Language:

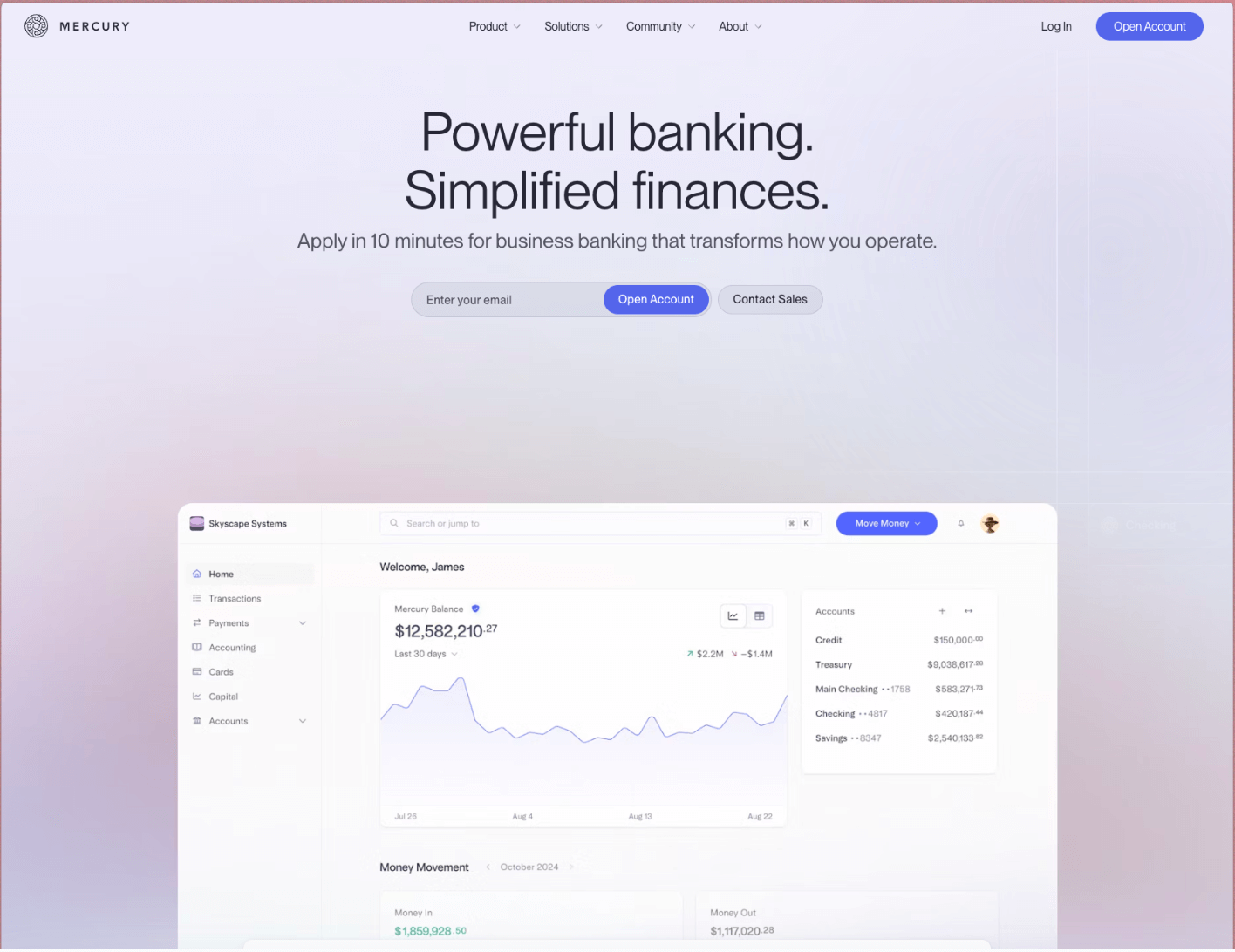

How to Open a Bank Account with Mercury

Opening a bank account with Mercury doesn’t have to be complicated. In this guide, we will guide you through the process and show you exactly what to do. If you get stuck somewhere, make sure to watch the video for further clarification.

