Language:

How to Get an LLC for Free: doola Guide for Business Owners in 2025

We know you’ve been wondering how to get an LLC for free. And today, we will provide you with the complete picture.

Now just about any LLC (Limited Liability Company) formation service will promise a “free LLC” only for you to eventually find out:

You need to “pay” for every add-on to register your LLC.

At doola, we give you a more accurate and realistic picture.

Every business owner wondering how to get an LLC for free must know:

- State filing fees are mandatory

- Registered agent services, EIN, and compliance come at added costs.

LLC formation services at doola focus on transparency from the beginning so there are no hidden surprises down the line.

So while starting an LLC isn’t entirely “free”, we guide you through cost-effective solutions — whether you’re a US resident or an international entrepreneur.

Without further ado, let’s doola it!

How to Get an LLC for Free

While it’s possible to minimize costs by forming an LLC on your own, it’s essential to understand the steps and requirements involved.

Here’s a breakdown of the process:

1. Research State Requirements

Each state has its own regulations and filing fees for forming an LLC, ranging from $40 to $500.

Familiarize yourself with your state’s specific rules by visiting its Secretary of State website.

2. Choose a Name for Your LLC

Your LLC’s name must be unique and compliant with your state’s naming guidelines. You can usually check name availability on your state’s website.

You can register your domain with GoDaddy after deciding the LLC name.

3. File Articles of Organization

This document officially registers your LLC with the state. It includes essential details like:

- Your business name

- Registered agent information

- Management structure

- Business address

📌 Important: State filing fees, which vary by location, must be paid to file these documents.

4. Appoint a Registered Agent

A registered agent is responsible for receiving legal documents on behalf of your LLC.

While you can act as your own registered agent, using a professional service ensures consistency and compliance.

If you don’t have an agent already, doola can provide registered agent services tailored to your needs.

5. Obtain an EIN (Employer Identification Number)

The IRS (Internal Revenue Service) issues this federal tax ID for free, which is necessary for opening a business bank account, filing taxes, and hiring employees.

6. Draft an Operating Agreement

Although not required in all states, an operating agreement defines your LLC’s internal rules, ownership structure, and decision-making processes.

It’s a smart and proactive way to avoid future disputes.

7. State Filing Fees

State fees are unavoidable and must be paid to complete your LLC formation.

Here are a few examples:

| State | Filing Fees |

| California | $70 |

| Texas | $300 |

| Florida | $125 |

Check the websites of individual states for the latest information on filing fees.

📌 LLC for Non-US Residents: Why Is It Difficult?

Forming an LLC as a non-US resident involves extra layers of complexity.

For example:

- You’ll need an ITIN (Individual Taxpayer Identification Number).

- Understanding US compliance laws can be challenging without expert guidance.

This is where services like doola can make a difference, providing end-to-end assistance for a seamless LLC formation process.

Whether you’re a local or international entrepreneur, navigating these steps efficiently is easier with a trusted partner.

Get rid of the complexities and see for yourself how LLC formation gets easier with doola.

What About doola vs. Competitors?

When choosing an LLC formation service, transparency, affordability, and comprehensive offerings matter.

Here’s how doola compares to its competitors:

| Service Feature | doola | Other LLC Formation Services |

| Transparent Pricing | ✅ | 🚩 Additional charges apply for key services. |

| EIN & Operating Agreement | ✅ | 🚩 Extra fee required. |

| Setting up US Bank account | ✅ | 🚩 Requires additional payment. |

| Registered Agent Service | ✅ | 🚩 Often sold as an add-on. |

| Hidden Fees | None | 🚩 Common in advertised plans. |

Let’s now explore how doola stacks up against top LLC formation services.

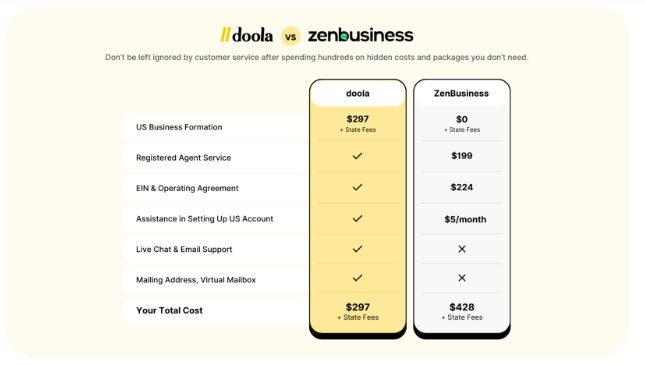

✅ doola vs. ZenBusiness

While ZenBusiness advertises low-cost plans, additional charges for essentials like EIN registration and operating agreement templates can quickly add up.

In contrast, doola provides transparent pricing that includes all the critical services you need — no unexpected fees or surprises.

