Language:

How Do I Apply for ITIN? Ultimate Guide for International Founders in 2025

Need to get an ITIN as an international founder? Discover how to get yours with our easy guide.

Starting a business as an international founder in the US comes with its own set of challenges—and applying for ITIN (Individual Taxpayer Identification Number) could be one of them.

Unless you have a strategic guide and partner like doola!

Whether you’re navigating tax forms or unlocking financial perks, this doola guide has everything you need to know about how to apply for ITIN in 2025 and beyond.

Let’s doola it!

What Is an ITIN?

An Individual Taxpayer Identification Number (ITIN) is a tax processing number issued by the Internal Revenue Service (IRS).

The IRS issues ITINs to individuals who are required to have a US taxpayer identification number but who do not have, and are not eligible to obtain, a Social Security number (SSN) from the Social Security Administration (SSA).

What Is an ITIN Used For?

IRS issues ITINs to help individuals comply with the US tax laws, and to provide a means to efficiently process and account for tax returns and payments for those not eligible for Social Security numbers.

They are issued regardless of immigration status, because both resident and non-resident aliens may have a US filing or reporting requirement under the Internal Revenue Code.

Please note that:

ITIN does not serve any purpose except federal tax reporting.

An ITIN does not:

- Authorize work in the US

- Provide eligibility for Social Security benefits

- Qualify a dependent for Earned Income Tax Credit Purposes

Who Needs to Get an ITIN?

As a foreigner, you only need to apply for ITIN if you:

- Have a federal tax filing requirement (or informational reporting requirement)

- Do not qualify for an SSN

To better understand who needs an ITIN and its implications, you can also learn more about the Top 10 ITIN Myths that impact global founders and their finances.

What Is the Difference Between an ITIN, EIN and SSN?

While an ITIN is designed for non-residents and foreign nationals needing to fulfill tax obligations, the EIN is for businesses managing taxes and operations.

On the other hand, the SSN is issued to US citizens and eligible residents primarily for personal identification and employment purposes.

The following table aptly summarizes the differences:

| Identifier | Purpose | Who Needs It | Use Cases |

| ITIN | Tax compliance for non-residents and foreigners | Non-residents, foreign nationals without SSNs | Filing taxes, opening U.S. bank accounts |

| EIN | Business tax identification | US and foreign business entities | Paying employees, filing business taxes |

| SSN | Personal identification and employment | US citizens and eligible residents | Employment, credit applications, taxes |

ITIN vs. EIN vs. SSN

Simplify your ITIN application with doola today.

How Do I Get an ITIN?

There are a few exceptions which allow you to apply for ITIN.

Unless you meet the above exceptions you need to have the following in order to apply for and receive an ITIN:

- A tax filing requirement in the US and

- You need to file a federal income tax return

The standard list of documents when you apply for ITIN includes:

- Application for IRS Individual Taxpayer Identification Number (Form W-7)

- US federal income tax return (Work with an accountant who specializes in US taxes for foreigners)

- Proof of foreign status (list of accepted documents from the IRS)

- Proof of identity (list of accepted documents from the IRS)

Regarding proof of foreign status and proof of identity:

Your passport is the only document that can be used to prove both at the same time.

You can find out the documents that can be used to satisfy either requirement in the “Supporting Documentation Requirements” section here.

Because the passport can be used to prove both foreign status and identity at the same time it is the most popular, easy and common option.

doola’s streamlined ITIN application takes the hassle out of the process. So if you feel overwhelmed with the paperwork, just doola it!

Is There an Exception for Getting an ITIN for LLC Owners?

Again, to re-iterate, generally, the ITIN application must accompany your tax return.

