Language:

How to Correct 1099 Forms: A Starter Guide

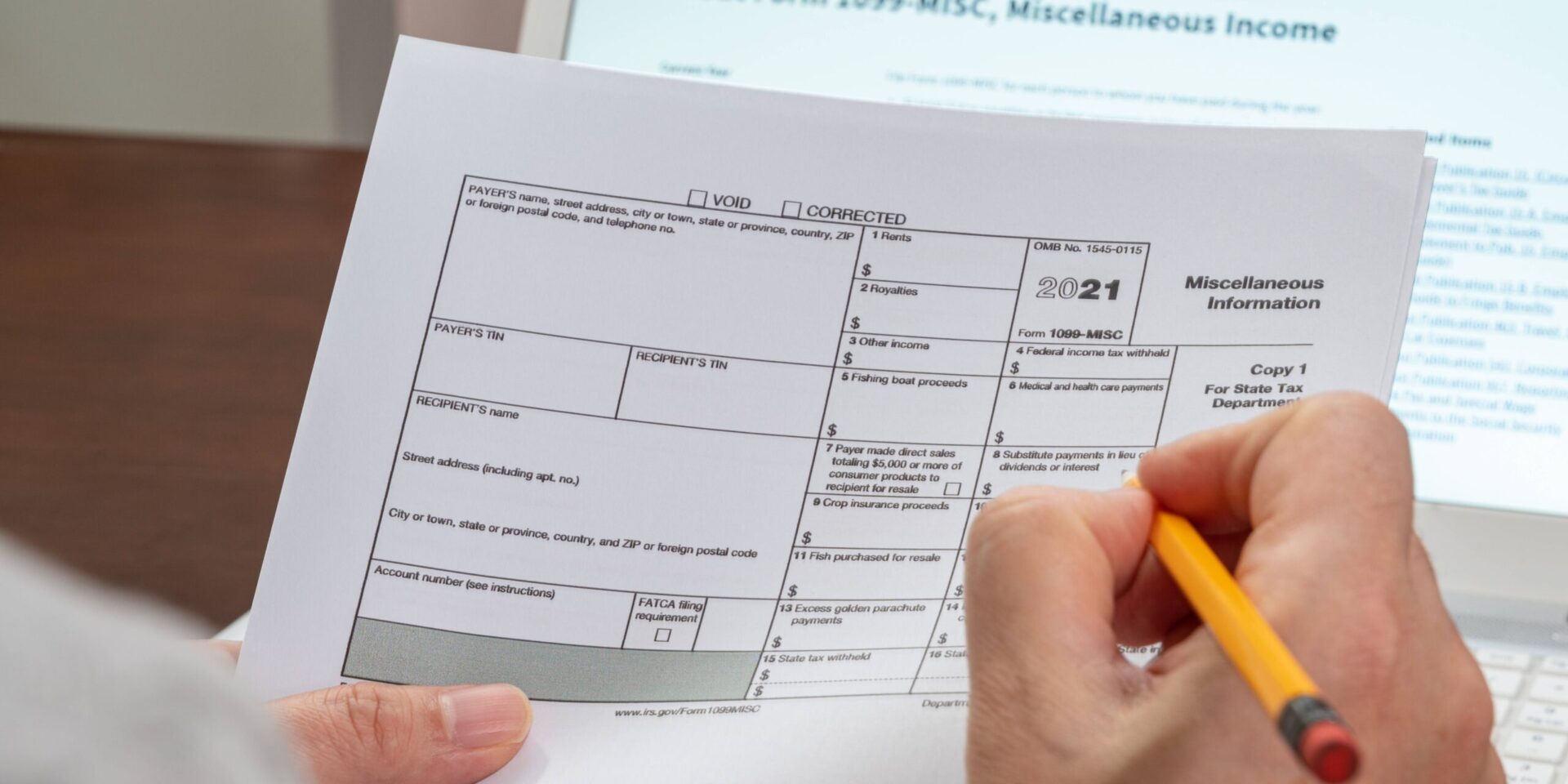

1099 forms are critical on tax day, but with many 1099s and little time, it’s easy to make a mistake. Filling out the wrong details, submitting the wrong form or using light ink can result in errors. If errors remain unaddressed for too long, you might end up with tax penalties. Correcting 1099 forms can get the IRS off your back and help you keep your finances in order. This article will shed some light on how to correct 1099 forms.

What Are 1099 Forms

If you work for an employer, you will get a W-2 form that you use for tax purposes. But not every worker has a full-time job. Some people are independent contractors and freelancers and make revenue from several clients instead of one boss. Even if you work full-time, you may have a side hustle, stocks that pay dividends or a rental property generating cash flow. What happens with this income? It’s actually a common tax question.

