Language:

How to Calculate Quarterly Estimated Taxes in 2025

Quarterly estimated taxes are a must if you’re self-employed, running an LLC, or operating an S Corp.

This guide to calculating quarterly estimated taxes will break down everything you need to know to stay compliant and avoid IRS penalties.

From estimating your tax liability to making timely payments, today’s doola guide to calculating quarterly estimated taxes ensures you’re always one step ahead.

But why exhaust your business hours doing taxes, that too, all by yourself?

With doola Bookkeeping, you get expert support to track income, calculate payments, and stay tax-ready year-round.

What Are Estimated Taxes?

![How to Calculate Quarterly Estimated Taxes in [year] Guide to Calculating Quarterly Estimated Taxes: Form 1040-ES](https://www.doola.com/wp-content/uploads/2025/01/Form-1040-ES-1080x449.png)

If you’re a freelancer, entrepreneur, or business owner earning income outside of a traditional W-2 job, you’re responsible for handling taxes on your own.

This guide to calculating quarterly estimated taxes will help you understand how to estimate and make direct payments to the IRS.

Unlike W-2 employees whose taxes are automatically withheld, self-employed individuals and business owners must proactively calculate and pay their taxes throughout the year.

For S Corporation owners, this includes both salary income (reported on Form W-2) and business income passed through to your personal tax return (reported on a K-1). Staying on top of these payments is crucial to avoid penalties and ensure financial stability.

With this guide to calculating quarterly estimated taxes, you’ll have the clarity needed to stay compliant and in control of your business finances.

Who Needs to Pay Estimated Taxes?

Knowing whether you need to pay estimated taxes is essential. Today’s doola guide to calculating quarterly estimated taxes breaks it down:

If you expect to owe at least $1,000 in taxes for the year and your income isn’t subject to automatic withholding (like W-2 wages), the IRS requires you to make quarterly estimated tax payments.

Missing these deadlines can result in penalties, so staying proactive is key.

Here’s a closer look at which business structures must pay estimated taxes and common use cases:

| Business Structure | Who It Applies To | Use Case |

|---|---|---|

| Sole Proprietor | Independent freelancers, gig workers, and self-employed professionals | A freelance graphic designer earning $75,000 per year must pay quarterly taxes since no employer withholds taxes from their income. |

| LLC (Single-Member & Multi-Member) | Small business owners operating as a Limited Liability Company | A boutique e-commerce store owner generating $120,000 annually needs to estimate their tax liability and make payments each quarter. |

| Partnership LLC | Businesses with multiple owners who report their share of income on personal tax returns | Two partners running a consulting firm each report their portion of the business’s income and must pay estimated taxes individually. |

| S Corporation (S Corp) | Business owners receiving a mix of salary (W-2) and pass-through income (K-1) | An S Corp owner who pays themselves a salary of $60,000 and earns an additional $50,000 in business profits must account for both in their tax calculations. |

Staying compliant with quarterly tax payments ensures you avoid unnecessary penalties and keep your financials in check. Our guide to calculating quarterly estimated taxes is here to help—but you don’t have to do it alone!

With doola Bookkeeping, you can track income, estimate taxes, and make timely payments with ease. Reach out to us today and let doola help you stay tax-ready all year round.

How Much Should You Pay?

Understanding how much to pay each quarter is crucial for staying tax-compliant. This guide simplifies the process by breaking down the IRS’s safe harbor rules.

Your estimated tax payments depend on your projected income, and the IRS provides two methods to calculate the correct amount:

📌 90% Rule: Pay at least 90% of your estimated 2025 tax liability to avoid penalties.

📌 100% Rule: Pay 100% of your total 2024 tax liability if your adjusted gross income (AGI) was $150,000 or less.

📌 110% Rule: If your AGI was above $150,000, you must pay 110% of your 2024 tax liability to meet IRS safe harbor requirements.

Here’s an example to help you understand the tax calculations better:

| Scenario | 2024 Tax Liability | AGI | Required Estimated Payments (2025) | Quarterly Payment Amount |

|---|---|---|---|---|

| Freelancer earning $80,000 | $12,000 | $80,000 | 100% of 2024 liability → $12,000 | $3,000 per quarter |

| S Corp owner earning $200,000 | $30,000 | $200,000 | 110% of 2024 liability → $33,000 | $8,250 per quarter |

| E-commerce business making $50,000 | $7,000 | $50,000 | 100% of 2024 liability → $7,000 | $1,750 per quarter |

Calculating your quarterly taxes correctly ensures you stay penalty-free and on top of your finances. Our Tax Guide makes it easier—but why do it alone?