If you are a foreign founder setting up a US business, it is a lot more difficult to open an account with a bank like Chase or Bank of America. To do this, you must be physically present at their office in the US and your entity must also be registered at a physical office address.

For this reason we suggest to open a bank account with Mercury.

Mercury accepts any physical address anywhere in the world (including your home or office address in your country of residence).

Right, let’s dive into what’s required to set up your bank account with Mercury!

A Step-by-Step Guide to Opening a Mercury Bank Account

Firstly, head over to our partner page with Mercury. Then, follow the steps below.

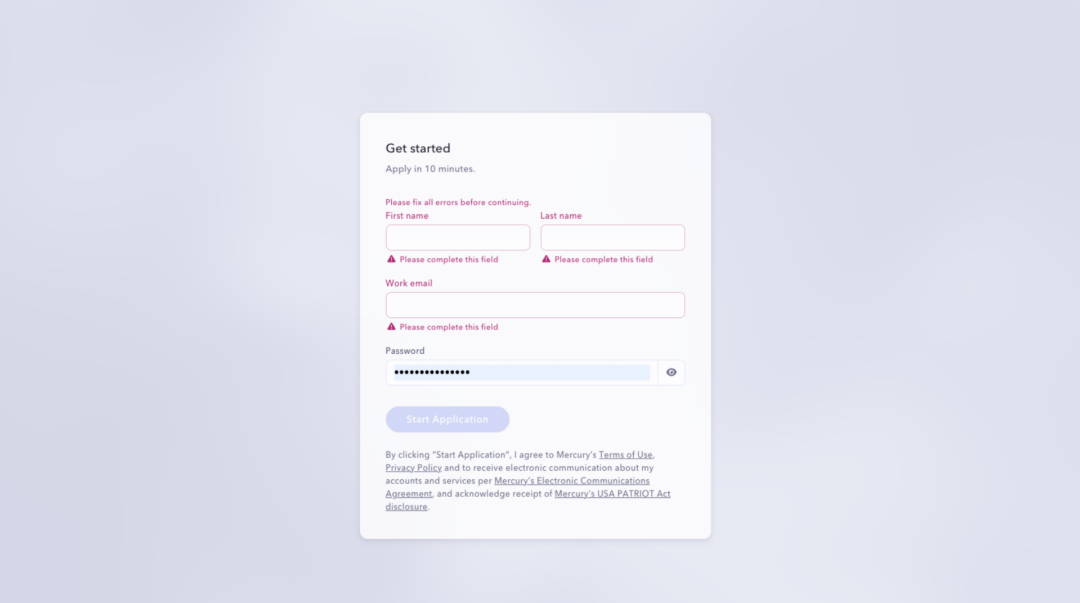

You will need the following:

- “Articles” (This is the document filed with the state in America that created your LLC, C-corp or LP. Think of it as the ‘birth certificate” for your entity.)

- Operating Agreement

- EIN number

- ID/Passport

Step 1: Enter your email

Step 2: Create an account

Step 3: Create a Mercury callsign

Share your company name and create a unique callsign. This callsign is crucial as it helps in easily accessing your account.

