As the world becomes increasingly interconnected, it’s easier than ever to work remotely or even overseas internationally. Whether you’re a freelancer with clients from around the globe or an employee who’s been assigned to work abroad, it’s important to know how to navigate the tax requirements that come with earning income outside your home country. One crucial piece of paperwork you’ll need to understand is the W-8 form. This document can help ensure you don’t end up overpaying on taxes or facing legal repercussions down the line. In this article, we’ll explain what W-8 forms are, who needs to fill them out and how to do so correctly.

What Is the W-8 Form?

A W-8 form is an IRS form used by foreign individuals and entities doing business in the United States.

The form contains information regarding the foreign person’s identity, such as:

- Name

- Address

- Country of citizenship or residence

- Details about their financial account

- Tax residency status

- Information about any withholding agent acting on behalf of them with respect to payments made to them by a U.S. payer (if applicable)

The form must also include either a valid chapter 4 status certifying agreement or an exemption from Foreign Account Tax Compliance Act (FATCA) reporting requirements to which they may be entitled under certain circumstances depending on their country of residence and type of income received.

What Is the Purpose of the W-8 Tax Form?

A W-8 tax form is a tool to help you avoid paying more taxes than you need to when earning income outside of your home country. It lets the organization or individual paying you know that you’re not a U.S. citizen or resident and therefore shouldn’t be subject to certain tax requirements. By filling out this form correctly, you can help ensure that you’re only paying taxes in the countries where you’re legally obligated to do so. So think of it as a key to unlocking the potential of global work and income opportunities without the headache of extra taxes.

Who Must Complete the W-8 Tax Form?

Foreign persons and entities, such as foreign corporations, trusts and estates must complete the W-8 tax form. This form is used to report income earned by a non-resident alien for work done in the United States or for income received from U.S. sources. In situations where a foreign person or entity is receiving payments from a U.S. source, they must provide a valid W-8 tax form to ensure they are not taxed on their income by the IRS.

In some cases, even U.S. citizens and residents may be required to fill out the W-8 tax form if they are receiving income from a foreign source. As most U.S. citizens know, all earned income is taxable. However, when taxes are paid on earnings outside of the U.S., it may be difficult for the IRS to track this information without verification of payment. Because of this requirement, U.S. citizens who receive money from abroad will need to submit a valid W-8 tax form that displays proof that foreign taxes were paid on those earnings so they do not get double taxed by both countries.

Certain other individuals or businesses may also have to file a W-8 tax form when providing services or selling goods internationally. These include freelance workers who are hired for projects outside of their home country and companies who offer international shipping services with goods that originate outside of the U.S.

Types of W-8 Forms

There are several types of W-8 forms, each designed for a specific purpose or situation.

