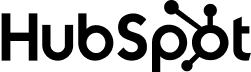

Stay ahead with a smarter tax solution

From preparation to filing, our experts ensure peace of mind every step of the way.

Backed by the best

A dedicated tax team

Tax filing made simple with expert guidance every step of the way. Count on us to keep you organized and ahead of deadlines all year round.

Save money on your returns

Our tax experts help you uncover every possible deduction, ensuring you save more and get the most out of your returns.

All-in-One solution

The All-in-One Accounting plan combines expert bookkeeping and tax support to keep your finances organized and stress-free all year.

Tax Deadlines

Income tax filing deadlines

Single Member LLCs and C-Corporations

Deadline: April 15th, 2025

For US Residents with a SMLLC

Schedule C, Profit or Loss from Single Member LLC.

For US Non-Residents with a SMLLC and C-Corporations

Form 1120, US Corporation Tax Return

Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign Corporation Engaged in a U.S. Trade or Business.

Multiple Member LLCs (Partnerships)

and S-Corporations

Deadline: March 17th, 2025

For Multi Member LLCs

Form 1065, US Return of Partnership Income + K-1 Forms

For S-Corporations

Form 1120-S, Income Tax Return for an S Corporation + K-1 Forms

Need to file Form 1099?

Don’t sweat, doola can help. We’ll help you confidently complete Form 1099 so you can have peace of mind it is submitted on time, and accurately.

Your dedicated team

Your team of experts will handle every detail, working together to keep you organized and ensure timely filing.

Bookkeeper

Your bookkeeper keeps your financials in check by organizing your books and preparing monthly financial statements. Got questions? They’re just an email or call away.

Tax Coordinator

Your dedicated Tax Coordinator guides you through the tax process, helping you gather documents and ensuring everything is ready for a smooth filing experience.

Tax Advisor

Licensed tax professionals handle everything from preparing and filing your income tax returns to offering year-round advisory support, so you’re always covered.

Trusted by 10,000+ U.S. business owners

Exceptional Service

Great company. Very clear and precise with the services provided. Extremely helpful customer success people will help you through the whole process, which is already very simple and very well explained.

Sr Gonzalo Cozzi

Professionalism on Steroids

If you are looking for a customer-centric agency with extraordinary communication, professionalism, and speed, there is no alternative to doola (and I’ve tried several others). Price-service relation is unbeatable. One of the few internet companies I am really enthusiastic about.

ADK

Beyond 4-Stars

I don’t know how anyone can even put a 4-star review… doola really gets you the same things just at a better quality, speed, and price. If doola had a supermarket, I would buy from there. If doola had a university, I would study there. Just an amazing company.

Maxim Kraynyuchenko

FAQs

What is dedicated bookkeeping?

With dedicated bookkeeping, a human bookkeeper will get to know your business, bring your books up to date, and do your book for you, start to finish.

What tasks does my bookkeeper perform?

Your bookkeeper will categorize your transactions, reconcile your accounts, generate your financial statements and close your books for tax time by working with you. While occasional input from you may be needed for specific transaction categorizations, we aim to make the bookkeeping process as effortless as possible for you.

How much does dedicated bookkeeping cost?

Dedicated bookkeeping is billed annually and cost $1999.

I’m behind on my bookkeeping and taxes. Can you help me get caught up?

If you’ve fallen behind on your bookkeeping and taxes, our specialized Catch-Up Bookkeeping service is designed to help you get back on track. We’ll assist with organizing and updating your financial records, ensuring everything is accurate and compliant.

Still have a question?

Book a demo with an expert from doola, today.

Join thousands of online businesses growing faster

Book a demo with our friendly team of experts.

Try our Bookkeeping Software free for 30 days.