1099 forms let you report taxable income that isn’t from a full-time position. You have to report this income for taxing purposes, and while some clients may send 1099 forms to your address, you may have to create 1099 forms for other clients. The IRS requires freelancers to report all of their income even if they didn’t receive a form from one of their clients.

Common 1099 Errors that Require a Correction

1099 forms make it easier to report other types of income to the IRS. But making mistakes along the way can require corrections and complicate your taxes. These are the errors you should avoid:

- Forgetting to fill out a form: Some people do not remember to report everything they make, and this may be more common for freelancers with numerous clients. Writing a complete list of your clients and having it readily available can help you stay on top of your taxable income.

- Using inaccurate information on the form: Make sure you write down your information and the client’s details correctly. Check to see that the addresses line up with each client instead of getting details mixed up for different clients. Some bookkeeping software tracks this information for you, which makes the process easier.

- Writing with light ink: The IRS uses a machine to process the forms. You can complete a form 1099 on your computer, but if you have to write it out instead, make sure you use dark ink, so it’s easy for the machine to decipher.

- Forgetting Form 1096: You need to file this transmittal form for each type of 1099. However, you can get around the Form 1096 requirement if you file your taxes electronically.

- Reporting an incorrect taxpayer identification number (TIN) or Social Security number (SSN): If you provide the wrong number, the IRS won’t make the connection that you are filing your taxes. This can result in a notice from the IRS. You may even get a penalty.

How to Correct 1099 Forms

No one’s perfect. You may make a mistake on a 1099 Form, but what happens then? The way you correct your 1099 form depends on the type of mistake. 1099 form mistakes are categorized into two types: Type 1 Errors and Type 2 Errors.

Type 1 Errors

These 1099 form mistakes are considered Type 1 Errors:

- Providing an inaccurate name or street address for the payee

- Filling in the wrong amount of money on your form

- Checking the wrong box

- Providing an inaccurate code

It is also a Type 1 Error if you filed a form you did not need to file. Taxpayers have to take the following steps to correct a Type 1 Error:

- File the correct form with updated and accurate information

- Check the “CORRECTED” box, which is usually near the top of the form

- Submit the corrected form

If you mail the corrected Form 1099, you will have to mail it with Form 1096. If you are not mailing the corrected form, you do not need to provide Form 1096. Regardless of whether you mail the form or submit it electronically, you will have to send the red Copy A to the IRS.

Type 2 Errors

Type 2 Errors consist of the following:

- Providing inaccurate payee or recipient information, including an inaccurate TIN

- You filled out the wrong form — some 1099s handle specific income streams, while others are miscellaneous

Taxpayers who make a Type 2 Error can take the following steps to correct it:

- File two Form 1099s.

- Check the CORRECTED box on the first form. It should have the same information as the original form but includes zeros for all amounts on the form.

- Do not check the CORRECTED box on the second form. This Form 1099 should be accurate. It’s essentially a reset where you get to provide the correct information.

The protocol for Type 1 Errors is the same as for Type 2 Errors. You will have to mail or electronically submit the 1099 forms with a red Copy A. Taxpayers mailing their updated forms will need Form 1096, while taxpayers electronically submitting their forms will not need Form 1096.

Tips to Prevent Committing these Errors

Tax form errors can lead to added complications and IRS scrutiny. While these errors are rare, you can take these preventative measures to increase the likelihood of a smooth tax season:

- Check your form before submitting it: Looking over your 1099 forms for a few minutes can save you a lot of headaches later. It’s worth double-checking them.

- Keep a list of your clients and income streams: Not every taxpayer remembers every possible form. Writing a list of your income streams will help you remember 1099s that you may have otherwise forgotten.

- Don’t rush: It’s easier to make mistakes and forget valuable information when you rush through the tax season. Taking a slow and steady approach can reduce the likelihood of making a mistake.

Keeping Track of Your Forms

Staying on top of your income streams and forms can get overwhelming. If you are an independent contractor or have several side gigs, you may receive several forms, and it’s possible for one of them to fall through the cracks. If you want to keep track of your forms and get your finances in order, a good bookkeeping software can get you on the right path.

FAQs

How long do you have to correct a 1099 form?

Taxpayers have three years to correct a 1099 form.

How do you file a corrected 1099 electronically?

You can file your 1099 form electronically with many platforms. Once you find the right software, follow the instructions to file a 1099 form electronically. You may also want to speak with a tax professional.

Can I correct a 1099 form by interlineation?

Yes. You can cross out incorrect information and place correct information next to it. However, you cannot “white out” any part of the document.

How late can you receive the corrected 1099 tax forms?

Corrected 1099 tax forms usually arrive from your employer by the end of February.