Language:

How to Open an LLC for Non US Residents: 8 Simple Steps to Get Started

We've personally helped hundreds of founders from around the world launch, maintain and grow US LLCs. Here's a list of their most common questions. Opening an LLC can be the first step to launching your US business. Even as a non-resident, you can open and operate LLCs across the US.

Even without being a US resident, you can create your own company and capitalize on the American dream.

Opening an LLC can be the first step to launching your US business. Even as a non-resident, you can open and operate LLCs across the US.

We’ve helped hundreds of founders worldwide to launch, maintain, and grow US LLCs. Below, we’ve compiled a list of the most commonly asked questions on how to file an LLC for non US residents.

Are you ready to start an LLC and learn more about launching a US company? Keep reading, and follow the steps to get started.

What we’ll cover:

Want to Get Started Now?

If you’re ready to file your LLC today, get a US bank account, and set up a company to receive payments, you’ll need to follow just a few simple steps. doola can help with each step – let’s get started!

1. Formation

With doola, you can get an LLC entity in one week, or an average of four weeks without a Social Security Number (SSN).

You can then file on your own through the states of Delaware or Wyoming or any other state you choose. doola offers fast formation or incorporation services to get your business up and running.

2. Banking

Mercury supports non-US residents with or without a US SSN. They give you an FDIC-insured bank account set up easily online.

3. Payments

Stripe allows you to accept payments through your eCommerce site or location.

This simplifies payment processing and allows you to accept payments online or on location. Stripe can help your business accept payments and establish a professional presence.

4. Phone

OpenPhone allows you to get a US phone line from anywhere in the world.

Banks often require verification via phone call or text to a US phone number. It also allows you to list a US phone number on your website and business cards, establishing a professional US presence.

Benefits of Choosing the US to Start Your Business

The US has one of the best reputations in the world for being business-friendly, even for non-US citizens!

The US also has a very competitive corporate tax system and a business structure that is easy to form and simple to manage in a limited liability company (LLC).

One of the biggest perks of starting a business in the US is the low startup costs in comparison to many other countries and the prestige of having a company based in the US.

Can a Non-US Resident Start a US LLC?

One common misconception about creating US companies is that you have to be a US citizen to start one and have a US Social Security Number (SSN).

Fortunately, that is false. You don’t have to be a US citizen, a US resident, or a green card holder, and you don’t need a US SSN.

That means you can start a US LLC as a non-resident, online, as a foreigner and get:

- A US LLC

- A US bank account

- Access to US payments

- And more!

One of the biggest benefits of being a non-US resident starting a US LLC is that an LLC is a “pass-through entity,” which means that taxes can pass through to the owners.

This means that your business would not be subject to US tax as long as your LLC:

- Is 100% owned by non-US tax residents (either natural or legal persons)

- Has no US presence or economic substance

- The income must not be “effectively connected”

The pros of creating an LLC as a non-resident include:

- Personal liability protection

- Simplified taxation (pass-through taxation)

- Flexibility in management and ownership

- Enhanced business credibility

- Owner privacy and asset protection

What Is an LLC?

A limited liability company or LLC is a legal business entity that allows your company to function as an independent entity. An LLC can set up a bank account, take payments, and as the name limited liability company implies, protect you from liability.

Simply put, an LLC functions as an independent entity from the owners or LLC members.

That means the LLC is responsible for lawsuits against the business, or debts. The personal assets of the LLC members or owners cannot be used to satisfy business debts.

For most owners, that is a key reason to create an LLC.

Should I Form an LLC or a C Corp?

If you are looking for liability protection and flexibility (limited admin upkeep, tax flexibility), an LLC is a great choice for new businesses. LLCs are considered easier to start and maintain.

If you are currently raising or will need to raise US venture capital and take a company public, a C Corporation is a great choice. US investors require a C-Corporation to invest venture capital.

However, at the end of the day: it’s your business, your choice!

You can learn more about LLC vs. C-corp here.

What Is the Best State to Form My LLC In?

The best state to form your LLC in is nearly always your home state. This is because your company is doing business primarily in that state, whether it is a physical business or an online business. However, for non-residents or certain LLCs, there are better alternatives.

The two exceptions to the form-in-your-home-state rule are:

- You are a non-US resident, in which case you can choose any state – we recommend a Wyoming LLC or Delaware LLC.

- If you have a real estate LLC essentially, the “home state rule” doesn’t apply.

States with additional benefits other than your home state are Wyoming and Delaware.

Here’s why:

- Delaware – Offers the business owner anonymity. Delaware is unique and does not require the owner to list their name on their entity formation documentation.

- Wyoming – Allows the business owner to list a “nominee” as the owner of the LLC other than their own name.

You can read more about the best states to form an LLC here.

Wyoming vs Delaware – What Do You Recommend?

