Language:

A Basic Guide to Bookkeeping for Nonprofits

Nonprofit organizations play a crucial role in serving communities and positively impacting society. These organizations are established for charitable, educational, or religious purposes and do not operate to make profits.

Like any organization, nonprofits also have financial responsibilities requiring proper bookkeeping practices.

Also, if you’d rather focus on what you do best — making an impact, doola’s All-In-One-Accounting is here to manage your books and numbers for you!

In this comprehensive guide, we will break down the basics of bookkeeping for nonprofits and show you how to keep your financial records in order.

Whether you’re a seasoned pro or just starting out, this blog post is packed with tips and tricks to help you navigate the world of finance confidently. So, let’s dive right in!

How Bookkeeping for Nonprofits is Different

One key difference between bookkeeping for nonprofits and traditional businesses is that nonprofits are accountable to their donors and the public.

This means they must maintain transparent financial records that show how donations are being used to fulfill their mission.

The primary goal of bookkeeping for nonprofits is not just about tracking money but also about demonstrating accountability, transparency, and credibility.

It allows donors, grantors, volunteers, and other stakeholders to see how donations are being utilized to create social impact.

Furthermore, effective bookkeeping ensures compliance with accounting standards set by regulatory bodies such as the Financial Accounting Standards Board (FASB) or the Governmental Accounting Standards Board (GASB).

These standards provide guidelines on how nonprofit organizations should record transactions accurately while adhering to ethical practices.

Importance of Bookkeeping for Nonprofits

Bookkeeping involves recording financial transactions and keeping track of all incoming and outgoing funds. Like any other business, nonprofits must maintain accurate and organized financial records to operate effectively and fulfill their mission.

Moreover, bookkeeping can help nonprofits make informed decisions about budgeting and spending.

By regularly monitoring financial records, nonprofit leaders can better understand their organization’s financial health and strategically allocate funds to achieve their goals.

Proper bookkeeping practices help ensure that all financial documents are up-to-date and accurate, making it easier to meet regulatory obligations.

It will help you capitalize on certain regulations regarding tax-exempt status and fundraising activities to secure funding for the organization.

Donors often request access to a nonprofit’s financial statements before making donations or grants.

Well-kept books show potential funders that the organization takes its finances seriously and supports internal control within the nonprofit.

This refers to measures put in place by an organization to safeguard its assets from fraud or misuse.

Basic Principles of Bookkeeping for Nonprofits

The first and most important principle of bookkeeping is accurate record keeping. This means that all financial transactions should be recorded promptly and with precision.

Nonprofits must maintain detailed records of all income and expenses, including donations, grants, program fees, and other sources of revenue.

Nonprofits often receive funds from various sources, such as government grants, donations from individuals or corporations, and program fees. It is crucial to keep these funds separate to track how each source is being utilized accurately.

This also ensures transparency and accountability when presenting financial reports to donors or grantors.

Regular bank reconciliation is also crucial. This involves comparing bank statements with internal accounting records to ensure that both balances match at the end of each month.

This process helps identify any discrepancies or errors that may have occurred during recording. It is an important step in ensuring accurate financial reports.

Setting Up a Chart of Accounts

A well-organized chart of accounts is essential for effective bookkeeping in nonprofits.

It provides a solid foundation for accurate financial reporting and helps streamline the bookkeeping process for accounting and tax calculations. Setting up a comprehensive chart of accounts can save time and headaches in the long run.

The first step in setting up a chart of accounts is to determine what types are needed. This will vary depending on the size and nonprofit, but some common categories should be included in any chart of accounts.

These include income, expenses, assets, liabilities, equity, and restricted funds.

Income accounts should include all sources of revenue for the organization, such as donations, grants, fundraising events, and program fees. Expenses should be categorized as salaries and wages, office supplies, rent or mortgage payments, utilities, and other operating expenses.

Assets include cash in bank accounts or savings bonds, while liabilities consist of loans or lines of credit. It is important to create subcategories specific to your nonprofit’s operations within each category.

For example, under expenses, you may have subaccounts for payroll taxes if your organization has employees.

If your nonprofit receives government grants or contracts with specific restrictions on how the funds can be used, it’s important to set up separate subaccounts for those restricted funds.