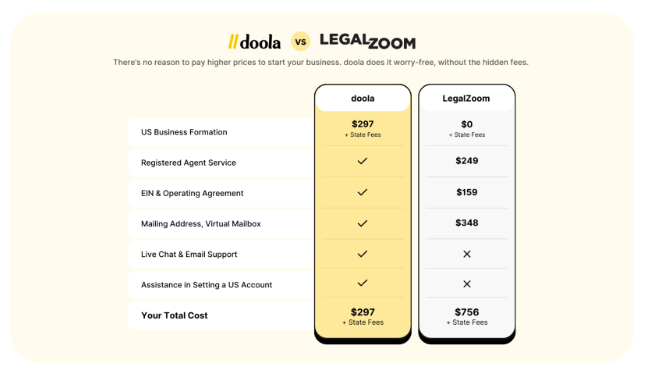

✅ doola vs. LegalZoom

LegalZoom is known for its brand recognition but often upsells services, making the total cost significantly higher than advertised.

doola, on the other hand, provides end-to-end solutions tailored for entrepreneurs, with straightforward pricing.

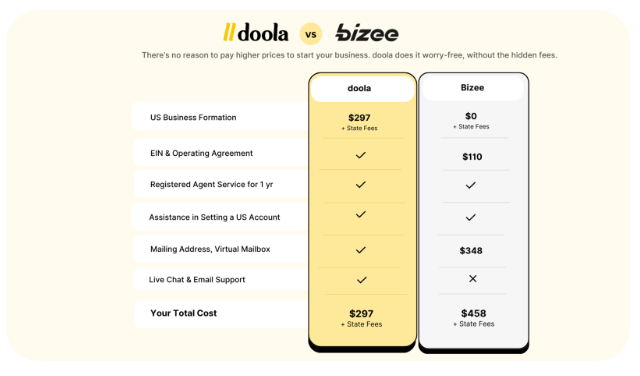

✅ doola vs. Bizee

Bizee offers a “free” LLC formation option but excludes critical features like compliance alerts and business banking support.

With doola, you get a comprehensive solution that not only forms your LLC but equips you for long-term success with built-in compliance and financial tools.

Why doola Stands Out

doola is the ideal choice for both US-based and international entrepreneurs.

Unlike competitors, doola specializes in simplifying the LLC formation process for non-US residents, providing essential tools like ITIN applications and global tax support.

Form an LLC with doola at just $297 and state fees.

What Is the Best LLC Formation Service?

Small business owners often say they prefer doola over other LLC services because of its unmatched value, transparency, and ease of use.

Here’s what makes doola the best LLC formation service:

✔️ All-Inclusive Packages

doola includes everything you need—from EIN registration to compliance reminders—in one simple plan.

No hidden fees, no surprises.

✔️ Support for Non-US Residents

Unlike most services, doola caters to small business owners and international entrepreneurs alike, providing:

- ITIN application support

- Seamless business banking setup

- Expert support to navigate US regulations

✔️ Affordable and Transparent Pricing

doola’s upfront pricing eliminates confusion.

You pay for what you need without getting upsold on basic services essential to running your business.

✔️ End-to-End Support

Whether you’re starting a small side hustle or scaling an international venture, doola guides you every step of the way, setting a strong foundation for long-term success.

With doola by your side, forming an LLC becomes not just easy but empowering — helping you focus on growing your vision while the experts handle the nitty-gritty details.

Simplify Your LLC Formation With doola

We hope this doola guide on how to get an LLC for free has has cleared up the reality of business formation and what to expect.

And indeed, doola frees you from the hassle or guesswork of forming an LLC.

From tackling compliance and filing requirements to mastering tax details and paperwork, doola does the heavy lifting while you focus on what really matters—building your business.

Skip the complexity and get your LLC started with doola today.

Book a free consultation and let’s grow your business together.

FAQs: How to Get an LLC for Free

1. How do I register a free LLC in the USA?

Technically, you can’t register an LLC for free due to mandatory state filing fees. However, handling the paperwork yourself can minimize costs.

Although outsourcing it to professionals guarantees accuracy and timely filing.

2. How much does it cost to form an LLC?

LLC formation costs vary across states, typically ranging from $40 to $500. Optional services like registered agent support and operating agreements may add to the cost.

3. Can I form an LLC as a non-US resident?

Yes, you can. Non-US residents can form an LLC in the USA, but additional steps, such as obtaining an ITIN and navigating international compliance, are required.

doola simplifies this process for global entrepreneurs.

4. How can I get a business bank account as a non-US resident?

Non-US residents need an EIN and LLC formation documents to open a US business bank account. doola provides comprehensive support to make this happen seamlessly.

5. What are the benefits of an LLC?

An LLC offers liability protection, tax flexibility, and a professional structure for your business, making it an ideal choice for entrepreneurs.

6. Can I form a free LLC on my own without using a service?

While you can handle the paperwork yourself to save on service fees, you’ll still need to pay state filing fees. Hiring a reliable and highly rated service like doola saves time and ensures accuracy.

7. Are there any ongoing costs after forming a free LLC?

Yes, ongoing costs may include annual state filing fees, franchise taxes, and registered agent fees if you don’t serve as your own. Some states also require annual or biennial reports.

8. What are the state fees associated with forming an LLC?

Each state has its own filing fees, which can range from $40 to $500. Some states also have annual reporting or franchise fees, so it’s important to factor these into your budget.