How to File Forms 5472 and 1120 to Avoid a $25,000 Fine – Filing Requirements for Foreign-Owned Single-Member LLCs

Here's our guide on filing requirements for foreign owned single member LLCs. Make sure you get this right to avoid IRS issues.

For foreign-owned single-member limited liability companies (LLCs) taxes and documentation can be a whirlwind of confusion. Form numbers and acronyms are thrown around like confetti. No explanation is given for what they mean. Do you file Form 5472 or Form 1120? Do you need an EIN or an ITIN? Are you a disregarded entity? A single-member LLC?

Feeling confused?

You’re not alone. Negotiating a foreign country’s bureaucracy is a daunting task. But the benefits of doing business in one of the world’s economic hubs is attractive. You want to grow your business. You want to spend your valuable time attracting customers and honing your skill.

Don’t get snowed in by paperwork.

Here at doola, we’re masters of cutting through the confusion. Specifically tailored to helping new businesses grow, we offer a vast range of services. We’re the one-stop-shop for all your business needs!

To get you started, we’ve created this comprehensive guide, simplifying foreign-owned single-member LLCs’ requirements into easy-to-understand steps.

Let’s begin with definitions and exemptions.

What is Form 5472 used for?

According to the IRS, Form 5472 is used for 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business. This means that if your business is at least 25% owned by a foreign person or entity, Form 5472 is needed to report any transactions during your company’s tax year.

Reportable transactions, according to the IRS, include:

- Any type of transaction listed in Part IV (for example, sales, rents, etc.) for which monetary consideration (including U.S.and foreign currency) was the sole consideration paid or received during the reporting corporation’s tax year; or

- Any transaction or group of transactions listed in Part IV, if:

- Any part of the consideration paid or received was not monetary consideration, or

- Less than full consideration was paid or received.

Transactions with a U.S. related party, however, are not required to be specifically identified in Parts IV and VI.

What is Form 1120 used for?

According to the IRS, Form 1120 is used for domestic corporations to:

- Report their income, gains, losses, deductions, credits.

- Figure their income tax liability.

This is a LLC’s main way to communicate their business performance and figure out their tax liability with the IRS. Form 1120 also has several different types of organization specific forms including:

- 1120-C: cooperative associations, such as farmers’ cooperatives

- 1120-F: foreign corporations

- 1120-H: condominium management, residential real estate management, timeshare association that elects to be treated as a homeowners association