With doola Bookkeeping, you can automate your tax calculations, track income, and make hassle-free payments.

Book a free demo and let doola take the guesswork out of your taxes!

Step-by-Step Guide to Calculating Quarterly Estimated Taxes

If you’re self-employed or running a business, estimating and paying taxes every quarter is a must to stay compliant and avoid penalties. This guide to calculating quarterly estimated taxes breaks down the process into easy steps so you can accurately determine what you owe.

Whether you’re an S Corporation owner or a freelancer, understanding how to calculate your quarterly tax payments ensures you’re prepared come tax time.

Step 1: Estimate Your Taxable Income

Before you can calculate your tax payments, you need to estimate your total taxable income for the year. This varies based on your business structure:

For S Corporation Owners:

- Salary income (reported on Form W-2)

- Your share of the business’s net income (reported on Schedule K-1)

For Sole Proprietors, LLCs, and Partnerships:

- Net business income after expenses

- Any additional self-employment earnings

Step 2: Calculate Your Total Expected Tax Liability

![How to Calculate Quarterly Estimated Taxes in [year] ✅ Step 2: Calculate Your Total Expected Tax Liability](https://www.doola.com/wp-content/uploads/2024/10/Difference-Between-In-House-Bookkeeping-vs.-Dedicated-Bookkeeping-Services-1080x608.jpg)

Once you’ve estimated your taxable income, use the following steps to determine your expected tax burden:

1. Apply Federal Tax Brackets: Use current IRS tax brackets to calculate your federal tax liability.

2. Include State Taxes: If your state has an income tax, factor in your expected state tax obligation.

3. Subtract Any Tax Credits: Reduce your liability by deducting any applicable tax credits you qualify for.

Step 3: Divide by Four

Now that you have your estimated annual tax liability, divide it by four to calculate your quarterly tax payment amount.

Example: If your estimated tax liability for the year is $16,000, your quarterly payments would be $4,000 per quarter.

Step 4: How to Pay

The IRS offers multiple ways to submit your quarterly estimated tax payments:

1. Online: Use the Electronic Federal Tax Payment System (EFTPS) to make quick and secure payments.

2. By Mail: Send a check along with Form 1040-ES to the IRS.

3. Through a Tax Professional: Successful business owners rely on doola Bookkeeping to track earnings, automate calculations, and ensure accurate tax filings.

Following our guide to calculating quarterly estimated taxes helps you stay penalty-free and in control of your business finances. But why stress over calculations when you can sign up for doola Bookkeeping?

Rely on our experts and let doola take care of your tax tracking, payments, and financial management.

