Formation

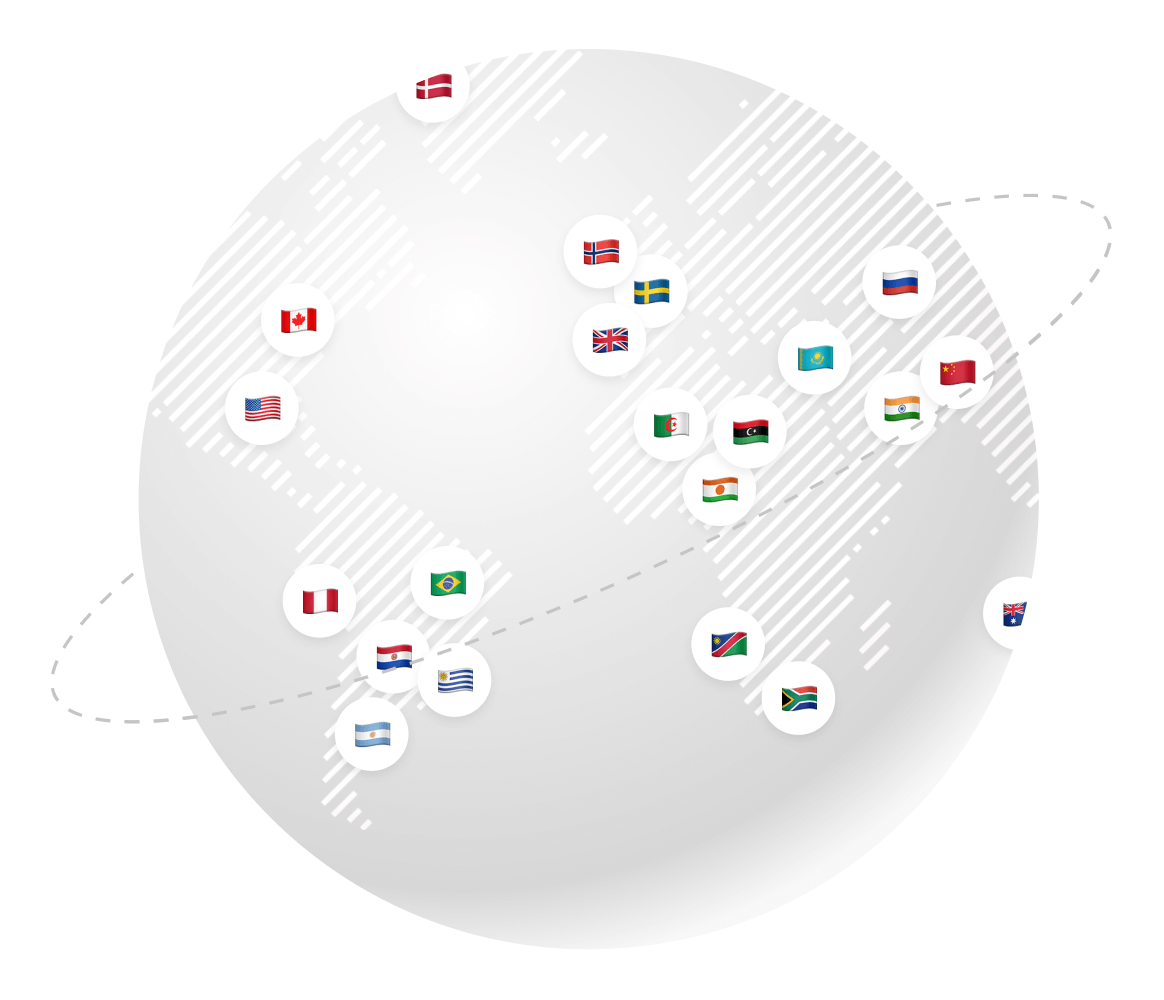

Form your US company from anywhere in the world

Form an LLC to monetize your US presence.

A Limited Liability Company merges partnership flexibility with corporate liability protection. It shields your personal assets from business debts, simplifies management, and allows for pass-through taxation, making it a popular choice for small businesses.

- Sylvia 👩

- Amazon Seller 📦

- Started a US LLC 🚀

- From Italy

Establish a C-Corp for global growth.

Empower your startup with a C-Corporation—crafted for growth and attracting investors. Offering liability protection and diverse funding options, it’s ideal for entrepreneurs aiming at significant expansion and actively seeking external investments.

- Mélina & Léo 🤝

- Co-founders 🛠️

- Started a C-Corp 🚀

- From France

Forge the future with a DAO LLC.

Step into the future with a DAO LLC, merging LLC flexibility with blockchain tech. Transform governance for transparency, autonomy, and innovation—an ideal option for shaping decentralized structures and revolutionizing decision-making processes.

- Spencer 👱♂️

- Software Engineer 🖥️

- Started a DAO LLC 🚀

- From NYC

Learn about business structures

LLC

- Great for small businesses due to more flexibility

- Simple management structure and easier to operate

- Less paperwork, corporate restrictions, no meeting requirements

- Ownership represented by members (LLCs cannot issue stock)

C-Corp

- Great for startups fundraising from investors

- Ability to raise capital by issuing stock; ownership represented by shareholders

- Management structure with more operating requirements

- More paperwork and corporate requirements such as annual meetings and minutes

DAO LLC

- Great for companies that primarily operate on-chain under a Decentralized Autonomous Network

- Simple management structure and easy to operate via smart contracts

- Legal Protection for the owners from lawsuits or legal procedures

- DAO LLC ownership represented by owners % ownership in the LLC. (LLCs cannot issue stock)

Getting started is easy

Learn how to start an LLC

in every state

Select your state

Learn how to start an LLC from any country

Not convinced yet?

The worlds best performing companies trusted doola with forming their business in the US.

Backed by the best

Latest blogs

FAQs

Why should I get an LLC and a business bank account?

Forming an LLC and opening a business bank account are essential steps to protect your personal assets and streamline your finances. An LLC limits your personal liability in case of legal or financial issues, while a business bank account helps you separate personal and business finances, making tax preparation easier and ensuring a more professional image for your business.

Do I need to be a US citizen to work with doola?

No, you don’t! We work with entrepreneurs from around the world to get their businesses incorporated. Don’t take our word for it, though; check out our TrustPilot Page to hear what people globally have to say about doola.

What is an LLC (Limited Liability Company)?

A limited liability company is a formal business structure (created as per state law) where the business is legally distinct from the owner(s). It may have a single owner in the case of a Single-Member LLC or multiple owners in the case of a Multi-Member LLC.

An LLC combines the perks of a corporation (protection against personal liability) and a partnership (pass-through taxation). Since the business has a separate legal existence, the members are not personally liable for the debts and obligations of the Company.

State laws stipulate how LLCs should be incorporated. Some states require specific documents, such as the articles of organization, membership agreement, etc., to be filed with the authorities.

Learn more about LLCs and how they work in FREE ebook.

What information do you need from me to get started?

We don’t need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

Later in the process, you’ll need a passport to set up your bank account.

What is an ITIN?

An Individual Tax Identification Number (ITIN) can be used as an alternative for a Social Security Number (SSN) in some cases and is not a requirement in most cases. However, you will be required to have one if you wish to apply for a PayPal account or certain bank accounts. We walk you through how this process looks like in our guide!

Still have a question?

Schedule a free consultation with an expert from doola, today.

Start your dream business with doola today

Sit Back & Relax. We’ll Handle the Rest.