- 1120-L: life insurance companies

- 1120-POL: political organizations

- 1120-S: S corporations

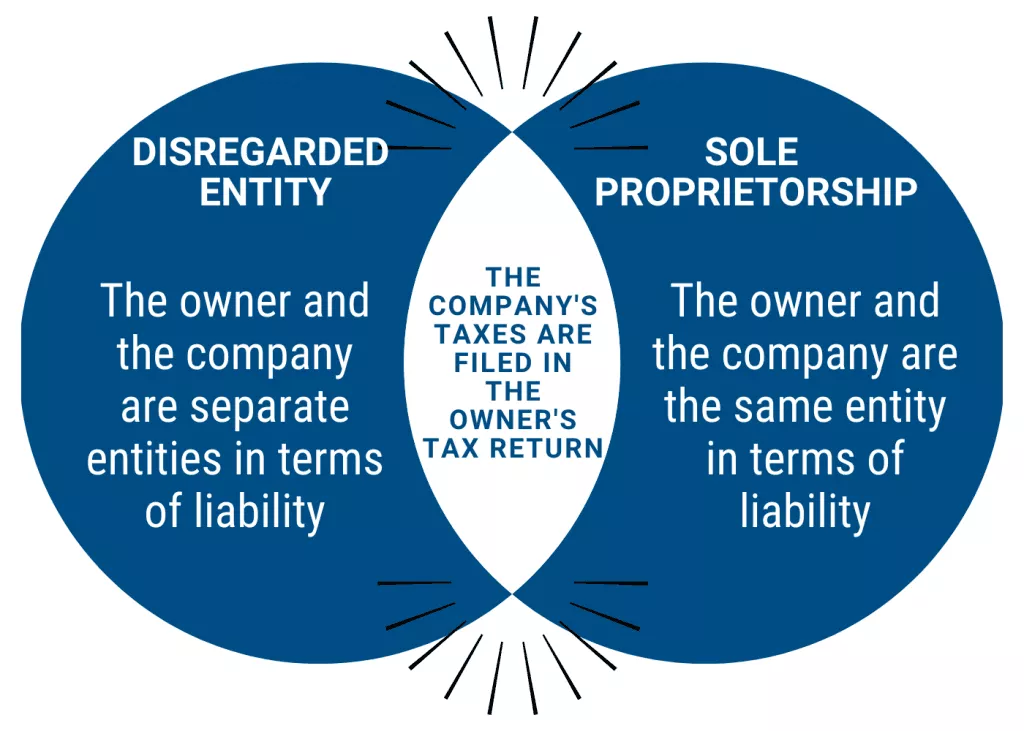

What is a disregarded entity?

According to the IRS, LLCs can be treated as a ‘corporation, partnership, or as part of [an] owner’s tax return’. This last item is a disregarded entity: it means the business or organization does not have to file for income taxes, despite existing legally. If an LLC has only one member, it is automatically treated as a disregarded entity known as a single-member LLC. Alternately, LLCs can elect to be treated as a corporation.

Foreign-owned single-member LLCs refer to the citizen status of the owner. A foreign person is any person that is not a US person, as well as foreign corporations, foreign partnerships, foreign trusts and foreign estates. So, if you’re a non-US resident or a non-US citizen, your business counts as foreign-owned.

Direct or indirect ownership?

Foreign-owned single-member LLCs can be either directly or indirectly owned. What’s the difference?

A direct owner is a foreign person or foreign company.

Indirect ownership is via a separate Disregarded Entity LLC that, in turn, owns the Single-Member LLC.

Both types of ownership are subject to reporting requirements. But the difference can determine how and what is reported.

Three simple steps

There are three simple steps you must follow to complete the necessary reporting requirements.

Step 1. Get an Employer Identification Number (EIN).

Step 2. File Form 5472 and Form 1120.

Step 3. Keep important financial records as evidence of claims in Form 5472.

In certain circumstances, you may also have to file a 1040NR (Nonresident Alien Income Tax Return) and get an ITIN (Individual Taxpayer Identification Number). This depends on factors such as type of business, the country in which you reside, US source income and more.

Moreover, if you own multiple foreign-owned disregarded LLCs, then you will need to submit separate information. Each of these is regarded as a separate entity by the IRS.

What’s next: Getting an EIN

If your business fulfilled the above criteria, then you are a foreign-owned single-member LLC. That means you don’t pay income taxes like a corporation. However, as of 2017, you still report information like a corporation (see Section 1.6038A-1). Therefore, unless you have registered as a corporation, all single-member LLCs are subject to these requirements. Failure to file or incorrect filling will incur a minimum penalty of $25,000.

That’s why it’s best to get help from the experts.

There are two primary forms you must file: Form 5472 and Form 1120. We’ll cover these later on.

First, to file these forms, you will need an Employer Identification Number (EIN), also known as a Federal Tax ID Number.

It might sound complicated. But we promise you don’t have to be an EINstein to work it out.

There are two ways to get an EIN:

- Using an ITIN (Individual Taxpayer Identification Number) or an SSN (Social Security Number), you can apply for an EIN via this IRS online portal.

- Without an ITIN or SSN, you can still get an EIN. You only need to do two things: Get your LLC approved by the State and then fill out and send Form SS-4 to the IRS. That’s it. You don’t need to spend any money, and you don’t need to be a US resident or citizen.

Filing Form 5472

Once you’ve got an EIN, you’re ready to start submitting information. Filing Form 5472 is a complicated process. The IRS provides a guide to each section (and we’ll cover each below). But given the steep fines for incorrect filing, it is best to seek help from doola.

