoices, and monitor client payments—all with the added support of a Dedicated Bookkeeper to ensure accuracy and meet your unique needs.

Taxes

Our team will prepare your annual tax return for submission. Our experts will ensure you stay up-to-date with any changes to tax laws and assist you in claiming all applicable credits.

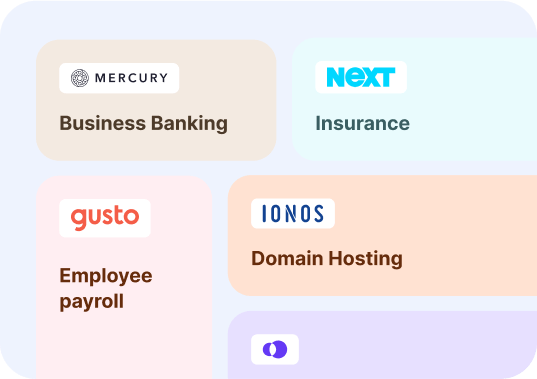

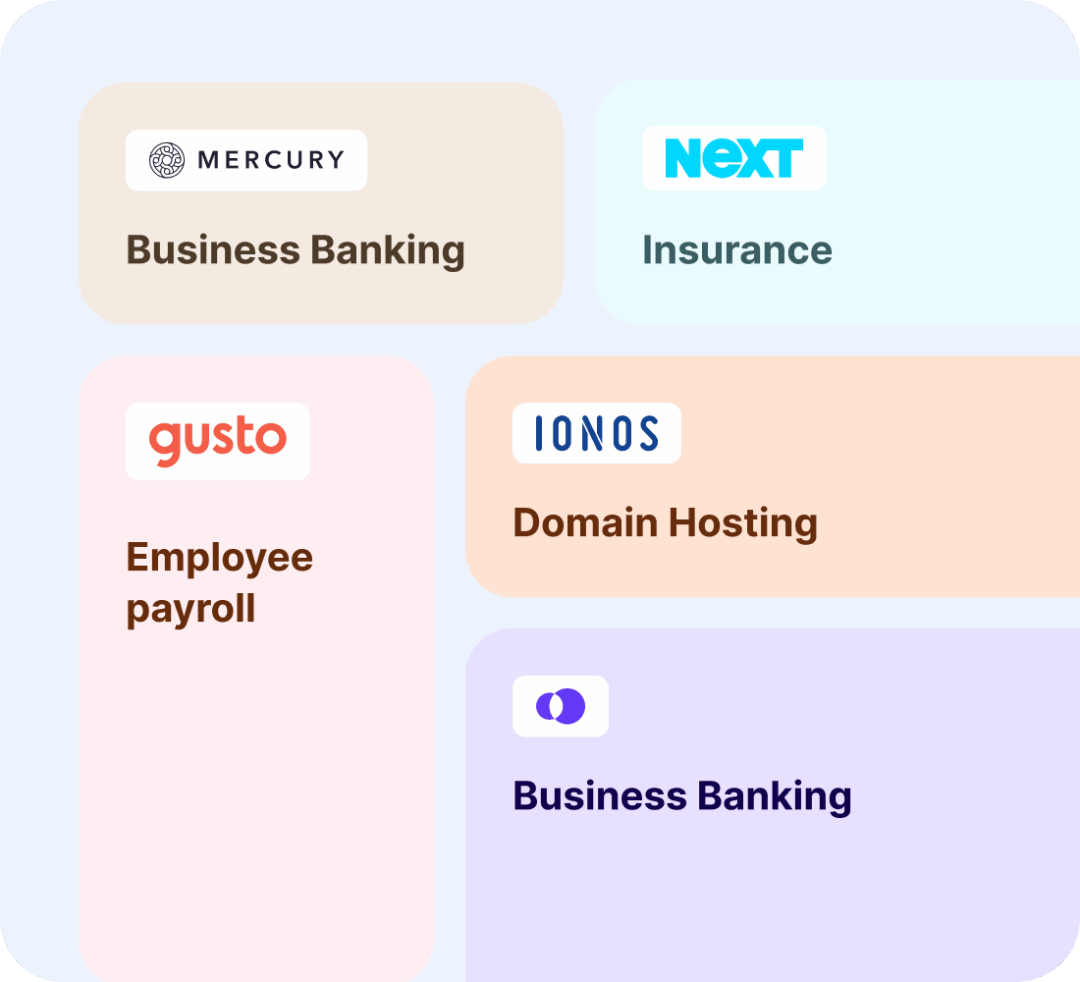

Marketplace

For any services we don’t offer directly, we have the right partners to support your business. Discover exclusive deals with industry-leading providers in our Marketplace, covering everything from business banking to insurance.

Unleash your success now

Discover essential reads

How to open a U.S. bank account?

How to open an LLC for Non-U.S. residents?

How to create a U.S. Stripe account?

How much does an LLC cost in every state?

Perks and Rewards

Get access to $100,000 in perks and rewards from the best brands, globally

And you can get your brand in front of our global customer base, today.

Meet our customers

doola is the best partner who has the ability & flexibility to accommodate the rapid changes that any business will need.

Mazeer Mawjood

Founder of AuroraRCM

I had a hassle-free experience with doola. You don’t need to spend hours on researching how to start a company.

Manja Munda

Co-founder of Grow & Scale

FAQs

Why should I get an LLC and a business bank account?

Forming an LLC and opening a business bank account are essential steps to protect your personal assets and streamline your finances. An LLC limits your personal liability in case of legal or financial issues, while a business bank account helps you separate personal and business finances, making tax preparation easier and ensuring a more professional image for your business.

Do I need to be a US citizen to work with doola?

No, you don’t! We work with entrepreneurs from around the world to get their businesses incorporated. Don’t take our word for it, though; check out our TrustPilot Page to hear what people globally have to say about doola.

What is an LLC (Limited Liability Company)?

A limited liability company is a formal business structure (created as per state law) where the business is legally distinct from the owner(s). It may have a single owner in the case of a Single-Member LLC or multiple owners in the case of a Multi-Member LLC.

An LLC combines the perks of a corporation (protection against personal liability) and a partnership (pass-through taxation). Since the business has a separate legal existence, the members are not personally liable for the debts and obligations of the Company.

State laws stipulate how LLCs should be incorporated. Some states require specific documents, such as the articles of organization, membership agreement, etc., to be filed with the authorities.

Learn more about LLCs and how they work in FREE ebook.

What information do you need from me to get started?

We don't need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

Later in the process, you'll need a passport to set up your bank account.

What is an EIN?

An Employer Identification Number is the tax identification number for your organization and a requirement of many banks or institutions (such as the IRS) to carry out business in the US. Once your EIN is acquired, you can apply for business bank accounts and payment gateways. Learn more about the full process.

What is an ITIN?

An Individual Tax Identification Number (ITIN) can be used as an alternative for a Social Security Number (SSN) in some cases and is not a requirement in most cases. However, you will be required to have one if you wish to apply for a PayPal account or certain bank accounts. We walk you through how this process looks like in our guide!

Still have a question?

Schedule a free consultation with an expert from doola, today.

Start your dream business with doola today

Sit Back & Relax. We’ll Handle the Rest.