Language:

The Ultimate Guide to Shopify Bookkeeping: Tools and Tips for Store Owners

Are you running a Shopify store and wondering if your finances are running you instead? While building your online empire is thrilling, managing the books can feel chaotic.

Without a rock-solid bookkeeping system, you risk falling into a whirlwind of cash flow chaos, tax season stress, and missed growth opportunities.

And doola Bookkeeping can transform your business, keeping every sale, expense, and tax obligation in check.

The highly trusted doola team of tax experts have put together this A-Z guide to Shopify bookkeeping for you to get started.

We’ll cover essential tools, actionable insights, and tips to help you keep your books balanced and your business thriving.

Best of all? With doola, you can let the experts handle the numbers so you can scale your store and become the ultimate Shopify bookkeeping champion.

Book a free demo to find out what’s in store.

Shopify Bookkeeping — What Should I Know?

Bookkeeping for Shopify is more than just tracking sales; it’s about gaining a clear picture of your business’s financial health.

Here’s everything you should know about Shopify bookkeeping for an e-commerce platform:

Diverse Revenue Streams

While Shopify may be your primary platform for sales, you might also generate income from marketplaces like Amazon, wholesale partnerships, or even pop-up shops.

Managing these multiple streams requires continuous monitoring and tracking.

Transaction Fees and Payouts

Shopify deducts transaction fees before transferring your earnings. Which means reconciling payouts to actual sales can get tricky and complex with DIY bookkeeping.

Inventory Management and Tracking

Staying on top of your inventory costs, such as Cost of Goods Sold (COGS), while aligning them with sales revenue is vital for measuring profitability and ensuring a healthy cash flow.

Effective Shopify bookkeeping with doola ensures you’re prepared for taxes, have accurate financial records, and can make confident decisions about growth.

Get started with us at just $250 per month.

Setting Up Your Bookkeeping System

Establishing a robust Shopify Bookkeeping system is the key to staying ahead in managing your ecommerce store’s finances.

Here’s how to set your online store up for success:

1. Separate Business Finances

Mixing personal and business finances is a bookkeeping disaster waiting to happen. With doola, you can always create a dedicated business bank account and credit card to ensure:

- Transparent financial tracking

- Simplified tax preparation

- Protection of personal assets

2. Select the Right Accounting Method

Pick wisely between the following two methods:

✔️ Cash Basis Accounting:

Record income and expenses only when money changes hands — ideal for a straightforward approach.

✔️ Accrual Basis Accounting:

Record revenue and expenses when they’re earned or incurred, regardless of cash flow. Accrual accounting offers a clearer long-term picture.

3. Sync Shopify with Accounting Software

Use tools like doola Bookkeeping to sync your Shopify transactions, automatically import data, and maintain accurate, up-to-date records with zero hassle.

4. Track Your Taxes from Day One

Enable Shopify’s tax settings to collect and track sales tax correctly.

Here’s a quick guide on setting up taxes on Shopify:

📌 Set Up Taxes On Shopify in 5 Steps

| 1. From your Shopify admin, go to Settings > Taxes and duties.

2. Go to Manage sales tax collection section > click on country/region 3. Click on Collect sales tax to activate tax collection for that region. 4. Input your tax number in the Tax number field. 5. Click Collect tax to confirm your changes. |

Setting up your bookkeeping system doesn’t have to be overwhelming—especially with doola’s expert services in your corner.

We take care of the details, so you can focus on what matters: growing your Shopify store.

Check out doola’s bookkeeping services and pricing and transform your Shopify bookkeeping experience today.

Essential Bookkeeping Tools for Shopify Store Owners

Once you’re off to a good start, it’s important to streamline your Shopify bookkeeping process and maintain financial clarity with these essential tools:

📌 Accounting Software:

Leverage doola Bookkeeping to seamlessly sync sales, monitor expenses, and generate comprehensive reports tailored to your business needs.

📌 Inventory Management:

Stay on top of your stock with tools like TradeGecko or Stocky, helping you track inventory levels and accurately calculate Cost of Goods Sold (COGS).

📌 Payment Processing:

Integrate platforms like PayPal and Stripe to easily manage transaction fees and payouts, ensuring your records align with your actual earnings.

📌 Expense Tracking:

Simplify receipt management and expense categorization with apps such as Expensify, keeping all your financial data organized and accessible.

Using these tools, you’ll save time, minimize errors, and gain peace of mind knowing your financial records are precise.

And if you aim to go beyond the basics, explore how doola can elevate your Shopify bookkeeping experience.

Daily Bookkeeping Tasks — A Checklist

To eliminate financial chaos from your bookkeeping routine, start ticking off these daily tasks:

✔️ Log Daily Sales:

Track Shopify revenue, refunds, and discounts to keep your sales data accurate and actionable.

✔️ Record Expenses:

Note down every expense—whether it’s ad spend, shipping costs, or office supplies. Every dollar counts!

✔️ Monitor Cash Flow:

Regularly monitor your bank accounts to ensure you have enough working capital for smooth operations.

A bit of daily diligence always prevents missed transactions, ensures real-time financial clarity, and sets your business up for long-term success.

Monthly Bookkeeping Tasks to Keep Track Of

Regular monthly reviews not only keep your books clean but also give you the financial clarity to plan confidently and grow strategically.

At the close of each month, dive deeper into your financials with these essential steps:

1. Reconcile Bank Accounts:

Cross-check your bank statements against your records to spot and resolve discrepancies early on.