Another key consideration when setting up a chart of accounts is whether you want to use accrual or cash-based accounting.

Accrual accounting records income when earned and expenses when incurred regardless of when money changes hands. Cash-based accounting records income when received and expenses when paid out.

This will ensure that your financial records accurately reflect the organization’s operations.

Recording Income and Expenses

Recording income and expenses involves accurately tracking all the money coming into and leaving the organization to maintain financial stability and transparency. The first step is establishing a system for categorizing them.

This can be done by creating different accounts or categories in your automated bookkeeping software or using separate folders if you are keeping physical records.

Some common categories for income include donations and grants, while expenses may include salaries, office supplies, and rent.

Next, all sources of income must be recorded accurately. This includes any donations from individuals or businesses and grants from government agencies or foundations.

It is important to keep detailed records of these transactions, including the date received, the source of the funds, and any restrictions on how they can be used.

Similarly, all expenses incurred by the organization should also be recorded diligently.

This includes both cash payments and credit card transactions. It is recommended that a designated person be responsible for making payments on behalf of the organization to ensure proper documentation of all expenses.

Tracking Donations and Grants

The first step in tracking donations and grants is to create a system for recording all incoming funds.

This can be done through donation management software or a simple spreadsheet. The key is to have a designated place where all donation information can be easily accessed and organized.

Next, it’s important to categorize the donations based on their source. Donations can come from various sources, such as individual donors, corporations, foundations, government agencies, or fundraising events.

Each source may have different reporting requirements, so it’s crucial to categorize the donations accurately.

Collect their contact information and the amount donated for proof of receipt when recording individual donor contributions.

For corporate or foundation grants, keep track of any restrictions or special conditions attached to the funding, such as how the funds should be used or specific reporting requirements that must be met.

In addition to tracking incoming funds, it’s equally crucial to record how the nonprofit is using these donations. This includes expenses related directly or indirectly to the organization’s programs and services.

By keeping track of these expenses, nonprofits can ensure that they are using their funds effectively and efficiently.

Reporting and Financial Statements for Nonprofits

Reporting is crucial for nonprofits as it provides an overview of an organization’s financial performance and its impact on achieving its mission. This information allows for informed decisions, goal setting, and identification of areas for improvement.

It also ensures compliance with legal requirements and enables effective communication with stakeholders.

Nonprofits should produce three main types of reports regularly: income statements, balance sheets, and cash flow statements. The income statement shows the organization’s revenues and expenses incurred during a specific period.

The balance sheet presents a snapshot of an organization’s assets (what it owns), liabilities (what it owes), and net assets (the difference between assets – liabilities).

Likewise, the cash flow statement tracks the inflow and outflow of cash over a specific period. It shows how much cash is available to cover operating expenses or invest in new projects.

Since donors play a significant role in supporting nonprofit organizations, producing easy-to-understand financial statements that provide transparency about how donor funds are utilized is essential.

It is advisable to seek professional help from dedicated bookkeepers with experience working with nonprofit organizations.

Best Practices for Auditing and Reporting

Auditing and reporting are crucial aspects of bookkeeping for nonprofits.

They provide transparency and accountability to stakeholders and help identify potential errors or discrepancies in financial records.

Following these best practices for auditing and reporting will ensure compliance with regulations and promote transparency and trust within your organization.

1. Establish Internal Controls

Establishing strong internal controls is the first step toward ensuring accurate audits and reports.

This includes properly segregating duties, maintaining a clear record-keeping system, and implementing checks and balances to prevent fraud or mismanagement of funds.

2. Regular Reconciliation

Regularly reconciling your bank accounts, credit card statements, and other financial records is essential. This helps identify any discrepancies early on so they can be corrected before the audit.

3. Documentation

Thorough documentation is crucial for both auditing and reporting purposes. Relevant documents, such as invoices, receipts, contracts, etc., should support all financial transactions.

Having organized and well-documented records makes it easier for auditors to verify the accuracy of your financial statements.

4. Use Accounting Software

Nonprofits can greatly benefit from using specialized accounting software designed for their needs.

These tools make bookkeeping more efficient and provide features like automatic expense categorization, tracking donor contributions, and generating reports with just a few clicks.