We recommend Delaware only if you plan to convert your LLC into a C-Corp (to raise venture capital from U.S. investors) or if you really want the “prestige” of saying your company is from Delaware. Some customers say this matters to them and if it does, it is your business, your choice!

Otherwise, Wyoming. Why?

Wyoming is the most popular state for non-resident entrepreneurs who run online businesses, e-commerce businesses, or business owners who want an easy and simple way to form and manage their companies.

It’s the most popular state among doola customers, has lower annual fees ($62 vs. $300 in Delaware), low filing fee ($100), and was the first state to create an LLC business structure.

Also, don’t sleep on Wyoming’s prestige as well; it has a friendly business environment and has even been called “The Switzerland of the Rocky Mountains.”

If you want to get more in the weeds on the differences between Wyoming and Delaware, check this guide on Wyoming vs. Delaware.

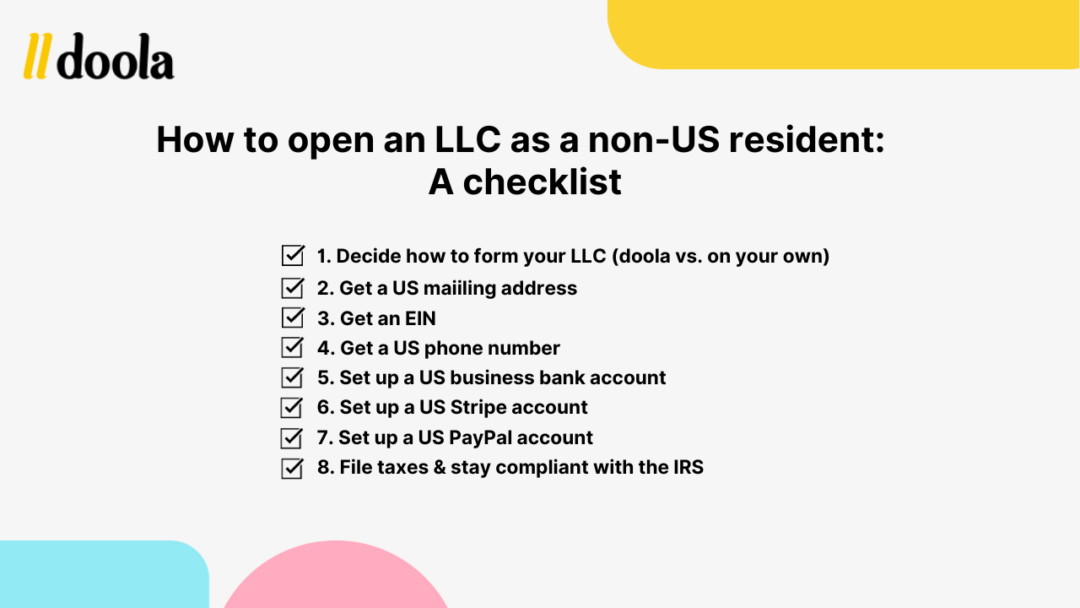

8 Steps to Open an LLC for Non US Residents

If you’re a non-US resident and ready to open an LLC, there are eight steps to creating an LLC.

Follow along to make sure you don’t miss any key steps!

1. Deciding How to Form Your LLC

You have a few options here and we’ll walk through each of them.

doola

If you’re looking for a “one-stop-shop” long-term solution that helps you not only form your LLC but also with getting a registered agent, a US business address, EIN, phone number, IRS tax filings, and serves as a long-term partner, check out doola.

File on Your Own with the State

You can form an LLC by filing directly with the state online!

To do so you will need to do a few things first:

1. Pick a registered agent

You can do this via a Google search and a registered agent is required in each state for an LLC. They charge yearly fees, depending on the state, from $25 up to $200.

2. Pick an LLC name

Search in your state registry if the name is taken. It also must end with “LLC” or “L.L.C” (LLC is usually the most popular)

3. File your LLC online.

You can do this directly through the state as well (google to find their link!) Each state has different filing fees, which can range from $50 to $500+. It can take several days to a week-plus for the state to get back to you.

The state will send you your formation documents which will include your operating agreement as well.

If you’d like to file on your own in Wyoming or Delaware:

- Here is a guide on how to file in Wyoming (there is a $100 filing fee with the state)

- Here is a guide on how to file in Delaware (there is a $90 filing fee with the state)

2. How to Get a US Mailing Address

There are a ton of different options out there to get a physical address for your mail (that you can operate remotely).

You can use a tool like VirtualPost Mail, or doola provides a US mailing address as part of its package.

3. How to Get an EIN

You can typically apply for an EIN easily, but there might be a waiting period depending on your situation. Want to see how long it is currently taking to receive an EIN in real-time?

Below we’ll address the process of getting an EIN:

- Can I apply for an EIN online?

