Looking to set up an LLC in India? Many companies have figured out how to start and operate a US-based LLC, and we'll show you exactly how to do it.

LLCs are popular business entities in the U.S. and are now gaining popularity in India as well. An LLC is a business structure combining the features of a corporation and a partnership/sole proprietorship.

Like a corporation, an LLC has limited liability for its members, meaning that the member’s personal assets are protected from creditors if the LLC cannot pay its debts. And like a partnership or sole proprietorship, an LLC is relatively easy to set up and maintain.

Unfortunately, the LLC has yet to reach India. However, you can set up a U.S.-based LLC while still being a resident of India. You will, however, need a U.S. address, phone number, and U.S. bank account.

If you want to set up a Limited Liability Company (LLC) in India, you have come to the right place. In this article, we will walk you through the process step-by-step and provide some tips on how to make it as smooth and stress-free as possible. So, without further ado, let’s get started!

Can You Register an LLC in India?

An LLC is a legal entity that is used by many types of companies in the United States. It is a hybrid between a corporation and a partnership, and it offers limited liability protection for a corporation with the flexibility and tax benefits of a partnership.

Unfortunately, there are no LLCs in India. The closest thing to an LLC in India would have to be a Limited Liability Partnership (LLP). However, the good news is that you can still set up a U.S.-based LLC while living in India.

The primary hurdle when setting up an LLC as a non-U.S. citizen is the sheer amount of paperwork involved. With doola, however, we can take care of all the paperwork for you so that you can focus on running your business/startup.

We’ll set you up with a physical U.S. mailing address and a dedicated LLC bank account, which you can access from India. We’ll also help you file the necessary paperwork with the U.S. government and obtain an Employer Identification Number (EIN).

Once your LLC is formed, we can provide registered agent service and annual report filing to help you comply with U.S. state laws. In fact, we’ll take care of all the paperwork and maintenance for you, making the whole process hassle-free.

So, in short, you cannot form an LLC in the U.S. from India. However, we can help you set one up in the U.S. that will provide you with all the benefits and protections of an LLC without any of the hassle.

Advantages of Forming a U.S.-Based LLC from India

There are many benefits to forming your company as an LLC in the U.S., even if you’re based in India. For instance:

- An LLC offers greater flexibility than a corporation regarding ownership structure, management, and taxation: You can elect to be taxed as either a corporation or a partnership, which gives you greater flexibility in how you structure your business.

- An LLC is not subject to the same stringent reporting and disclosure requirements as a corporation, making it easier to keep your affairs private: You’re not required to hold shareholder meetings or disclose financial information to the public, which can be a major advantage if you’re looking to keep your business affairs private.

- An LLC offers limited liability protection to its owners, meaning that they are not personally liable for the debts and liabilities of the business: This is a major advantage if you’re worried about being held personally liable for the debts of your business.

- An LLC is not subject to double taxation like a corporation: This means that the profits of an LLC are only taxed once, at the individual level, which can save you money.

- LLCs are not required to hold annual shareholder meetings or prepare detailed financial reports, making them ideal for smaller businesses: The amount of paperwork and compliance required for an LLC is much less than that of a corporation.

What Does Limited Liability Protection Mean?

Limited liability protection is one of the main advantages of forming an LLC. It means that the LLC’s business owners are not personally liable for the business’s debts and liabilities. For example, if the LLC owes money to creditors, the creditors cannot go after the LLC’s owners’ personal assets.

Outside of the basic benefits of an LLC, a few key benefits apply specifically to LLCs formed in the U.S., even if you’re based in India. For instance:

- You’ll have access to the U.S. market and be able to form business relationships with U.S.-based companies, helping to expand your business – something that may not be possible if you were operating as a sole proprietor or partnership.

- As an LLC, you’ll also be able to take advantage of the benefits and protections offered by U.S. law, including the limited liability protection discussed above. This can give you a significant competitive advantage, particularly if you’re doing business in a country with less developed legal systems.

- You can trade in USD, the world’s reserve currency—another big advantage. This gives you more flexibility when pricing your products and services and can help insulate you from currency fluctuations.

- You’ll have a U.S. address, phone number, and bank account, making it easier to do business with U.S. companies – Many businesses, particularly larger ones, are hesitant to do business with companies based in other countries. Having a U.S. presence makes it much easier to overcome this hurdle.

