do. Formation Faster

Launch your US business from anywhere in the world. We handle the paperwork, filings, and compliance so you can focus on building your vision.

Start Smart. Stay Compliant.

Start Your U.S. Business

We help you start your business in the United States, ensuring compliance from day one.

Business Documentation

We help you get essential documents for banking, taxes, and e-commerce, including an operating agreement and articles of organization.

Registered Agent Service

We provide a trusted Registered Agent to receive important government documents on your behalf, keeping your business compliant.

Sales Tax & Reseller Certificate

Setup your business for sales tax and get a reseller certificate, ensuring compliance while unlocking tax-exempt purchasing for your business.

Dedicated Bookkeeping

We manage your books while our software syncs with your bank accounts and Stripe, tracking and categorizing every transaction.

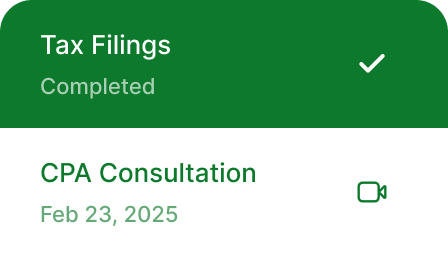

Business Taxes

We handle your annual tax paperwork with our in-house tax and CPA teams to maintain good standings and avoid hefty penalties.

Launch in No Time.

Step 1

Submit Your Information Through Our User-Friendly Dashboard

To kick off the process, you’ll need to provide some basic information about your future business.

- Company Information (Preferred Name, Entity Type, State, and a Few Other Basics)

- Members Information (Legal Name, Address, Ownership, and a Few Additional Details)

15 minutes

Step 2

Start Your U.S. Company in Any of The 50 States

We help you set up everything you need to start your business in any state.

- Company Formation in Any U.S. State

- Operating Agreement & Articles of Organization

- Registered Agent Service for Secure Document Handling

1 week (on average)

Step 3

Secure Your Business

Documentation

We secure your Business Documents needed for opening a business bank account, hiring employees, and filing taxes.

- Essential Business Documents

1 – 2 business days (US residents)

4-6 weeks (on average) (non-US residents)

Step 4

Set Up Your

U.S. Bank Account

Once you get your business documents, you can apply for a U.S. bank account through our partner portal

- Business Documents Required

- Passport Required (for International Clients)

3 – 5 business days

Step 5

Run & Grow

Your Business

Your business is fully set up and compliant, so you’re ready to dive into your work with confidence.

- Additional Services Keep your company on track with our Bookkeeping and Tax services.

- Stay Compliant For full compliance support, consider starting with Tax and Compliance.

Siddharth is an

Amazon Seller who

started a US LLC

from India.

Limited Liability Companies (LLC)

A Limited Liability Company (LLC) is a flexible business structure in the U.S. that offers personal liability protection and can have one or multiple owners (called members). It’s popular among small business owners and entrepreneurs for its simplicity and tax flexibility.

- Limited liability protection for owners

- Simple management structure and easy to operate

- Unlimited owners (U.S. and international)

- LLCs cannot issue stock

- Ownership represented by members

Sam & Melina are

Co-founders

who started

a C-Corp

from France.

C-Corporation (C-Corp)

A C-Corporation (C-Corp) is a type of business entity that is legally separate from its owners, providing strong liability protection. It’s the default corporation type in the U.S. and is often chosen by businesses that plan to grow and attract investors.

- Limited liability protection for owners

- Ability to raise capital by issuing stock

- Ownership represented by shareholders

- Management structure with more operating requirements

Jessica is a

Software Engineer

who started an

S-Corp from

New York.

S-Corporation (S-Corp)

Only U.S. citizens or residents can be shareholders.

An S-Corporation (S-Corp) is a business structure that offers limited liability like a corporation but with the tax benefits of a pass-through entity. Profits and losses pass directly to the owners’ personal income, avoiding double taxation.

- Limited liability protection for owners

- Pass-through taxation

- Ability to raise capital by issuing stock

- Only U.S. citizens or residents can be shareholders

- Limited to 100 shareholders or fewer

What If Today Was The Day?

Your dream business is waiting, let’s get it off the ground.

Starter

Formation + Registered Agent + Virtual Address - the essentials to get a U.S. Business Bank Account.

$297/yr

+ State Fees

Essential Reads for Do’ers.

The Extras That Set You Up for Success.

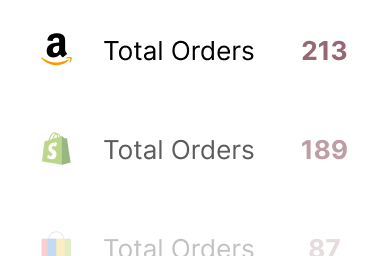

Smart Sales Analytics

Know what’s selling, what’s not, and how to boost your revenue.

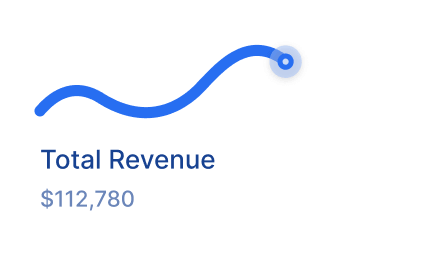

Seamless Bookkeeping

No spreadsheets, no hassle. Just real-time financial insights.

Stress-Free Taxes

Stay compliant, save time, and never stress about tax season again.

10,000+ Founders

Built for Founders. Loved by Founders.

doola handled Flagaholics’ legal and financial setup so we could focus on growth & delivering a great customer experience.

Adam Fuller

Co-Founder of Flagaholics

The ease of setup, combined with the resources available through doola, helped me get things done efficiently.

Deon Bryan

CEO at Viteranz

FAQS

Frequently Asked Questions.

What is doola?

Do I need to be a US citizen to work with doola?

Why should I get an LLC and a business bank account?

What information do you need from me to get started?

We don’t need any documents to get started. We just need a few pieces of info from you:

- Your Company Name

- Your Personal Address

- Phone Number and Email (For contact purposes)

To set up your business bank account, you’ll need an international passport or U.S. government identification document for each founder or majority owner of the company. See here for everything you’ll need to open a Mercury business banking* account.

*Mercury is a fintech company, not an FDIC-insured bank. Banking services provided through Choice Financial Group and Column N.A., Members FDIC.

What is doola Bookkeeping?

Can doola help me with my business taxes?

Who is doola Analytics for?

doola Analytics is designed for e-commerce business owners to help track sales, manage orders, and monitor financial metrics in a simple, intuitive dashboard. For the initial product launch, doola will offer integrations with Shopify and Amazon, but will continue to expand to add more integrations.

Can doola help me with sales tax and reseller certificates?

Still have a question?

Book a demo with an expert from doola, today.

Less blah,

More doola.

Join doola and start building today.