- What is the overall process to apply for an EIN?

- Can I digitally sign Form SS4?

- What is the latest timeline or how long will it take to get an EIN back?

- Can I check my EIN status by myself?

- EIN vs ITIN vs SSN

Can I apply for an EIN online?

In order to apply for an EIN online, the person applying must have a valid Taxpayer Identification Number (SSN or ITIN).

If you don’t have a Social Security Number or Individual Taxpayer Identification Number, then you have to mail or fax an application to get an EIN for your US company.

What is the overall process to apply for an EIN?

- With SSN: If you have a Social Security Number, you can apply for your EIN online. If all your information is valid, you will receive your EIN in minutes!

- Without SSN: If you do not have a Social Security Number, you must fill out an SS-4 and fax it to the IRS. It can take anywhere between 8-11 weeks from the day of submission.

Can I digitally sign Form SS-4 (application for an EIN)?

Due to recent events, the IRS has relaxed some wet signature requirements.

You can read more here in this IRS newsroom update. For us at doola, digital signatures have worked with no issues. We have only been sending in SS-4s with digital signatures and have been receiving EINs with them!

What is the latest timeline or how long will it take to get an EIN back?

In most cases, you can get your EIN back shortly after filing the LLC.

I’m skeptical about these delays, can I confirm them for myself/check-in on the status of MyEin application?

If you want to contact the IRS to check on your EIN Application, here are the steps:

- Call the Business & Specialty Tax Line at 800-829-4933

- The hours of operation are 7:00 a.m. – 7:00 p.m. local time, Monday through Friday.

- Follow the instructions to discuss EIN

You will need your SS-4 form readily available to confirm any information the IRS may ask for.

EIN vs ITIN vs SSN

These acronyms can get pretty confusing so we thought it’d be helpful to define them! We have a full blog post on EIN vs. ITIN vs. SSN to understand what you need here.

What Is an EIN?

EIN stands for Employer Identification Number.

The IRS issues an EIN to a business for tax reporting requirements, and you also need an EIN to open a US business bank account once you have opened an LLC.

Click here to get your EIN or check out this blog post for more information on how to get an EIN.

What Is an SSN?

SSN stands for Social Security Number.

The US SSA (Social Security Administration) issues an SSN in order to identify a US Citizen, Permanent Resident, or Temporary Nonimmigrant Worker.

What Is an ITIN?

ITIN stands for Individual Taxpayer Identification Number.

The IRS issues an ITIN to people who have a US tax filing (or informational reporting requirement) and are not eligible for an SSN.

How Do I Get an ITIN / Do I Need One?

Unless you are filing a US tax return or trying to set up a US PayPal account, you don’t need an ITIN.

If you decide you definitely need one, apply for ITIN or learn more here about how to get an ITIN.

4. How to Get a US Phone Number? Do You Need One?

You will need a US Phone number to apply for a US bank account and to set up your Stripe account (and more). Here are some of the main reasons why a US Phone Number is important:

- Business Verification: When applying for a bank account, Stripe, PayPal, Amazon Seller account, and more, a U.S. phone number is required.

- Proof of Location: Many services will require a utility bill as a proof-of-location to conduct business. If you want to sell on Amazon, this is a must!

- Customer Support: Sometimes customers want to talk to people rather than read a website to search for answers.

- Professionalism: Give your LLC an added element of professionalism with a U.S. Business Phone number instead of an international cell or no number at all.

In terms of phone number options, there are many many providers online. A quick Google search can show you a ton of different possibilities, but we recommend using OpenPhone.

5. How to Set Up a US Business Bank Account

Unfortunately, there are very limited options when it comes to banking in terms of who can support:

- Non-US residents

- Without a US SSN

- No requirement to travel to the US

We recommend the two following banks that can support founders who don’t have a US SSN or who aren’t US residents.

These are:

What are some other banking options?

If you’re curious about other banking options and what their requirements are, this guide outlines how to open a US business bank account, and includes a list of banks that one can approach and what their requirements are:

In the guide you can see all the requirements for the following banks:

- Wise

- Bank of America

- Wells Fargo

- Lili

- First Republic

- Novo

- Brex

- And more!

Once I Have a Bank Account, Should I Use Stripe or PayPal?

Stripe does not require a US SSN and only requires an EIN and formation documents.

PayPal requires a US SSN or ITIN in addition to an EIN and formation document. Unfortunately, if you do not have a US SSN or ITIN, PayPal is not an option.

Given the above requirements, we have seen from thousands of founders globally that Stripe is a much more convenient option!

6. How to Set Up a US Stripe Account

To open a US Stripe account, you’ll need:

- An LLC

- An EIN Number

- A physical location in the country of your EIN

- A phone number in that country

- A Government ID from any country

You should also make sure you are not on Stripe’s list of restricted businesses. As long as you don’t see your business on the list, there is little reason to believe you won’t be able to work with Stripe.