- You’ll be able to take advantage of the many free trade agreements that the U.S. has in place – If you’re selling products or services that can be exported, this can be a big advantage. The U.S. has free trade agreements with 20 countries, including Canada, Mexico, Chile, Colombia, and Israel.

- You’ll be able to benefit from the country’s business-friendly environment – The U.S. is consistently ranked as one of the best countries in the world for doing business. It’s also been ranked as the most innovative country in the world. This means that you’ll be able to take advantage of a supportive environment that encourages businesses to thrive.

- You’ll be able to take advantage of the U.S. tax system, which can be more favourable than India’s tax system for certain types of businesses – The U.S. has a territorial tax system, which means that businesses only have to pay taxes on income earned within the U.S. This can benefit businesses that export products and services to other countries.

Regarding credibility, an LLC is also generally seen as a more professional and established business entity than a sole proprietorship or partnership. This can be helpful if you’re looking to attract investors or partners.

A U.S.-based business also adds credibility to your business if you want to expand internationally. Many countries, including India, prefer U.S.-based businesses when it comes to awarding contracts and other business opportunities.

Setting up an LLC in the U.S. can be a good option for Indian entrepreneurs who want to take advantage of the many benefits of having a U.S.-based business.

The best news yet is that, with doola, it takes just five simple steps to set up an LLC in the U.S., so let’s go through them individually!

5 Steps to Register an LLC in India

The reason that doola is used by hundreds of founders from India is that we make it very easy to set up an LLC in the U.S. All you need to do is follow these five simple steps:

1. Form your company with doola

Our mission statement is very simple: we want to help you form your company in the U.S. as quickly and easily as possible. To do this, we’ve created a platform that makes it super easy to set up an LLC in the U.S.

doola’s platform is specifically designed to help U.S. and non-U.S. founders with company registration and incorporation, which means that we take care of all the paperwork and red tape for you. We also provide a virtual office address in the U.S., so you don’t need to worry about having to use your personal mailing address on any LLC formation documents.

For all foreign companies, we recommend opening an LLC in Delaware or Wyoming, as these states have the lowest annual filing fees.

Hundreds of entrepreneurs have already used doola to form their LLCs in the U.S., and we’re sure that we can help you, too.

2. Get your EIN

The next step is to get an Employer Identification Number (EIN) for your LLC. An EIN is a nine-digit number assigned by the IRS that is used to identify your business for tax purposes.

Getting an EIN can be tricky if you’re a non-resident without a U.S. SSN (Social Security Number). But don’t worry, we can help you with that too. Our expert team will handle the process for you and ensure everything is done correctly.

Even better, the cost of obtaining an EIN is part of our business plan, so you don’t have to worry about any additional expenses, and we’ll give you real-time updates on the status of your application so that you can be confident that everything is moving along smoothly.

Why do I need an EIN?

Under U.S. law, all businesses must have a tax ID number, which is used for identification purposes when filing taxes. If you don’t have a U.S. SSN, then the only way to get a tax ID number is by applying for an EIN.

Not having a tax ID number can create a lot of problems for your business, including:

- You will not be able to open a bank account in the U.S.

- You will not be able to file taxes

- You may not be able to get business licenses or permits

- You may not be able to enter into contracts

Without an EIN, it will be very difficult to do anything with your business in the U.S. So, if you’re serious about starting a U.S. business, you need to get an EIN.

