Language:

Can I have 2 businesses under 1 LLC? Discover Your Answer

Want to know if you can have two businesses under one LLC? Read this to find out.

Tl;DR

- One technique we see quite often is a Wyoming LLC is set up as a holding company first. The formation is done the same way any other entity would be set up with the Wyoming Secretary of State.

- Once that is set up, you can form your operations companies or subsidiary holding companies with the holding company (WY LLC) as the owner.

- This is one technique, you may want to discuss with an attorney about other techniques for setting up holding companies and operations or subsidiaries 🙂

And read on to learn more!

Can I Have Two Businesses Under One LLC?

Often businesses get confused over the decision of having multiple businesses under one LLC. Are you currently pondering upon trying your business luck in new endeavors? If yes, then you might have the following question swirling in your mind.

- How many businesses can be operated under a single LLC?

- Do I have to create a separate LLC for each business endeavor?

- Which LLC kind would be suitable for me?

So the answer to your question is YES; you can have multiple LLC under one umbrella.

Establishing Multiple Businesses with a Single LLC

Let’s start our discussion with an example, where you are the owner of travel business and incorporated as LLC. However, over time, you decide to include real estate services as well. As both the businesses belong to different areas, the question is whether the owner can operate both the businesses under a single LLC?

Although it seems natural if you want to avoid getting a separate LLC for the new business to avoid the additional costs, the good news is you can establish multiple businesses with a single LLC. This practice is known as “Fictitious Name Statement” or “DBA,” where the owner can run multiple businesses under a single LLC but with different names.

Though it is permissible, you should not opt for that option as there are various drawbacks associated with it.

For instance, in case of any litigation or lawsuit filed against one business, the assets or other business resources will also be at stake. It means if one block in the entire LLC is held liable, the LLC will be too.

Most owners opt to have a separate LLC for each business venture to mitigate the risk. Moreover, additional fees and costs are associated with it, including the maintenance cost, etc. however, it offers a shield against the liabilities and litigations related to other businesses.

What is a Series LLC?

Most of the businesses opt for series LLC to operate multiple companies. The series LLC is a cost-effective solution, including the annual tax payment and annual registered agent fee. However, it is quite a new structure for business operations and thus involves various hurdles.

So what is the ultimate solution?

Separate LLCs

The solution is to create separate LLCs for each business venture!

So no matter what growth orientation you are considering to adopt, consider doing it under an independent LLC—having individual LLCs ensure that debts, assets, and liabilities are separated and can never impact each other.

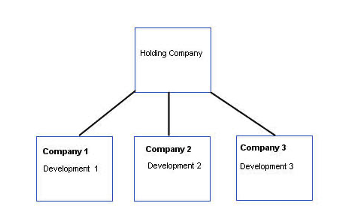

How about creating a hierarchy blueprint to understand the relationship between different LLCs. In this chart, the parent LLC takes the top position, the name ‘ABC holding company**.’** And then, the siblings will be created with different names and LLCs.

In this manner, all the companies have the same parent or holding company. They can have similar assets, liabilities, ownership interests, and structures, but they are protected, guarded, and shielded from each other.

If you are looking for further information regarding establishing multiple businesses, you can contact us through various platforms, and our experts will be delighted to serve.

Our recommendation: set up a “Holding Company” Structure in Wyoming

- One technique we see quite often is a Wyoming LLC is set up as a holding company first. The formation is done the same way any other entity would be set up with the Wyoming Secretary of State.

- Once that is set up, you can form your operations companies or subsidiary holding companies with the holding company (WY LLC) as the owner.

- This is one technique, you may want to discuss with an attorney about other techniques for setting up holding companies and operations or subsidiaries 🙂

Check out this blog post to see how to actually create your Holding Company!

Keep reading

Start your dream business and keep it 100% compliant

Turn your dream idea into your dream business.