Language:

A Complete Guide to DIY Bookkeeping for Small Business Owners

In the hustle of running your own business, bookkeeping might feel like the last thing on your to-do list.

But keeping those numbers straight is more than just balancing the books—it’s your secret weapon for business growth.

From tracking your expenses to staying tax-ready, good bookkeeping lets you keep a pulse on your business’s health.

And the best part? You don’t need a finance degree to get started.

Whether you’re a Do It Yourself (DIY) bookkeeping newbie or just looking to hone your skills, this guide is here to help you master the basics.

And with doola by your side, you’re not just maintaining books—you’re steering your business toward success.

Let’s dive into everything you need to get started with DIY bookkeeping, and learn how doola can make the process easier.

What Is Bookkeeping?

Bookkeeping is like keeping a diary—but instead of journaling your life events, you’re logging every cent that comes in and out of your business.

From jotting down every dollar spent on that fancy new coffee machine to tracking the cash flow from your latest product drop, bookkeeping keeps your money moves in check.

Whether you’re plugging numbers into accounting software or going old-school with a pen and a ledger, it’s all about having a crystal-clear view of your business’s finances.

You’ll know exactly where you’re splurging, what’s bringing in the big bucks, and—bonus—you’ll be ready for those tax write-offs.

So bookkeeping isn’t just about crunching numbers; it’s about keeping your business story on point and getting financially savvy.

Why Do You Need Bookkeeping?

Let’s break it down: bookkeeping isn’t just another thing on your to-do list—it’s the lifeblood of your business.

Here are the top five reasons to prioritize bookkeeping, and how doola can make it all a breeze:

1. Taxes, But Make Them Manageable

Tax time is nobody’s favorite season.

To file those taxes right, you need to know your net profit, which means keeping track of every cent that’s coming in and going out.

Without accurate books, you’re basically throwing darts blindfolded.

How can doola help?

doola keeps your books up-to-date and audit-proof by automating the tracking of every transaction, ensuring you’re always ready for tax season without the last-minute scramble.

With doola, your financials are organized and error-free, making tax time a breeze instead of a burden.

2. Your Money Map: Follow the Cash Flow

Want to know if your business is killing it or just scraping by? That’s where bookkeeping comes in.

It’s your financial GPS, showing you exactly where your money’s going and where it’s coming from.

Sales soaring? Shipping costs sinking you?

Accurate bookkeeping helps you produce those financial statements that tell you the real story behind your numbers, so you can make moves that matter.

How can doola help?

With doola’s bookkeeping services, you can:

- See where your money goes: Track your income and expenses with ease.

- Identify areas for savings: Spot unnecessary costs and optimize your spending.

- Make informed financial decisions: Use accurate financial data to guide your business.

So no more guesswork—just a full picture of where your money is going!

3. Score All the Tax Deductions

Tax deductions are the ultimate money-saving hack, but you’ve got to have receipts and records to back them up.

Keeping your books updated means you’re always ready to show the Internal Revenue Service (IRS) you’ve got your act together.

Balancing your books helps you track every deductible dollar, making sure you never miss out on a legit claim.

So when your Certified Public Accountant (CPA) asks for records, you can flex that perfectly organized paper trail.

How can doola help?

doola helps you maximize tax deductions by keeping your financial records organized and up-to-date.

With doola’s intuitive tools, you’ll easily track every expense and deduction, ensuring you don’t miss out on any potential savings.

Our expert insights make tax time a breeze, so you can focus on growing your business.

Learn more about 18 tax write-offs doola can help you with.

4. Hassle-Free Business Loans and Funding

Planning to apply for a loan or impress potential investors? They’ll want to see more than your bright ideas—they need solid numbers.

Lenders dive into your financial statements to understand your revenue, cash flow, and debts before they fork over the funds.

Keeping your books tidy helps you secure the next big opportunity without breaking a sweat.

How can doola help?

doola’s accurate bookkeeping services provide a clear, detailed view of your financial health, making it easy to impress lenders and investors.

With neatly organized financial statements, you’ll be ready to showcase your business’s strengths and secure those crucial funds.

doola helps you build a rock-solid financial profile that turns loan and investment opportunities into a reality.

Need more help understanding where your business finances stand?

5. Spot Errors and Audit-Proof Your Books

Ever ignored a flashing gas light on a road trip?

So why wait till year-end to sort your finances? By keeping your books updated, you spot errors like double charges or missing payments early on.