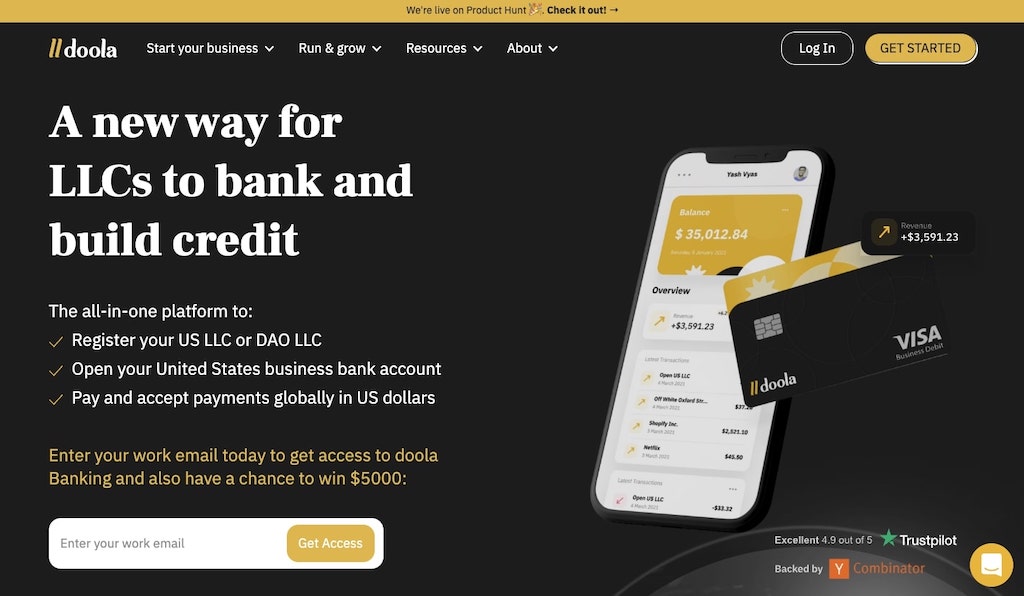

3. Apply for a U.S. business bank account

Generally, opening a US bank account requires an in-person visit to a local branch, which is clearly not possible if you’re based in India.

However, with our help, you can open a business account with a top US bank without ever having to leave the country. We’ll take care of all the paperwork and requirements for you and ensure that your account is opened quickly and smoothly.

Additionally, our banking partner provides a $250 cash bonus if you reach the minimum spend requirement in the first 90 days, so you’ll actually earn money just by signing up!

With doola Banking, signing up for a business account is easy and hassle-free. We’ll take care of all the paperwork and requirements so you can focus on what’s important: growing your business and making money.

4. Set up your payment gateways

Once you have registered your LLC and we’ve obtained an EIN on your behalf, you’re ready to set up your payment gateways. This will allow you to start doing business, receive payments from US customers, and accept payments in USD.

Several different options are available, but the two most popular are PayPal and Stripe. Both are easy to set up and use and have fairly low transaction fees.

PayPal:

PayPal is one of the most popular payment processors in the world, and it’s very easy to use.

1. Go to PayPal.com and sign up for a business account.

2. Follow the instructions to link your bank account and credit/debit cards.

3. Once you’ve registered your LLC and have an EIN, you can add that information to your PayPal account so that customers can see your company name when they pay.

4. Set up your PayPal account to accept USD payments. To do this, go to the “Profile” tab and click on “More options.” From there, click on “Set Currency Conversion Options” and select “Enable.”

Stripe:

Stripe is the world’s largest online payment processor, handling billions of dollars in transactions yearly. They’re also one of the easiest platforms to use, with a simple, straightforward interface that makes it easy to get started.

1. Go to Stripe.com and create an account.

2. Follow the instructions to link your bank account and credit/debit cards.

3. Once you’ve registered your LLC and have an EIN, you can add that information to your Stripe account so that customers can see your company name when they pay.

4. Set up your Stripe account to accept payments in USD. To do this, go to the “Account” tab and then click on “Settings.” From there, click on “Currency” and select “United States Dollar.”

5. Keep up with annual tax filings

Under U.S. law, LLCs are required to file an annual tax return. These tax returns are due on the 15th day of the fourth month after the end of your fiscal year. For example, if your fiscal year ends on December 31, your tax return would be due on April 15 of the following year.

It’s important to keep up with annual tax filings because your LLC could be dissolved if you don’t. Failing to file an annual return can also result in late filing fees and penalties.

If you’re unsure how to file your LLC’s annual tax return, you can consult an accountant or tax attorney. Alternatively, you can sign up for doola Tax and Compliance, and we will handle everything on your behalf, from company formation to yearly tax filings and more.

Set up Your U.S. LLC Today With doola!

If you’re looking for help with company formation, then you should definitely consider setting up an LLC with doola. An LLC is perfect for small businesses and can offer great benefits such as pass-through taxation.

Additionally, having a U.S. company while being based in India can offer many opportunities for your business. It opens markets and can help you form partnerships with other companies and give your business a more global footprint.

There are many things to consider when setting up an LLC, but doola can help simplify the process. We can handle all the paperwork and filings for you so that you can focus on running your business.

doola provides an easy and efficient way to set up your U.S. LLC online. We’ll take care of all the paperwork and filings for you so that you can focus on running your business.

Contact us today to get started!