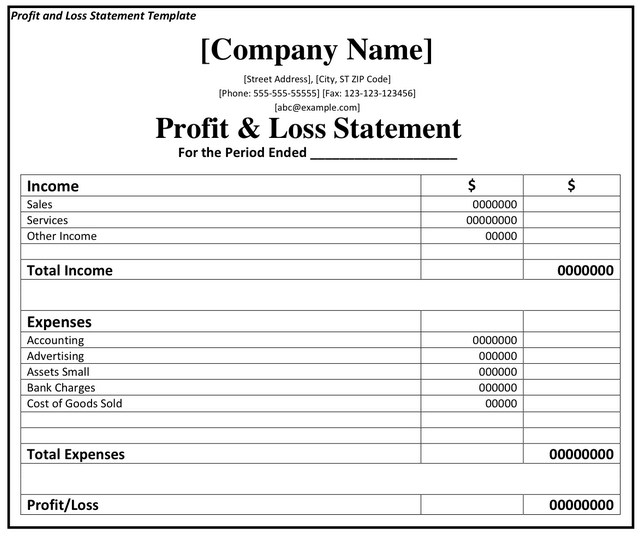

2. Analyze Profit and Loss:

Generate a Profit and Loss (P&L) statement to assess your store’s performance. Use it to identify trends, flag issues, and celebrate wins.

Here’s a standard P&L template commonly used by companies:

3. Review Inventory:

Match your inventory records with physical stock. Address any variances to ensure accurate reporting and smooth operations.

4. Set Aside Taxes:

Calculate sales tax liabilities and estimate income taxes. Secure and set aside these funds to stay ahead of tax deadlines and avoid surprises.

Book a demo with doola to stay on top of these bookkeeping tasks.

Tax Preparation and Compliance

Navigating e-commerce taxes can feel overwhelming, but the right strategy makes all the difference.

Here’s how to stay on top of tax preparation and compliance and improve your Shopify bookkeeping experience:

✔️ Automate Sales Tax Collection:

Use Shopify’s built-in tools to calculate and collect sales tax automatically based on customer locations. It’s a lifesaver for accuracy and compliance.

✔️ Quarterly Tax Filings:

If required, set reminders to file estimated quarterly taxes. Staying on schedule helps you avoid penalties and interest charges.

✔️ Track Your Deductions:

You can always maximize savings by recording Shopify-specific tax deductions such as:

- Shipping expenses

- Advertising costs

- Payment processing fees

✔️ Organize Your Records:

Keep receipts and invoices well-organized to make tax season stress-free and ensure you’re audit-ready at all times.

doola’s bookkeeping pros simplify tax preparation, ensuring compliance and saving you from the stress of manual calculations.

doola’s Top Bookkeeping Tips to Be a Shopify Business Owner

As a Shopify entrepreneur, managing your books shouldn’t slow you down.

Here’s how doola empowers you to stay ahead with these expert tips:

Automate and Elevate Your Workflow

Integrate doola Bookkeeping with Shopify to effortlessly import transactions, track inventory, and categorize expenses.

Automation isn’t just a time-saver — it’s your accuracy guarantee.

Distinguish COGS from Operating Expenses

Understanding your Cost of Goods Sold (COGS) is the key to unlocking healthier profit margins.

doola’s tools make it easy to separate these from your operating expenses, giving you a crystal-clear view of your financial health.

Consistency is Key

Dedicate a regular time slot — weekly or monthly — to review your books. Staying on top of updates ensures no detail gets overlooked, keeping your business audit-ready and scalable.

Partner with the Experts

Instead of wasting productive hours on bookkeeping backlogs, let doola’s experts step in and take over the reins.

From catching up on messy records to ensuring tax compliance, doola handles the heavy lifting so you can focus on growth.

Get started with doola today at just $250 per month.

Checklist: How Organized Are Your Shopify Store Finances?

It’s now time to assess your financial organization with this Shopify checklist:

1. Do you have a dedicated business bank account?

Separate finances mean easier tracking and fewer tax headaches.

2. Are all Shopify transactions synced to accounting software?

Automated syncing ensures nothing slips through the cracks.

3. Do you reconcile your accounts every month?

Spot discrepancies early and keep your financial records squeaky clean.

4. Have you accurately tracked all collected sales tax?

Compliance isn’t optional—stay audit-ready by tracking tax collection.

5. Can you generate a profit and loss (P&L) statement on demand?

A ready P&L report is your window into performance and decision-making.

If you answered “no” to any of the above, it’s time to tighten up your bookkeeping strategy.

doola Bookkeeping can transform chaos into clarity, making your Shopify finances effortless.

Let’s fine-tune your financial flow — explore how doola can help your Shopify business.

Why Choose doola for Shopify Bookkeeping?

Shopify store owners face unique financial challenges, and doola is here to simplify the process.

With doola’s expert bookkeeping services, you get:

Tailored for Ecommerce:

Our services are custom-designed to meet the unique financial needs of Shopify businesses.

Automates Core Tasks:

With doola, business owners enjoy seamless integrations with Shopify and other tools to automate repetitive tasks and eliminate manual errors.

Tax Readiness:

We offer accurate, audit-proof records to help you breeze through tax season.

Do not ever let bookkeeping slow you down!

Book a free demo with doola today and let us handle the numbers while you focus on scaling your Shopify empire.