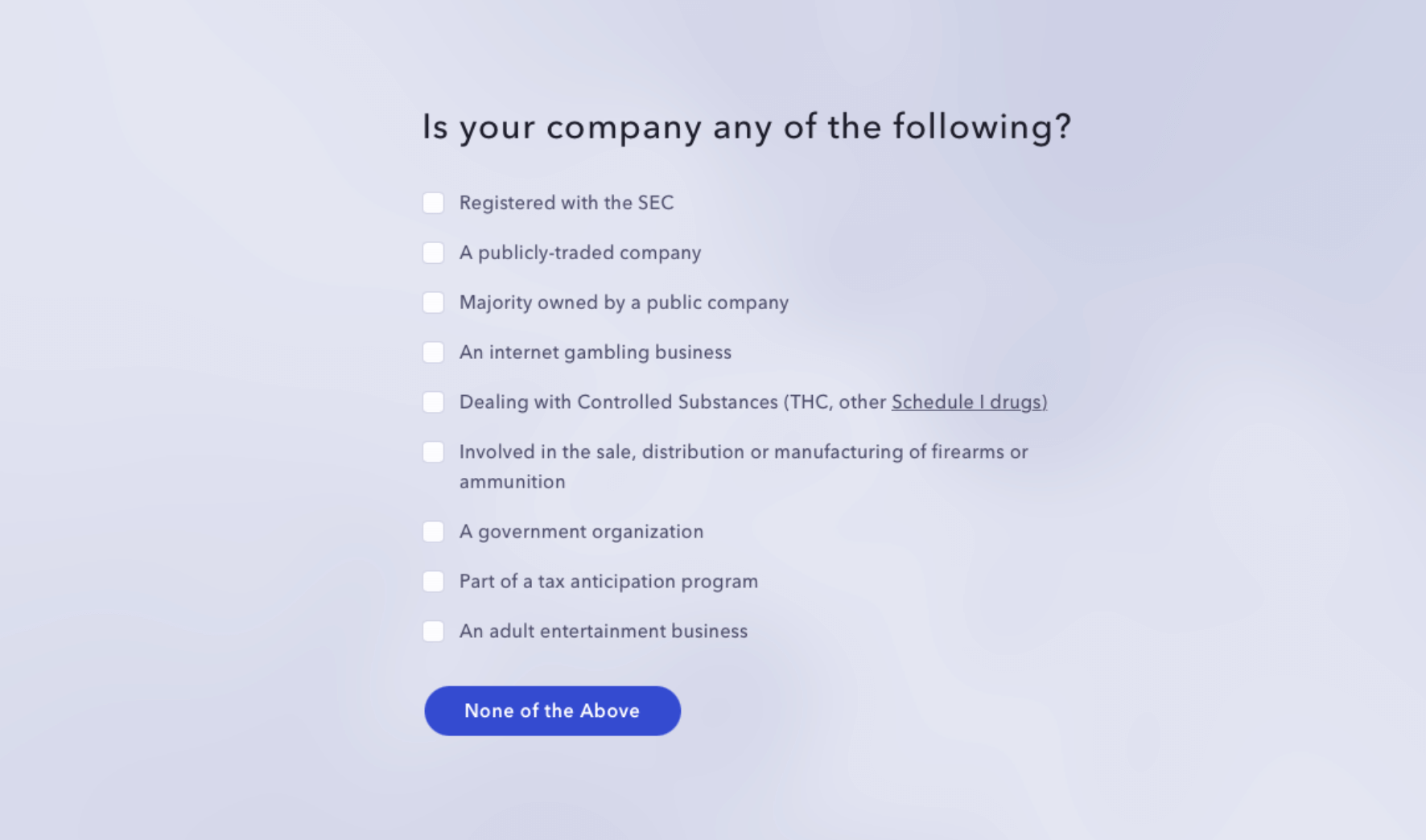

Step 4: Complete the KYC questionnaire

As part of their KYC procedure, Mercury will ask some questions about the type of company. The entire process takes no longer than 10 minutes.