Not when you’re drowning in tax forms.

How can doola help?

doola’s tax experts proactively identify and fix errors in your books before they face the audit scrutiny.

With real-time monitoring and regular reconciliations, doola ensures your books are error-free and audit-ready.

With doola by your side, you’re not just managing bookkeeping—you’re mastering it.

Book a consultation today, and let’s get those numbers working for you.

A 7-Step Guide to DIY Bookkeeping

Meet Alex. A fellow entrepreneur and a doola customer who had faced the bookkeeping beast head-on.

Ask Alex and you’ll learn how easily bookkeeping turns into this tricky maze of:

Tax forms and transactions. Receipts and spreadsheets.

With a little help from doola and some DIY hustle, Alex turned chaos into clarity.

Here’s the step-by-step playbook Alex used—and now it’s your turn to ace DIY bookkeeping like a pro.

Step 1: Separate Your Business and Personal Finances

Alex had a vision and a business to run. But he made one mistake.

He mixed personal and business expenses.

Coffee runs? Charged on the business card. That new laptop? Paid with the personal debit.

So when tax season hit, Alex found himself drowning in a mess of mixed receipts and blurred lines.

Next, Alex did what every smart founder should—opened a business bank account and introduced boundaries between personal and business assets.

This wasn’t just about tidying up; it was about protecting his business and staying audit-proof.

The doola Lesson

With doola by his side, Alex learned that keeping things separate wasn’t just a good idea—it was essential.

No more missed deductions or unnecessary CPA fees. Just clean, clear, and stress-free books.

So, take it from Alex: keep your dollars in their lanes, and let doola help you keep your business game on point.

Step 2: Choose the Right Bookkeeping System

When Alex finally cracked the code on choosing the perfect bookkeeping system, he shared a brilliant analogy during one of our coffee chats.

Picking a bookkeeping system is much like choosing a gaming console.

Single-entry is like the classic Nintendo—simple and fun for beginners. Double-entry is more like a high-tech gaming PC—powerful but a bit more complex.

Now which one is right for you?

- Single-entry: Perfect if you’re just starting out and want something easy.

- Double-entry: Ideal for established businesses that need a more robust system.

Alex initially started out with the beginner-friendly single-entry mode. All it took was logging each transaction once and keep it simple.

But when Alex’s business started to grow and things got a bit more “official,” it was time to switch to double-entry.

Now double-entry mode is:

Complex, but got the muscle to handle a real-deal business.

In double-entry bookkeeping, every transaction gets double the attention—first logged in a journal, then in the general ledger as both a debit and a credit.

Thus keeping your finances in sync.

The doola Lesson

doola was there to make this transition simple and seamless for Alex.

Since most accounting software these days is already double-entry ready, Alex was set to keep his books in check and future-proof his business.

With doola’s tax experts by his side, Alex decoded the basics in his own signature game analogy style:

Pick your player—single for simple and double for double the power.

Consult a doola CPA to amp up your bookkeeping game like Alex.

Step 3: Cash vs. Accrual – Pick an Accounting Method

This was the critical juncture for Alex to make his next big bookkeeping decision: cash vs. accrual accounting.

He quickly learnt that cash accounting is like “pay as you go.” You only record the dollars when they hit your hand—simple.

It’s the go-to for small business owners who just want to know what cash they have on deck without the whole exercise of tracking who owes what.

Then there’s the accrual method—perfect for when you’re leveling up. It’s like:

Bill now, record now, get paid later.

Income hits the books when you send that invoice, even if the cash is still a few months away. Same deal with expenses—logged when billed, not paid.

This method gives you the real 360 view of your business’s health, showing the true hustle of what’s coming in and going out.

Alex was glad he didn’t have to figure it out alone—doola’s got his back.

The doola Lesson

Whether you’re rolling with the easy cash method or diving into the deeper waters of accrual, doola’s tailored services keep things smooth and stress-free.

And in the process, our list of 9 things to do if your books don’t balance, keeps you afloat.

Now, Alex knows his numbers, his cash flow, and most importantly, how to keep steering his business toward success!

Step 4: Choose the Right Tools

Alex was deep in the bookkeeping trenches when he realized every little swipe of his card needed to be sorted into neat little boxes—or “accounts”.

Flash forward six months:

Alex found a crumpled receipt for some fancy lunch spot. Was it a client meeting? Team celebration?

Who knows—unless you’ve got your accounts in check.