There are eight parts to Form 5472.

Part I – Reporting Corporation

List the basic details of your corporation, including name, address, total assets, EIN, country of LLC formation and more. Ensure all the information is the same as your EIN application and State approval.

Part II – 25% Foreign Shareholder

Section II only applies to US-formed companies that have a 25% foreign shareholder. For companies formed outside the US, then this section is inapplicable. This section is irrelevant for all single-member LLCs.

If the criteria are applicable, you will need to provide the relevant information for each 25% foreign shareholder, whether direct or indirect, including their Foreign Taxpayer Identification Number (FTIN).

Part III – Related Party

For each Related Party, a separate Form 5472 must be filed. But what is a Related Party?

Related Parties can include:

– LLC owner or close-family members of LLC owner (parents, siblings, spouse, etc.)

– Additional companies owned by LLC owner (directly or indirectly)

For further examples of a Related Party, please refer to Section 1.6038A-1(d). Related Parties must have a Reportable Transaction. A Reportable Transaction is the movement or exchange of money or property between an LLC and any foreign owners.

Part IV – Monetary Transactions Between Reporting Corporations and Foreign-Related Party

If Reportable Transactions were with a Foreign Person, then Section IV must be completed. List the total monetary amount for each of the possible transactions.

Part V – Reportable Transactions of a Reporting Corporation that is a Foreign-Owned U.S. Disregarded Entity (DE)

Section V requires the listing of all Reportable Transactions related to a foreign-owned US DE:

– Forming of the LLC

– Dissolving of the LLC

– Buying of the LLC

– Selling of the LLC

Part VI – Nonmonetary and Less-Than-Full Consideration Transactions Between the Reporting Corporation and the Foreign-Related Party

If the Reportable Transactions were with foreigners, then an attached statement is required for Part 6. Otherwise, if transactions were with US persons, then Part 6 does not require completion.

Part VII – Additional Information

These questions must be completed and refer to any further information required by the IRS.

Part VIII – Base Erosion Payments and Base Erosion Tax Benefits Under Section 59A

Base Erosion Payments refer to any amount paid or accrued by the reporting corporation to a foreign person. These can be subject to a US deduction, which is known as a Base Erosion Tax Benefit.

Filing Form 1120

Unlike Form 5472, you only need to complete Name, Address, Section B and E for Form 1120.

Follow these steps:

- Write ‘Foreign-Owned U.S. DE’ at the top of the form.

- Complete your Name and Address in the relevant boxes.

- Section B: Enter your EIN

- Section E: Check a box if it is your first return or last return for your LLC (for instance, the first time you send off Form 5472 and Form 1120, or for shutting down the business). Otherwise, don’t check any box.

After Completing Form 5472 and Form 1120

Following completion, send both Form 5472 and Form 1120 via mail or fax.

Mailing address:

Internal Revenue Service

1973 Rulon White Blvd.

M/S 6112, Attn: PIN Unit

Ogden, Utah 84201

Fax number:

855-887-7737

Both Form 5472 and Form 1120 are required by April 15th each year. Such requirements apply to LLCs operating on the calendar year (January – December). Alternately, some LLCs operate differently. See further information on different fiscal years.

Save Yourself the Hassle

That was a lot to take in.

If you’re anything like most people, they’ll be one line that stands out: the $25,000 penalty. That’s a hefty sum that could sink some businesses. Moreover, if you own multiple foreign-owned single-member LLCs, those fines can stack. Make the same mistake on more than one form, and you could be looking at tens, if not hundreds, of thousands of dollars in penalties.

Why bother?

Instead, contact doola. Our helpful service takes the weight off your mind. We’ll help fill and file all those complicated forms, and sort out your EIN and a US address. We’ll provide free Tax consultations and practically everything a new US business could need.

That way, you can focus on what you do best: making money. We’ll handle the rest.