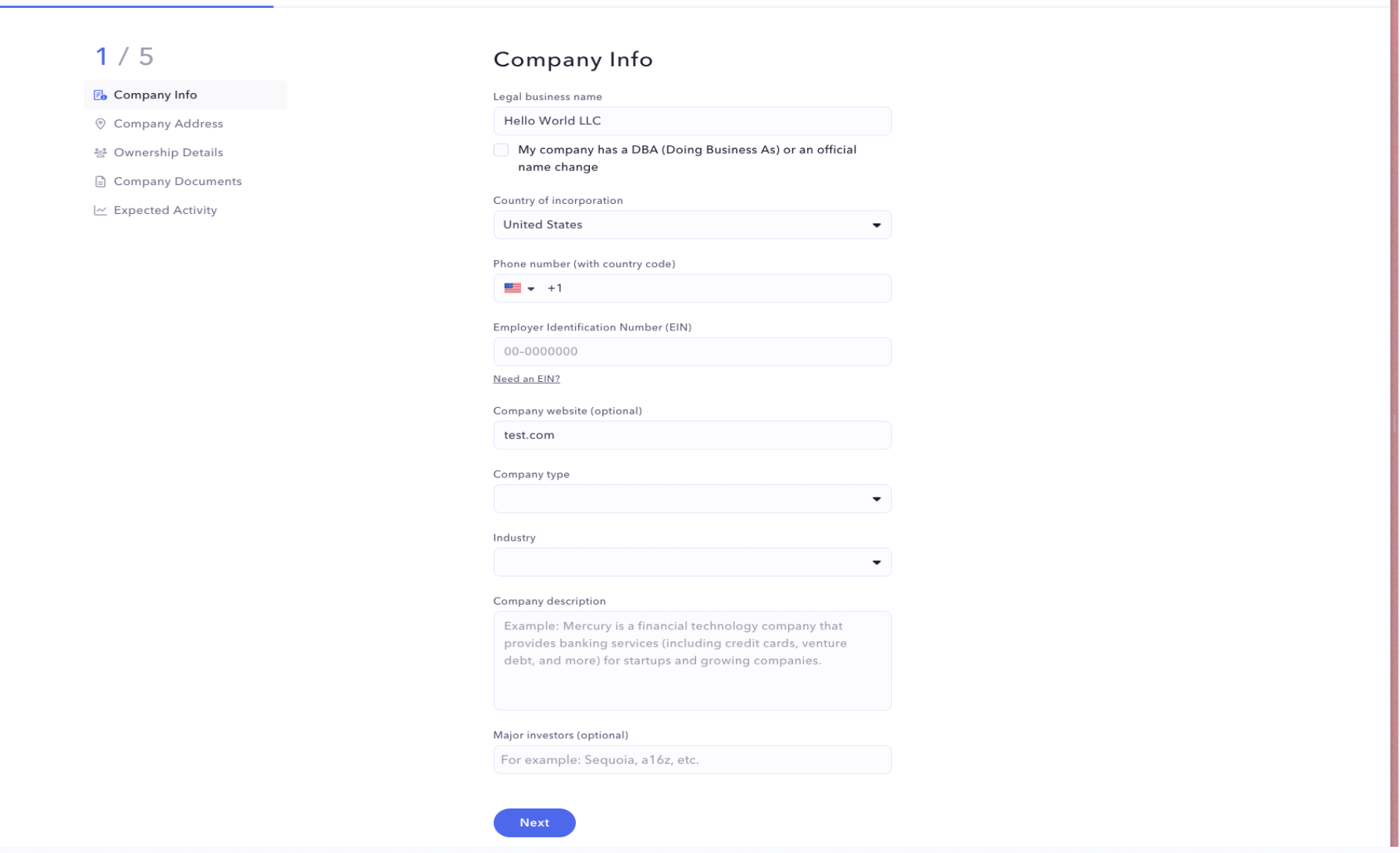

Step 5: Complete the company info

Complete the company info like EIN, company type, industry, and a brief company description. Do NOT click the “my company has a DBA” box unless you have filed a DBA before. The phone number can be your phone number.

Step 6: Company incorporation details

Specify your company of incorporation, typically indicating if you have a US LLC or C Corp, meaning your company is formed in the United States.

Step 7: Company address

- For the company address, use the Registered Agent address in the Articles/Certificate of Formation.

- Use your foreign home/office address in the “Where do you do most of your work?”. It needs to be an address you can verify.