It all boils down to five main account types:

- Assets

- Liabilities

- Equity

- Revenue

- Expenses

It’s all about that detail game and Alex found three ways to win:

1. Accounting Apps:

You could dive into one of the many cloud accounting tools like QuickBooks, Xero, or Wave—these platforms pack a punch if you know how to navigate them.

But if you’re a newbie or don’t have hours to spare learning the ropes, these tools can turn into a stress tornado faster than you can say “unbalanced ledger.”

And the worst part? Finding out from your accountant that you’ve been using them all wrong for the past year.

Living nightmare!

2. Spreadsheets:

You might as well keep it basic with the good old spreadsheet grind—a classic option, but tread with caution.

One wrong click, and you could be in financial chaos.

Now you wonder, what’s the third way?

It’s the smartest way if you don’t want to waste hours on the number game and hand the reins over to the experts instead.

You’re right, the third way is the doola way. That’s what Alex went for and here’s his takeaway.

The doola Lesson

doola’s one-stop solution is more than just bookkeeping—our experts handle everything, from keeping your books clean to dropping those monthly financial power-ups right into your lap.

No more guesswork, no more spreadsheets—just a smooth sail with the right insights, all while you level up your business game.

Step 5: Categorize Your Transactions

One of Alex’s early lessons? Every transaction needs a home.

Whether it’s coffee with a client or a team lunch celebrating a big win, categorizing your expenses correctly can save you from future headaches.

Six months down the line, you don’t want to be staring at a mysterious receipt and asking:

“Was this a business lunch or a random Tuesday splurge?”

It’s all about getting those transactions into the right buckets—assets, liabilities, expenses, and beyond.

The doola Lesson

With doola’s guidance, Alex didn’t just categorize his way to sanity; he set up his system to match industry standards, CPA expectations, and most importantly, his own business flow.

doola understands the unique needs of every business and lets you choose either of the options:

1. Bookkeeping Software: Tag and categorize income and expense transactions.

2. Dedicated Bookkeeper: A doola CPA categorizes your business transactions.

Let doola help you streamline your bookkeeping process and avoid the stress of miscategorized transactions.

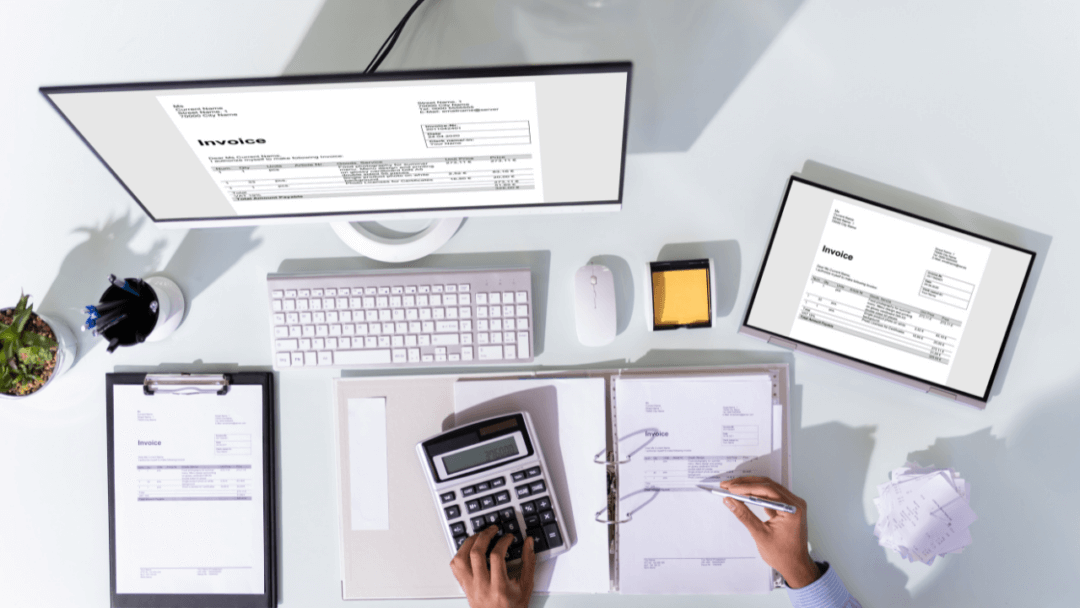

Step 6: Store Your Documents

Does this sound familar?

Tax season looms, and you’re on a scavenger hunt for that crumpled receipt you stuffed in a drawer six months ago.

