Unlock the best all-in-one platform in the industry.

- I Need a New U.S. Company

- I Have an Existing U.S. Business

30-Day Free Trial

$297/yr

+ State Fees

$1,999/yr

+ State Fees

$329/mo

+ State Fees

| $0 Business Formation + STATE FEES | |||

|---|---|---|---|

| Formation Filings | |||

| Employer Identification Number (EIN) | |||

| Operating Agreement / Corporate Bylaws | |||

| Expedited EIN Processing ONLY WITH ANNUAL BILLING | |||

| Beneficial Ownership Information (BOI) Filing | |||

| Sales Tax Registration & Reseller Certificate TERMS APPLY |

| Compliance | |||

|---|---|---|---|

| Registered Agent Service | |||

| Virtual Mailing/Business Address | |||

| Dedicated Account Manager |

| Compliance OPTIONAL | |||

|---|---|---|---|

| Registered Agent Service | |||

| Virtual Mailing/Business Address | |||

| Dedicated Account Manager |

| Taxes | |||

|---|---|---|---|

| Annual State Tax Filings | |||

| 1:1 CPA Consultation | |||

| Business IRS Tax Filings |

| Bookkeeping | |||

|---|---|---|---|

| Track Your Transactions | |||

| Send Invoices | |||

| Download Financial Reports | |||

| Connect Multiple Bank Accounts | |||

| Monthly/Quarterly Closings | |||

| Dedicated Bookkeeper |

| Bookkeeping | |||

|---|---|---|---|

| Track Your Transactions | |||

| Send Invoices | |||

| Download Financial Reports | |||

| Connect Multiple Bank Accounts | |||

| Monthly/Quarterly Closings | |||

| Dedicated Bookkeeper |

| Free Bonuses | |||

|---|---|---|---|

| doola Community Full Access | |||

| $100,000 in Perks and Rewards |

- Only with Annual Billing.

- Sales Tax Registration in one state is included

- Only in Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, Wyoming.

$0 Business Formation + State Fees

Only with Annual Billing

- Only with Annual Billing.

- Sales Tax Registration in one state is included

- Only in Arkansas, Georgia, Indiana, Iowa, Kansas, Kentucky, Michigan, Minnesota, Nebraska, Nevada, New Jersey, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Dakota, Tennessee, Utah, Vermont, Washington, West Virginia, Wisconsin, Wyoming.

Compliance

Compliance Optional

Taxes

Bookkeeping

Free Bonuses

Deduct Up to $5,000 in Startup Costs.

You can deduct up to $5,000 for organizational expenses in the year your business is formed (including what you spend with doola). Your doola subscription is tax deductible and can be used to offset some of the taxes that your business may need to pay.

These expenses must be recorded in your business accounting books to qualify as a tax deduction,

and you must also retain and maintain receipts for these expenses.

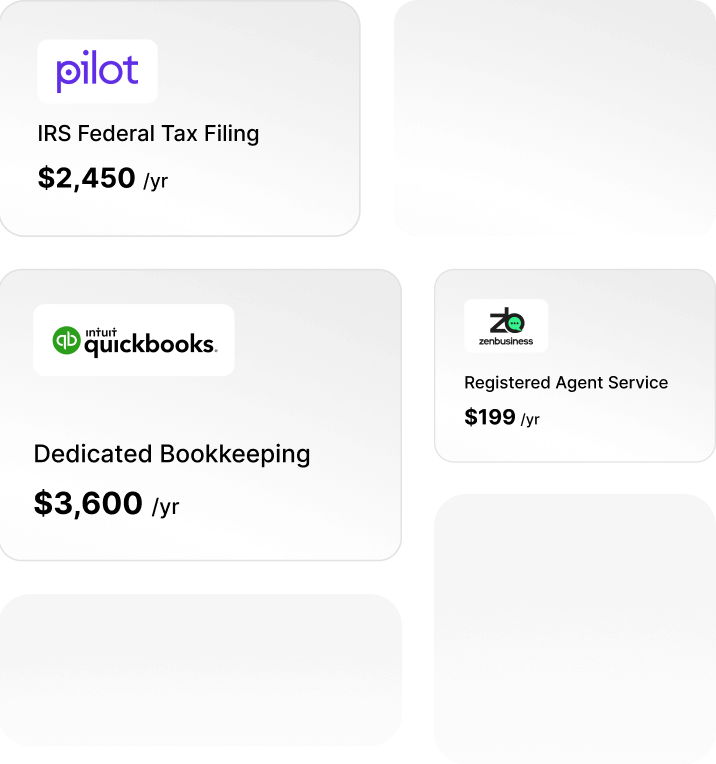

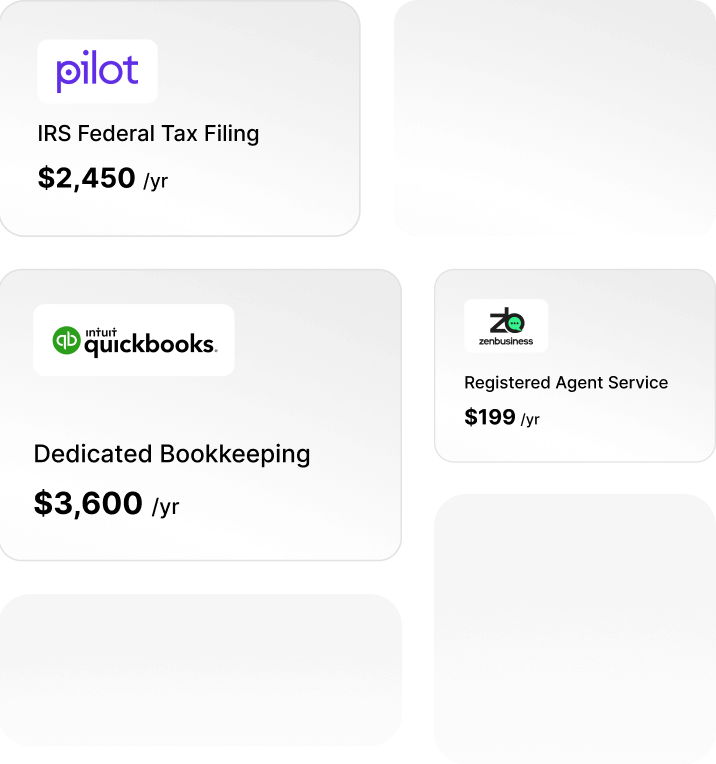

The Best Value in The Industry.

Whether you’re looking for comprehensive features or unbeatable savings,

our solution stands out as the most affordable choice.

10,000+ Founders

Built for Founders. Loved by Founders.

FAQs

What is doola?

Do I need to be a US citizen to work with doola?

Why should I get an LLC and a business bank account?

What information do you need from me to get started?

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

What is doola Bookkeeping?

Can doola help me with my business taxes?

Who is doola Analytics for?

Can doola help me with sales tax and reseller certificates?

Still have a question?

Schedule a free consultation with an expert from doola, today.

Less blah,

More doola.

Join doola and start building today.