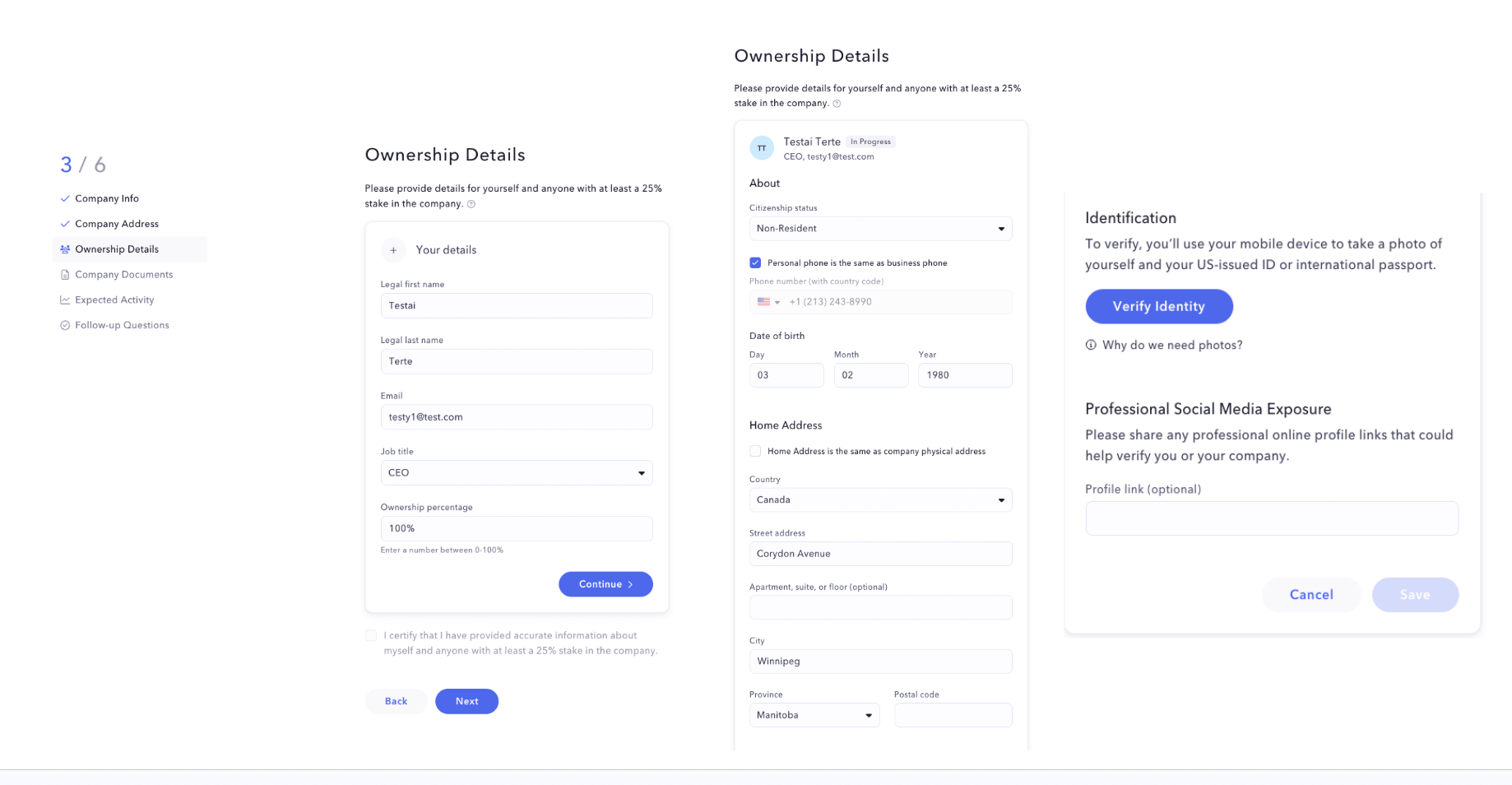

Step 8: Ownership details

Enter the complete information of all shareholders and their percentages here, and press the blue “Continue” until you verify your identity and phone number.