Read more about how to open a US Stripe account, including the exact requirements from Stripe.

7. How Do I Set Up a US PayPal Account?

To create a Business PayPal account, you’ll need:

- An LLC

- A Company Phone Number

- A Company Address

- An EIN Number

- A Social Security number or an Individual Taxpayer Identification Number

Read more about how to open a US PayPal Account and learn about their exact requirements (as directly told by PayPal).

8. How to File Taxes and Stay Compliant with the IRS

Taxes and IRS filing requirements can be extremely confusing. So, below is an overview of the required filings + key deadlines to keep in mind to stay on top of taxes and/or IRS filing requirements for your LLC.

Read more about the latest up-to-date requirements for US tax filings.

I am a Foreign Single Owner/Sole Proprietor (Foreign Single Member LLC).

If you own a Foreign Single Member LLC, and you are not considered as “Engaged in US Trade or Business,” you are not required to file 1040NR or pay personal income taxes.

As a “Non-Resident Alien” (aka foreigner), you are only required to file and pay taxes in the U.S. if you have FDAP source income for which withholding was not done at source or have effectively connected income with U.S. trade or Business.

However, as of 2017, you still report information like a corporation (see Section 1.6038A-1). Therefore, unless you have registered as a corporation, all single-member LLCs are subject to these requirements. Failure to file or incorrect filing will incur a minimum penalty of $25,000.

Key Filings

- Preparation of Pro-forma (Form 1120)

- Preparation of foreign owner report (Form 5472)

Key Dates

- April 15, 2021: Deadline for LLC tax returns when filing as Foreign-Owned Disregarded Entity (Forms 1120 and 5472) or to request a six-month extension of time to file.

- April 15, 2021: Deadline to file individual tax returns for foreign individuals (Form 1040NR) or to request an extension for an extra six months to file your return.

I am a Multi Owner (Multiple Member LLC)

Key Filings

- Preparation of partnership return (Form 1065)

Key Dates

- March 15, 2024: Deadline for partnership and LLCs owned by multiple members to file tax returns (Form 1065) or to request a six-month extension of time to file.

Do I Have to Pay a Professional CPA to File Any Needed Forms?

No, you are not required to do so. But folks sometimes find these forms confusing, or stressful to fill out, so working with a professional is always an option to remove some stress.

Where Do I Submit My LLC Annual Report / Filing?

As mentioned above in Wyoming, there is a $62 payment + an annual report due each year to the state, and in Delaware, there is a $300 annual franchise tax.

Both of these can be paid online, directly to the state by following the links below.

You can also check out our guides on how to submit these filings for each state:

Ready to Form Your LLC? Let Us Help!

It is possible to launch and grow a US LLC business from anywhere in the world (without the need for US citizenship). And it is also possible to do it on your own.

But there are a lot of moving pieces here so it can be helpful to have a helping hand and a long-term partner that takes you through the business formation process smoothly and accurately.

At the end of the day, it’s your business, your choice, regarding whether or not you decide to launch a US business, and how you go about doing it.

If you’re ready to open a US LLC but want some help with the paperwork, banking, and tax compliance – we’re here to help.

Get started by answering a few questions, and we’ll take it from there.

You can also book a free consultation with one of our doola experts.

FAQs

Is it necessary to appoint a registered agent for an LLC as a non-resident?

Yes, every LLC needs a registered agent. The Secretary of State may act as the registered agent in a few states. However, in most states, you’ll need to appoint a registered agent.

How long does the process of forming an LLC as a non-resident typically take?

LLC formation for non-residents typically takes four weeks on average. If you have a Social Security number, the LLC could be formed in as little as a week.

Can a non-resident LLC owner obtain a US business visa?

A non-resident LLC owner could apply for a US business visa. You could apply for a B-1 business visa or an E-1 or E-2 investor visa, depending on your situation and how long you plan to stay in the US.

Is it possible for a non-resident LLC owner to participate in US government contracts?

Non-resident LLC owners can participate in US government contracts, depending on specific criteria. Most government agencies welcome bids from any company qualified to complete the contract.

Can a non-resident LLC owner hire employees in the US?

Yes, a non-resident LLC owner can hire US employees to work for the LLC.

Can a non-resident LLC owner apply for US trademarks or patents?

While you cannot file for the US trademark or patent directly without a US domicile address, a US-based lawyer could file for the trademarks or patents on your behalf.

What happens if a non-resident LLC owner becomes a US resident or citizen?

If a non-resident LLC owner becomes a US resident or citizen, they must abide by US laws and file appropriate forms related to pass-through LLC taxation.

Can a foreigner be a partner in an LLC?

Yes, a non-resident or foreigner can be a partner or member of an LLC.