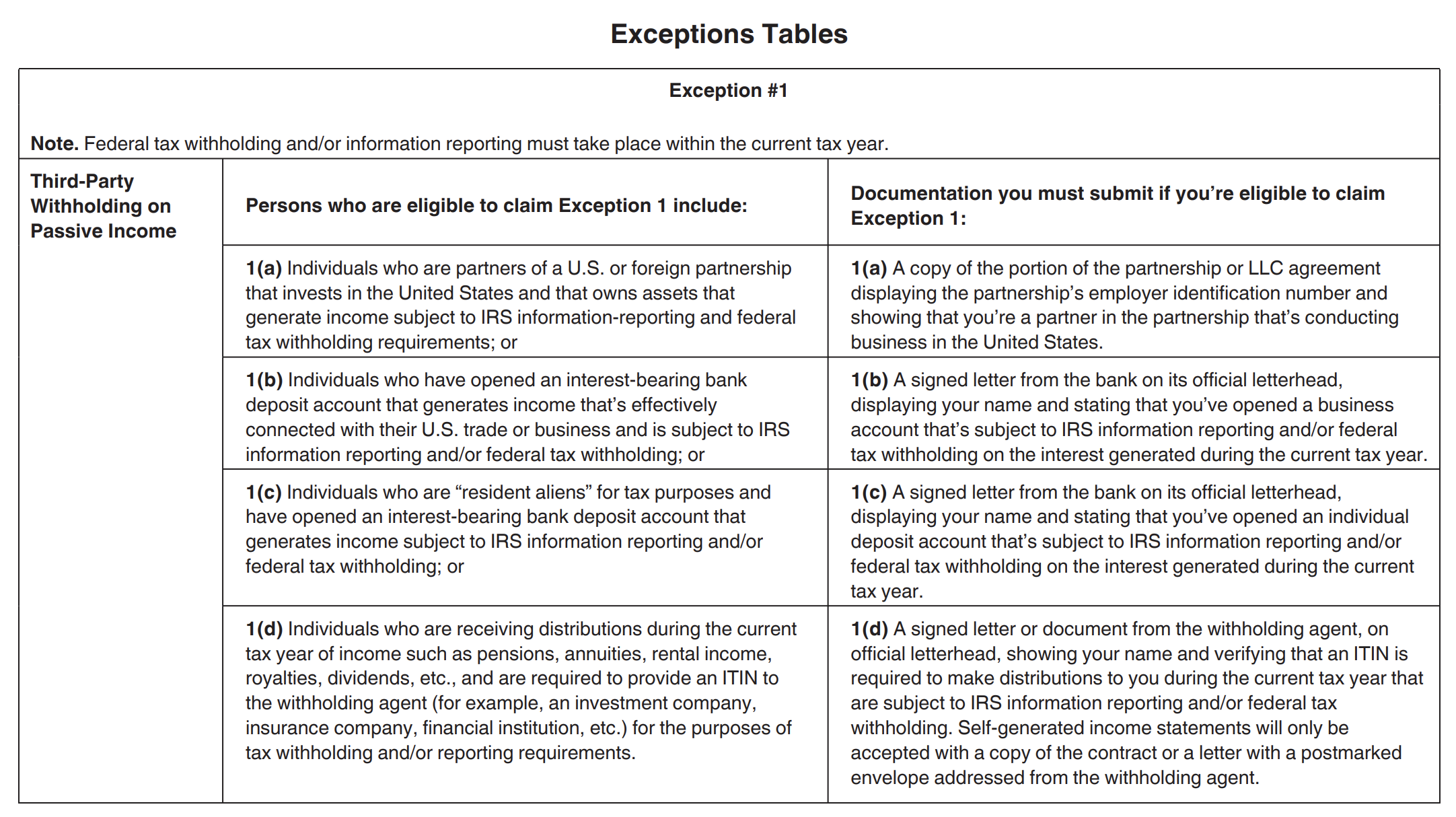

However, per the exception 1(a) listed on the IRS site (and image below as well):

📌 People eligible to claim Exception 1(a) include:

Individuals who are partners of a US or foreign partnership that invests in the United States and that owns assets that generate income subject to IRS information-reporting and federal tax withholding requirements.

📌 Documentation you must submit if you’re eligible to claim Exception 1(a):

A copy of the portion of the partnership or LLC agreement displaying the partnership’s employer identification number and showing that you’re a partner in the partnership that’s conducting business in the US.

How Do I Complete the Application for IRS Individual Taxpayer Identification Number (Form W-7)?