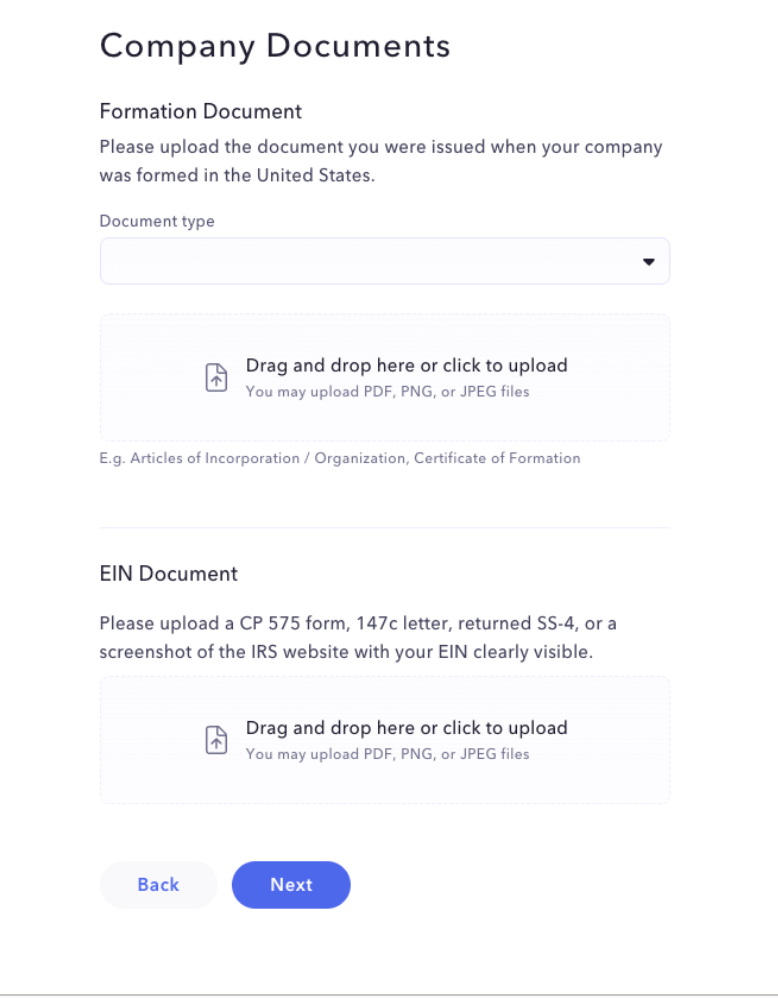

Step 9: Company documents

- If your bank account is for an LLC select “Articles of Organization.”

- If your bank account is for a C-corp then select “Articles of Incorporation.”

- If your bank account is for a LP, select “Certificate/Articles of Incorporation” depending on your document.

- Attach the EIN letter.