5. Segregate Restricted Funds

Many nonprofits receive donations or grants that are restricted in use by the donor or grantor. To ensure compliance with their terms, separate accounts or fund categories must be designated for these restricted funds.

6. Conduct Internal Audits

Along with external audits performed by independent auditors, conducting internal audits can help identify any weaknesses in the organization’s financial management processes before they become major issues during external audits.

7. Audit Preparation

Prior preparation is key to successful external audits.

Ensure all relevant documents are organized and readily available, financial statements are accurate, and all necessary schedules and disclosures are completed.

8. Timely Reporting

Nonprofits are required to submit annual reports to the IRS and other regulatory bodies. To avoid penalties or legal issues, these reports should be submitted accurately and on time.

Compliance and Regulations for Nonprofits

Staying compliant with these regulations is crucial for the success of any nonprofit organization. Failure to comply can result in loss of tax-exempt status, fines, or even legal action.

Therefore, nonprofits must stay informed about these requirements and regularly review their policies and procedures to ensure compliance.

The most important aspect of compliance for nonprofits is maintaining their tax-exempt status. To obtain this status, organizations must file for recognition as a 501(c)(3) entity with the Internal Revenue Service (IRS).

This requires meeting specific criteria such as having a charitable purpose, being organized for public benefit, and not engaging in political activities.

Nonprofits must also ensure they file annual information returns (Form 990) with the IRS to maintain their tax-exempt status.

In addition to obtaining federal tax exemption, nonprofits may be required to register with the state where they operate.

Each state has its own set of registration requirements for charities, so it’s crucial to research and comply with these regulations to avoid potential penalties or fines.

Nonprofits should also have proper governance policies to ensure accountability and transparency in their operations.

These policies include conflict of interest, whistleblower, and document retention policies to maintain compliance and trust with donors and stakeholders.

If they have employees, nonprofits must comply with all relevant employment laws, such as minimum wage laws, anti-discrimination laws, worker’s compensation insurance requirements, etc.

Organizations must also have proper employee records and a payroll system to ensure compliance with these laws.

Some states have specific regulations governing soliciting donations from individuals or corporations within their jurisdiction. These regulations may include registration and reporting requirements, disclosure statements, and restrictions on fundraising practices.

Nonprofits must research and comply with these laws to avoid potential legal issues.

Get professional guidance from a CPA specializing in nonprofit law to navigate the complex world of compliance and regulations for nonprofits.

Common Mistakes to Avoid in Nonprofit Bookkeeping

Organizations often make common mistakes when it comes to bookkeeping for nonprofits.

These errors can lead to financial mismanagement and have serious consequences, such as losing tax-exempt status or damaging the organization’s reputation.

Mixing personal and business finances is a mistake that many small nonprofits make due to limited resources or a lack of understanding about the importance of separating personal and business finances.

It is crucial to have a separate bank account for your nonprofit organization and avoid using personal funds for organizational expenses.

Failure to reconcile accounts means matching your accounting records with bank statements or credit card statements. Many nonprofits fail to do this regularly, resulting in discrepancies in their financial reports.

This can lead to incorrect reporting of income or expenses, which can be problematic during audits.

Improper transaction classification can result in inaccurate financial statements, which can be problematic for the organization.

Proper classification ensures that income and expenses are recorded correctly in the books according to generally accepted accounting principles (GAAP).

Tools and Resources for Nonprofit Bookkeeping

Nonprofit organizations have unique accounting needs, and proper bookkeeping is crucial for their success and sustainability.

Fortunately, various tools and resources are available that can help streamline nonprofit bookkeeping processes, save time and money, and ultimately contribute to the success of the organization’s mission.

1. Accounting Software

One of the most important tools for nonprofit bookkeeping is accounting software.

These programs come with features specifically designed for nonprofits, such as tracking donations and grants, budgeting, and creating reports for stakeholders.