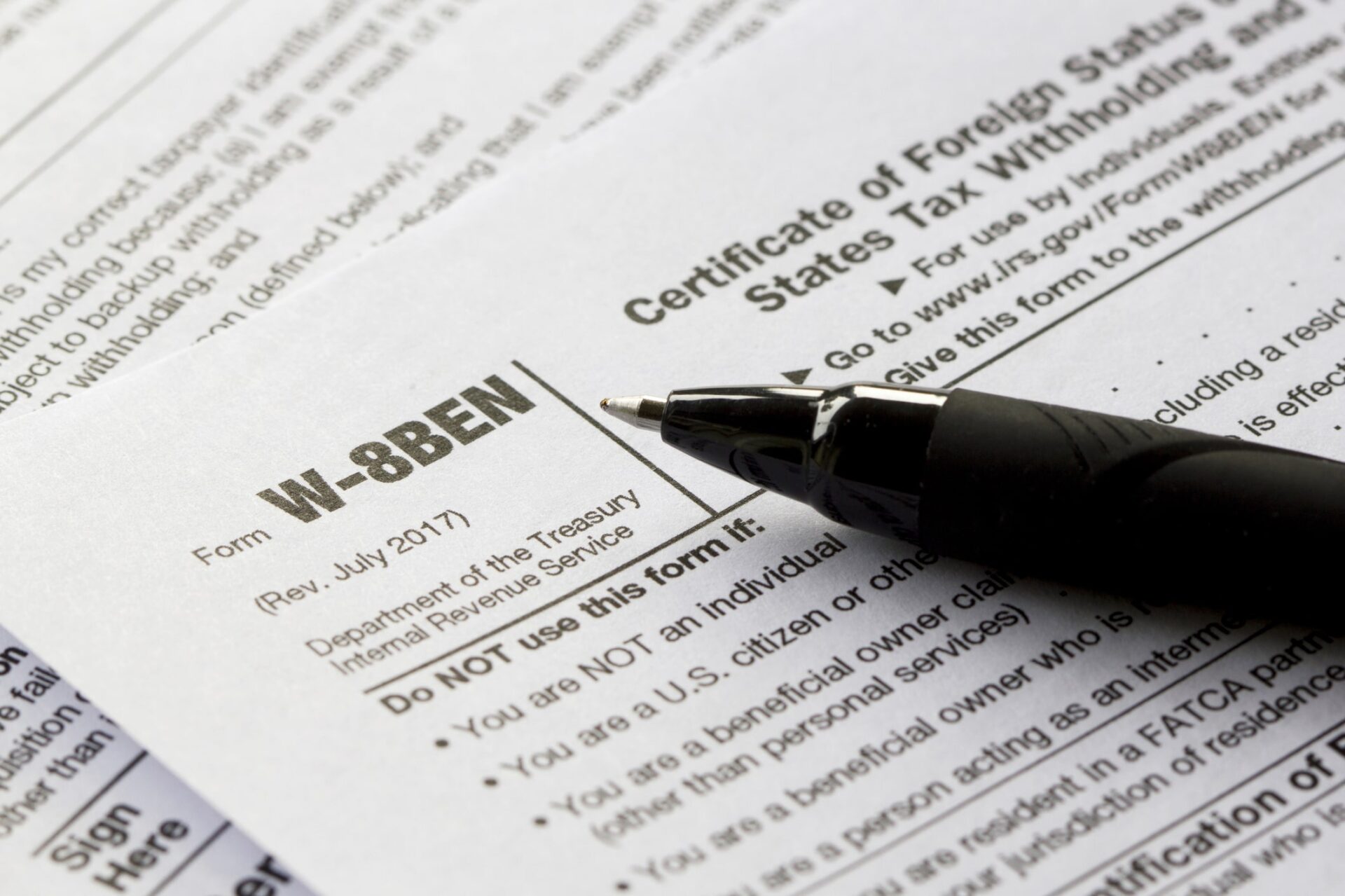

Form W-8BEN

The W-8BEN form is used by individuals or entities that are not U.S. citizens or residents who wish to claim an exemption from U.S. taxes on the income they receive from a U.S. source. This form can be used for both individuals and entities such as corporations, trusts and partnerships. The form includes information such as full name, address, foreign tax identification number (TIN), type of foreign entity (if applicable) and whether the individual/entity has a permanent establishment in the U.S. It also includes questions regarding other withholding agreements and assets owned by the individual/entity that might be subject to different rates of taxation.

Form W-8BEN-E

The W-8BEN-E form is similar to the W-8BEN, but it is designed for entities such as corporations, trusts and partnerships rather than individuals. This form requires more detailed information including registered name, address, contact information, entity type (corporation or trust), business activities conducted by the entity in the U.S. or outside of it, percentage ownership held by each owner of the entity (if applicable) and list of beneficial owners of the entity (if applicable). It also requires information about any other withholding agreements or treaties that might apply to the entity regarding U.S. taxes.

Form W-8ECI

Form W-8ECI is used by non-U.S. individuals or entities who earn income from U.S. sources that are effectively connected with a United States trade or business. This includes foreign individuals or entities who conduct business in the U.S. or have a U.S. presence, such as a branch office or subsidiary, and earn income that is attributable to that business or trade.

The “ECI” in W-8ECI stands for “effectively connected income.”

Form W-8ECI is specifically used to claim an exemption or reduction from withholding tax on income that is effectively connected with a U.S. trade or business.

Form W-8EXP

The W-8EXP form is used when a foreign payer needs to certify that certain payments made to a nonresident alien are either exempt from U.S. taxes under an income tax treaty or will have a reduced rate due to a treaty provision. In order for this exemption or reduction in taxes to be claimed on behalf of the payee, it must be established that they fall under one of several categories specified in IRS regulations. To do this, Form W8EXP must be completed with details about the payee’s identity (name and TIN) and residence status as well as details about the payment itself, including the amount paid and the purpose for making payment.

Form W-8IMY

Form W-8IMY is used when filing an application for U.S. tax-exempt status under Internal Revenue Code section 501(c)(3). This form requires detailed information about an organization applying for tax-exempt status including its legal name and address, governing body, officers, activities, financial data, corporate structure, membership, contributions received and operating costs.

When Is the W-8 Tax Form Required?