Step 10: Expected Activity

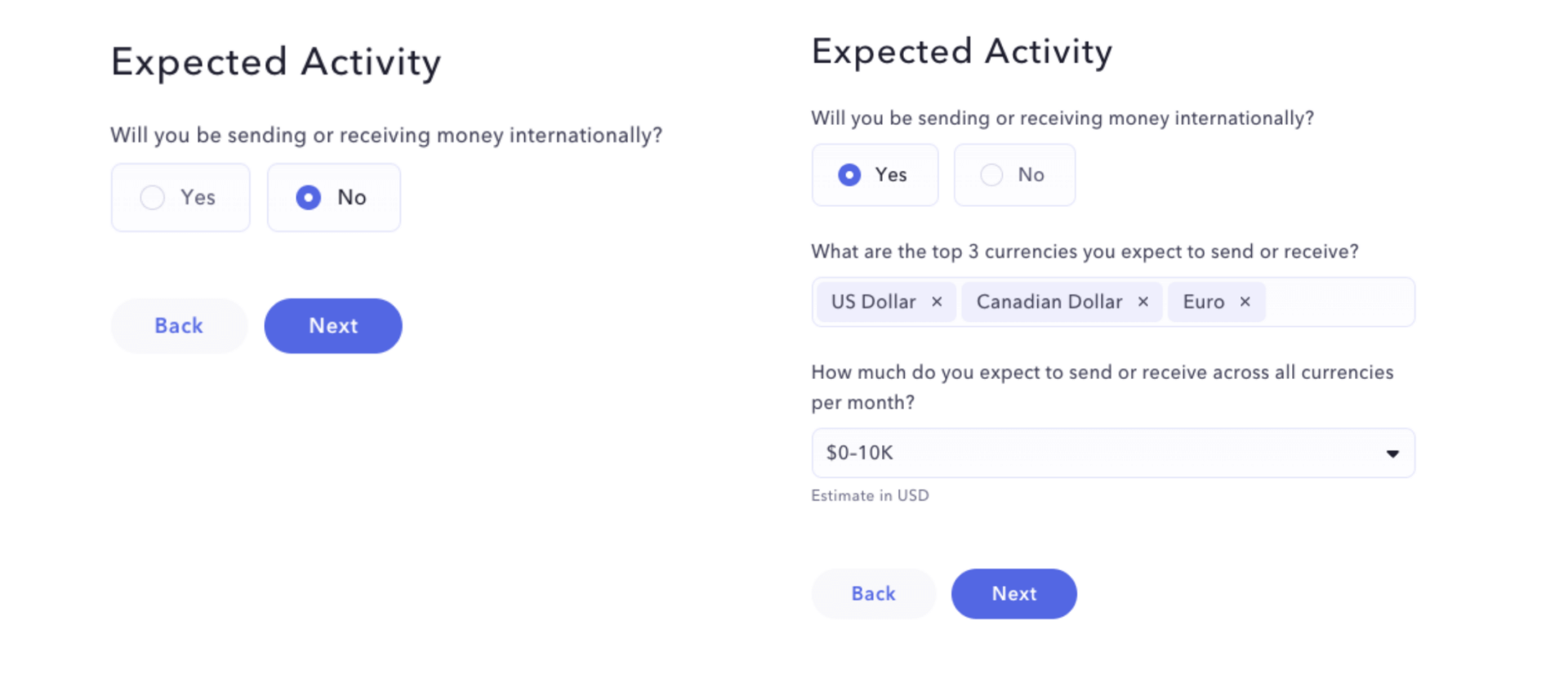

Indicate whether your business involves cryptocurrency and proceed by clicking next.

- Answer “No” if you only intend to receive payments from the US.

- Answer “Yes” if you will be receiving and sending money internationally. You will need to select top 3 currencies and how much you expect to receive and send per month.