We strongly recommend working with a professional because if your Form W-7 has any mistakes, your ITIN Application will be rejected by the IRS.

However, if you would like to see what the application looks like and see the instructions to fill out the form on your own:

📌 Follow instructions from the IRS to download Form W-7, or

📌 You can download a copy of Form W-7.

How Do I Submit My Application to the IRS?

Per the Instructions for Form W-7 (please see the link for the most updated version, the details below are directly added from the Instructions):

✔️ By mail:

Mail Form W-7, your tax return (if applicable) or other documents required by an exception, and the documentation described under Supporting Documentation Requirements earlier, to:

Internal Revenue Service ITIN Operation P.O. Box 149342Austin, TX 78714-9342

If you mail your application, don’t use the mailing address in the instructions for your tax return.

✔️ By private delivery services:

If you use a private delivery service, submit your Form W-7, your tax return (if applicable) or other documents required by an exception, and the documentation described under Supporting Documentation Requirements, earlier, to:

Internal Revenue Service ITIN Operation Mail Stop 6090-AUSC3651 S. Interregional, Hwy 35Austin, TX 78741-0000

The private delivery service can tell you how to get written proof of the mailing date.

✔️ In person:

You can apply for ITIN by visiting designated IRS Taxpayer Assistance Centers (TACs).

They can verify original documentation and certified copies of the documentation from the issuing agency for primary and secondary applicants and their dependents.

For dependents, TACs can verify passports, national identification cards, and birth certificates. These documents will be returned to you immediately. Service at TACs is by appointment only.

Schedule your appointments by calling 844-545-5640.

See IRS.gov/W7DocumentVerification for a list of designated TACs that offer ITIN document authentication service.

TACs that don’t offer ITIN document authentication service will mail the original documents, Form W-7, and the tax return to the IRS Austin Service Center for processing.

✔️ Through an acceptance agent:

You can also apply through one of the two types of acceptance agents authorized by the IRS.

📌 Acceptance Agent (AA)

An Acceptance Agent (AA) can help you complete and file Form W-7. To get a list of agents, visit IRS.gov and enter “acceptance agent program” in the search box.

Your AA will need to submit original documentation or certified copies of the documentation from the issuing agency to the IRS for all applicants.

📌 Certifying Acceptance Agent (CAA)

A Certifying Acceptance Agent (CAA) can verify original documentation and certified copies of the documentation from the issuing agency for primary and secondary applicants and their dependents, except for foreign military identification cards.

For dependents, CAAs can only verify passports and birth certificates. The CAA will return the documentation immediately after reviewing its authenticity.

Taxpayers residing outside of the United States can apply for ITIN through a CAA.

Learn everything about State-Specific ITIN Requirements before you apply for one.

Work With a Professional (Instead of Applying on Your Own)

Again, we strongly recommend working with an expert. Because a professional accountant can not only assist with your US federal income tax return but also help you apply for ITIN.

And as we mentioned before: if your Form W-7 has any mistakes, your ITIN Application will be rejected by the IRS.

Therefore, we recommend working with a a professional accountant who is also an IRS Acceptance Agent.

How Long Does It Take To Process and Approve an ITIN?

📌 If you apply between January 1st and April 30th it will take 9 to 11 weeks.

📌 If you apply for ITIN between May 1st and December 31st it will take 7 weeks.

What to Do if I Don’t Get My ITIN?

You can call the IRS to check the status of your application:

- For people in the US: call 1-800-829-1040.

- For people outside the US: call 1-267-941-1000.

Do I Ever Need to Renew My ITIN?

For a visual chart from the IRS about ITIN renewals, check out this page.

Can doola Help Me Get My ITIN?

If there’s one thing we emphasize to every global founder we work with, it’s this:

A single mistake on Form W-7 can lead to the IRS rejecting your ITIN application.

And why stress over the complexities of applying on your own? doola’s experts are here to help!

With doola, you get a seamless, expert-led process that ensures your application is error-free and stress-free.

Let us handle the paperwork while you focus on scaling your business.

Apply for ITIN with doola today and take the next step toward unlocking your entrepreneurial journey!