Key Due Dates for 2025 Quarterly Estimated Taxes

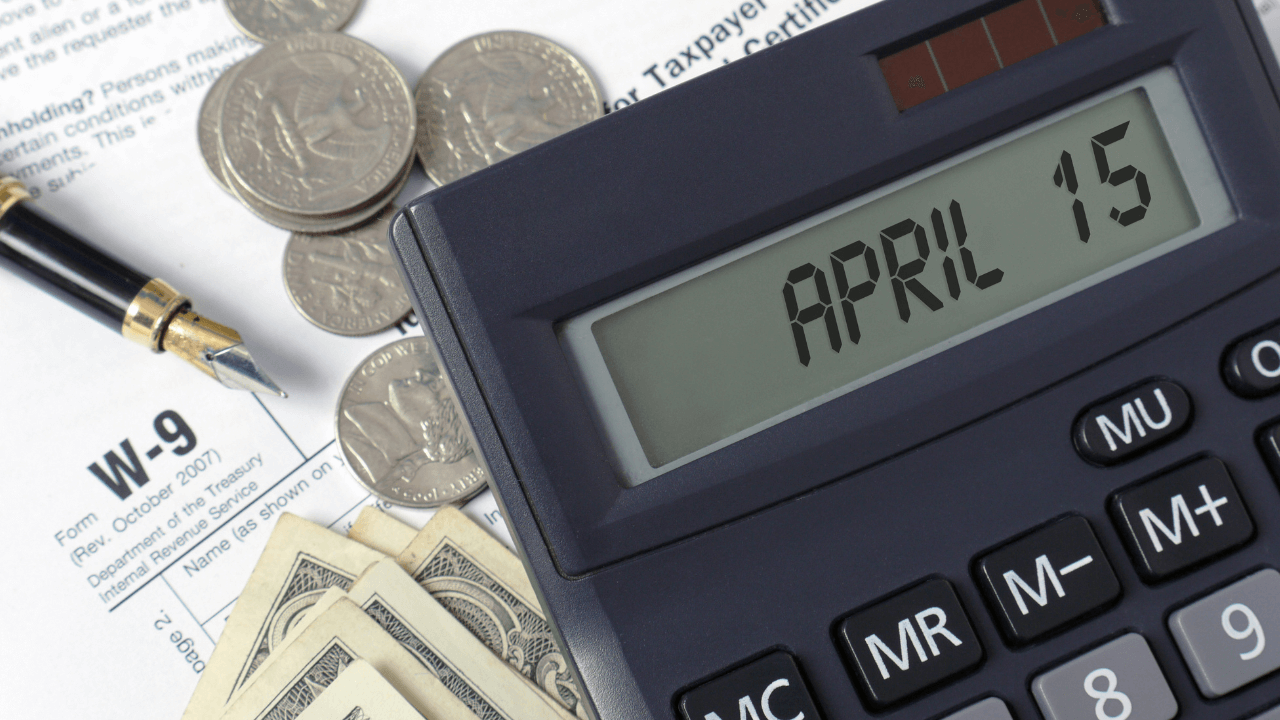

One of the most critical parts of managing your taxes is making sure your payments are on time. Missing a deadline can lead to IRS penalties, so staying ahead of these dates is essential.

Our Guide to Calculating Quarterly Estimated Taxes ensures you never miss a payment by breaking down the key due dates for 2025.

2025 Quarterly Estimated Tax Due Dates

| Quarter | Payment Due Date |

|---|---|

| 📆 1st Quarter | 🕒 April 15, 2025 |

| 📆 2nd Quarter | 🕒 June 15, 2025 |

| 📆 3rd Quarter | 🕒 September 15, 2025 |

| 📆 4th Quarter | 🕒 January 15, 2026 |

Following this guide to calculating quarterly estimated taxes ensures you stay compliant and avoid last-minute tax stress.

2024 Federal Income Tax Brackets

When following our guide to calculating Quarterly Estimated Taxes, it’s essential to understand how tax brackets impact your estimated payments. The US follows a progressive tax system, meaning different portions of your income are taxed at different rates.

Use the table below to determine how much of your income falls into each bracket.

| Tax Rate | Single Income Range | Married Filing Jointly Income Range |

|---|---|---|

| 37% | $626,351 and above | $751,601 and above |

| 35% | $250,526 to $626,350 | $501,051 to $751,600 |

| 32% | $197,301 to $250,525 | $394,601 to $501,050 |

| 24% | $103,351 to $197,300 | $206,701 to $394,600 |

| 22% | $48,476 to $103,350 | $96,951 to $206,700 |

| 12% | $11,926 to $48,475 | $23,851 to $96,950 |

| 10% | $0 to $11,925 | $0 to $23,850 |

Accurately estimating your tax liability is a crucial step, as you’ve learnt from today’s guide to calculating quarterly estimated taxes. If keeping up with these numbers feels overwhelming, let doola Bookkeeping simplify your tax process—reach out to us today!

📌 Need Help Estimating Your Taxes?

You can use the Estimated Tax for Individuals calculator by IRS to help compute your tax liability for the year.

Struggling With Your Taxes? Let’s doola It!

![How to Calculate Quarterly Estimated Taxes in [year] When to Choose doola](https://www.doola.com/wp-content/uploads/2024/04/When-to-Choose-doola-1080x608.png)

Staying ahead of quarterly estimated taxes isn’t just about avoiding penalties—it’s about maintaining steady cash flow and setting your business up for long-term success.

But that said: crunching numbers while running a business can feel like a full-time job.

So why not just doola it?

We’ll keep your financial records accurate and IRS-ready, so you never have to second-guess your tax calculations. From tracking income to estimating payments, we’ve got you covered.

Skip the tax headaches—let doola handle your books while you focus on growing your business.

Book a free demo to get started right away!

![How to Calculate Quarterly Estimated Taxes in [year] How to Calculate Quarterly Estimated Taxes in [year]](https://www.doola.com/wp-content/uploads/2024/12/black-butotn.png)

![How to Calculate Quarterly Estimated Taxes in [year] How to Calculate Quarterly Estimated Taxes in [year]](https://www.doola.com/wp-content/uploads/2024/12/younglady.png)

![How to Calculate Quarterly Estimated Taxes in [year] How to Calculate Quarterly Estimated Taxes in [year]](https://www.doola.com/wp-content/uploads/2024/09/bottom-cta-3.png)