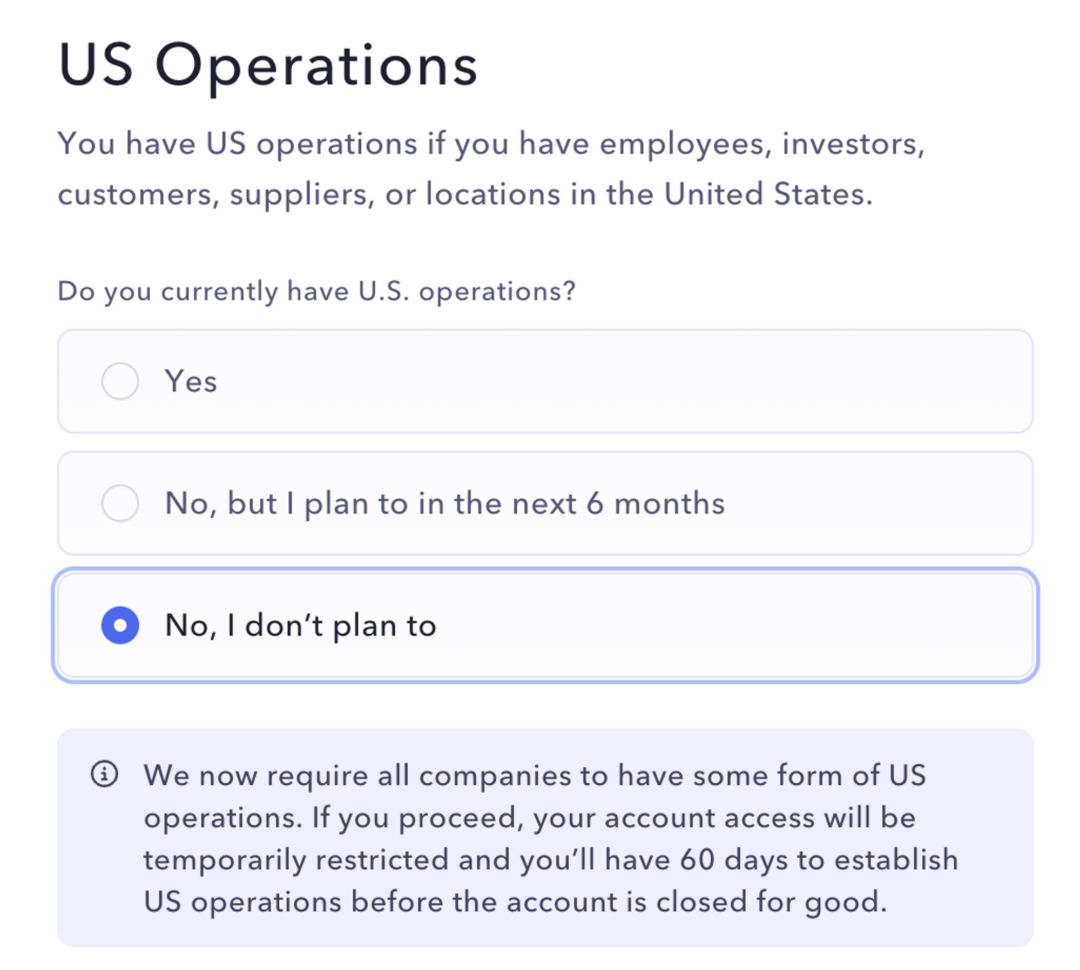

Step 11: Follow-up questions

You will be asked several follow-up questions in this section.

Mercury now requires the Beneficial Owner to establish some form of US operations within six months of opening the account. This is a compliance measure mandated by their banking partners and government regulations.

This guideline by Mercury outlines the acceptable attributes and documents that can be presented to fulfill the US operations requirement. We recommend you refer to it for the latest updates.

Step 12: Verify your physical address

If you don’t reside in the US, it’s the foreign address provided earlier.

Step 13: Review and wait

After submitting all information, Mercury will process it. This will be verified within 1-3 business days and you will receive all information by email, or you will receive a request for more information. Keep an eye on your inbox for anything from Mercury, and check your spam folder (just in case).

This is often simple information that needs to be supplemented.

If you have followed through with the steps correctly and your business does not fall under restricted types, you should be able to successfully open a US business bank account with Mercury.

For any queries during this process, check out the Mercury FAQ section for detailed answers to common questions. Mercury offers various banking features for startups, including FDIC-insured accounts up to $5 million, ensuring your funds are safe and secure.

Should you have any questions while navigating this process, feel free to reach out.

FAQs

What is Mercury?

Mercury is banking for startups. They provide many features, including a checking account, savings account, direct deposits, physical cards, virtual cards, check payments, domestic and international wires, and more.

Deposits are FDIC insured up to $5 million, meaning in the case of a downside scenario where the bank fails, up to $5 million of your funds will be protected, and this is critical to ensure that you have peace of mind your funds are safe.

How much does it cost to use Mercury?

Mercury is free to use, meaning you don’t pay costs upfront. However, for certain advanced features, there might be fees, which you can see here.

Can you apply for a Mercury account if you are a non-US resident?

Yes. You can see here the exact entity types and countries that Mercury accepts companies from. You can also see here the restricted list of countries, and this is critical. If you are a founder living in any of these countries, you will not be able to open an account with Mercury.