2. Bookkeeping Systems

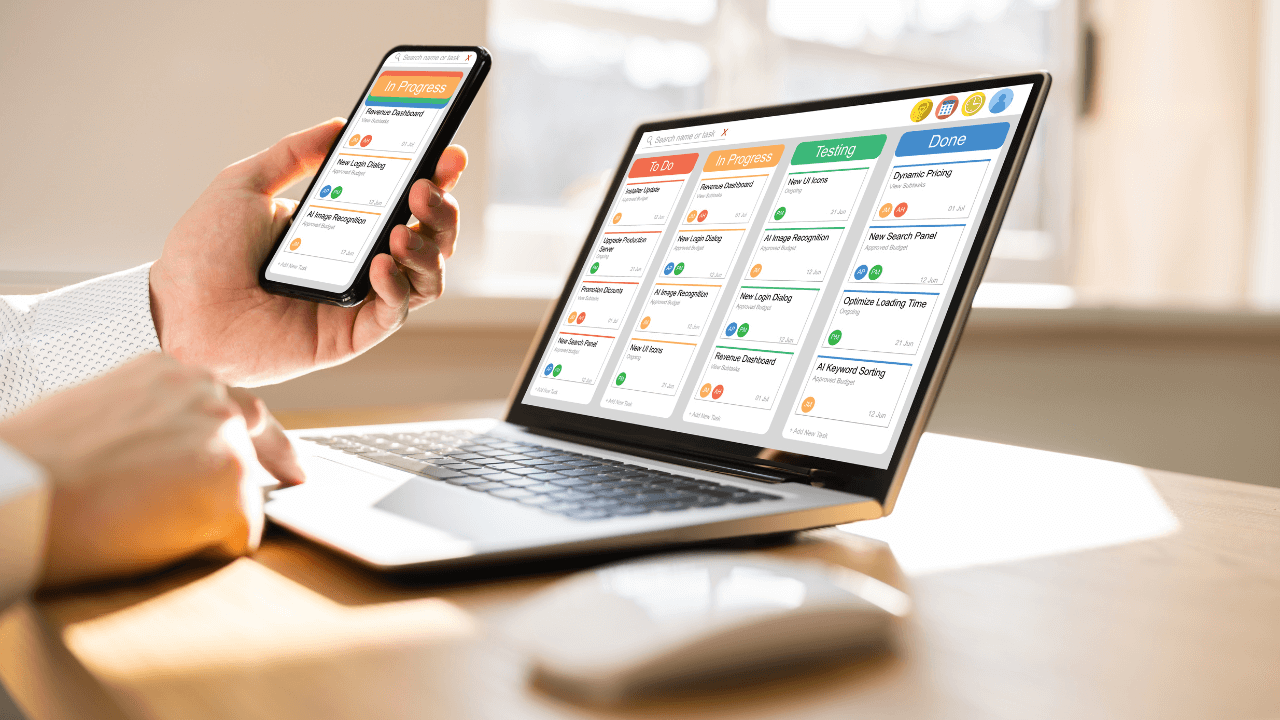

With the rise of technology, many nonprofits now opt for digital bookkeeping systems instead of traditional pen and paper.

These systems integrate multiple processes to record and update all transactions automatically, allowing users to access financial data in real-time from anywhere with an internet connection.

3. Fundraising Platforms

Many nonprofits rely on fundraising events or campaigns to fund their causes.

In such cases, a fundraising platform like DonorPerfect or GoFundMe can help streamline the donation process by automatically recording contributions into the organization’s books.

4. Budgeting Tools

Budgeting is essential to nonprofit bookkeeping as it helps organizations plan expenses and track spending against revenue.

Tools like You Need a Budget (YNAB) or Mint can help create budgets based on income streams and provide insights into potential cost-cutting measures.

5 . Online Payment Processing Services

Accepting online payments has become increasingly important for nonprofits due to their convenience for donors and potential increase in donations.

You can sign up for Payoneer, which can be useful as it offers discounted transaction fees and super-fast payments, which can be beneficial for nonprofit organizations.

In addition to these tools and resources, nonprofits should consult a CPA to ensure that all financial records are accurate and up-to-date and to obtain valuable budgeting and financial planning advice.

Get in the Good Books with doola Bookkeeping

Bookkeeping can be slightly different for nonprofits than for traditional businesses. doola is here to help nonprofits navigate these complexities with ease.

Our specialized services cater to nonprofits’ unique needs and ensure your organization complies with all the necessary regulations.

With doola’s All-in-One Accounting, nonprofits can rest assured that their financial books are in good hands. This allows them to focus on their mission and positively impact the community.

Leave the number crunching to us – book a demo today and get on the good books!