Well, Alex has been there. And now he knows better.

Since the IRS accepts digital records, Alex ditched the paper trail and switched to cloud-based options like Dropbox, Evernote, or Google Drive—no more stressing over smudged or lost receipts.

Note: You can also tap into apps like Shoeboxed that are designed specifically to keep your receipts sorted and secure.

The doola Lesson

With doola by his side, Alex could upload and stash all his digital receipts and documents right in the doola app.

No more scrambling or stress—just seamless and sorted-out records.

And here’s the bonus:

If doola does your bookkeeping, you never have to worry about an IRS audit.

Explore the doola Total Compliance package to learn more.

Step 7: Tax Deductions – Organize Before You Claim

While deductions are a tax-saving weapon, not every expense is a deduction.

Quick example.

Let’s say you’ve splurged some $900 on a shiny branded pen and a gold plated stapler. And now you are trying to claim deductions.

Sounds crazy? Spoiler, there are crazier stories in our tax world! So read on.

Soon you realize those expenses do not qualify for tax write-offs. Why?

Because the IRS golden rule says:

Your expenses must be both “ordinary” (standard in your industry) and “necessary” (crucial to your business).

So, while pens are cool for writers, that diamond-encrusted pen might be a stretch.

And just because you run your startup from your dining room doesn’t mean you can write off your entire rent.

Like every other founder doola has guided in forming a thriving business, Alex learned that the key to mastering deductions is knowing “what’s ordinary and necessary” for his line of work.

The doola Lesson

With doola’s bookkeeping services, Alex never had to guess which of his deductions were legit.

doola helped him track, organize, and categorize all his expenses, making sure he utilized every tax benefit while staying on the right side of the IRS.

He simply focused on growing his business, knowing that doola’s keeping his deductions in check.

Step 8: Build a Bookkeeping Regime

A busy founder trying to manage bookkeeping on his own, Alex often used to be buried under a mountain of sticky notes, receipts, and unopened bank statements.

Until he realized he was drowning in paperwork and missing out on key insights.

That’s when he decided to level up his game and make bookkeeping a habit, not a headache.

So, Alex blocked out a day each month on his calendar—started calling it “Bookkeeping Battle Day.”

He’d grab his coffee, crank up his favorite playlist, and dive into his financials.

The doola Lesson

As his business grew, Alex often fell behind or couldn’t keep up with the tax law changes, but, he didn’t wait for things to get worse.

He always had doola on speed dial. Our experts would take over the tax reins and:

- Enter transactions

- Reconcile bank statements

- Review previous month’s wins (and losses)

- Make any big changes needed.

And now it’s your time to cut the clutter and let doola gets your books in shape.

Book a CPA consultation today.

DIY vs. Professional Bookkeeping

Should you tackle bookkeeping yourself, or outsource it to an expert?

As a founder donning multiple hats, you’ve been at similar crossroads. And you’re not alone.

Alex had this dilemma too.

We helped him find a solution, and let’s sort this out for you too.

DIY Bookkeeping: The Cost-Saver

If you’re just starting out and want to keep costs low, DIY bookkeeping might be the way to go.

Much like building your own IKEA furniture—it’s totally doable, but you might need a few extra hands (or a professional) to help you put it together.

Outsourcing to a Pro: The Time-Saver

If bookkeeping is becoming a full-time job, it might be time to outsource.

Let a professional handle the number crunching, so you can focus on growing your business.

With doola, you can bid adieu to the stress of bookkeeping. Our team of experts will handle everything from data entry to financial reporting.

As Alex puts it:

It’s like having your own personal accountant, without the hefty price tag.

Let doola Crunch the Numbers

Your business will grow from an idea to IPO. Real soon.

Unless your DIY bookkeeping path starts to look more like a minefield.

Those “I’ll-do-it-later” bookkeeping tasks will stack up faster than coffee cups on your desk.

You’d realize you’re spending more time on the tedious number game than building your dream.

We want to make your tax time stress-free. Your business deserves the best and doola is here to guide you.

With doola’s all-in-one bookkeeping service, you hand over the financial heavy lifting to real experts.

No more stressing over categorizing expenses or reconciling accounts—doola’s bookkeepers will handle it all.

Delivering financial statements straight to your dashboard and making tax season a breeze.

Having empowered business owners from over 175 countries fulfil their American dream, we’re waiting to write your success story next.

Ready to get your bookkeeping machine humming?

Schedule a free consultation. Let’s doola it!