The W-8 tax form is an essential document for foreign individuals or businesses to possess if they’re receiving income from a U.S. source. This includes dividends, interest, royalties, pensions, annuities, rents and other forms of income. It’s also necessary in cases where a foreign person or company is providing goods or services to an American individual or business. Without this form, the organization paying you may withhold a portion of your income in order to pay taxes, assuming you’re a U.S. citizen or resident of the United States. This can be problematic as it often leads to long and drawn-out processes in order to claim back these withheld funds.

For this reason, any foreign person or company who expects to receive payments from U.S. sources should complete and submit a W-8 form beforehand. The information provided on the form will help inform the payer about the appropriate tax rate and whether withholding should apply at all. For example, some countries have treaties with the United States that provide reduced withholding rates for their citizens – something that must be stated on the W-8 form in order for these benefits to take effect.

How to Complete the W-8 Tax Form

The general instructions for completing a W-8 tax form are as follows:

Step 1: Determine which type of W-8 form you need to fill out based on your situation.

Step 2: Fill in your personal information, including your name, address and tax identification number (TIN). If you don’t have a TIN, you may be able to use an alternative identification number or apply for one.

Step 3: Indicate your country of citizenship and tax residency. This is important because it determines which tax treaties apply to you and whether you’re subject to U.S. tax withholding requirements.

Step 4: Complete any additional sections or boxes that apply to your situation. For example, if you’re claiming treaty benefits, you’ll need to provide specific information about the treaty.

Step 5: Sign and date the form, certifying that the information you’ve provided is accurate and that you’re not a U.S. citizen or resident.

Step 6: Submit the completed form to the organization that’s paying you. They may require a physical or electronic copy of the form.

You can also refer to the IRS website for form-specific instructions.

Benefits of the W-8 Tax Form

There are several benefits to filling out a W-8 tax form, including:

- Avoiding double taxation: By providing the necessary information on a W-8 form, you can claim treaty benefits and reduce or eliminate the amount of taxes you owe in both your home country and the U.S. This can help you avoid the burden of double taxation.

- Simplifying the tax process: Filling out a W-8 form can help streamline the tax process and make it easier for you to receive payment for your work. By certifying that you’re not a U.S. citizen or resident and providing the necessary information, you can help ensure that the organization paying you withholds the appropriate amount of taxes and avoids any penalties or issues with the IRS.

- Opening up new opportunities: By filling out a W-8 form, you can work with U.S.-based organizations and take advantage of the opportunities that come with it. This can include access to new clients, projects and markets.

- Avoiding complications and delays: If you don’t fill out a W-8 form and the organization paying you withholds taxes, it can create complications and delays in receiving payment. By providing the necessary information upfront, you can help avoid these issues and ensure a smoother payment process.

A Beneficial Extra Step

Whether you’re a digital nomad working from a beach in Bali or an engineer on a short-term assignment in the U.S., it’s important to understand if and when you need to fill out a W-8 form. While completing a W-8 tax form may seem like an extra hassle when it comes time to pay taxes each year, its purpose is essential in ensuring proper taxation is applied based upon applicable tax law requirements by both foreign countries and the United States alike.

Don’t let the complexities of W-8 forms stress you out — let doola help you streamline the process and ensure compliance with U.S. tax laws.

FAQs

How long is Form W-8 valid?

The validity of Form W-8 depends on the type of form being filled out. Generally, Form W-8BEN and W-8BEN-E remain valid for three years after the date it was signed, while a Form W-8EXP and W-8IMY remain valid for one year after the date it was signed. This means that if an individual or entity wishes to maintain their foreign status with the IRS, they should ensure that they renew their forms before these timeframes are up.

Are there any penalties or fines for not providing Form W-8 to payors?

Yes, there can be penalties and fines associated with not filing a Form W-8 correctly or at all. If an entity fails to provide a properly completed form to their payor by the due date specified in their agreement, then that payor will be required to withhold 30 percent of any payments made as taxes for that entity in accordance with U.S. law. Furthermore, failure to file accurate information may result in civil and criminal penalties being imposed on the filer by the IRS.

Who has to fill out a W-8 form?

A Form W-8 must be completed by anyone who is not considered a U.S. citizen or resident alien but otherwise receives income through U.S. sources, including foreign entities such as corporations and partnerships; individuals who hold accounts outside of the United States; foreign trusts; certain government agencies and international organizations; nonresident alien individuals; and U.S. branches of foreign banks and other financial institutions, among others. It is important that all such entities complete this form accurately and submit it on time so as to avoid any penalties and ensure that all obligations under U.S. tax law are met appropriately.