Stay on top of bookkeeping and taxes

Falling behind on business taxes or bookkeeping? Our experts will organize your records, file your back taxes, and ensure you’re compliant with the IRS.

Solutions for your business challenges

Overdue taxes

Let us clean up your financials and get everything back on track, so you can move forward with confidence.

Need tax help

From tax preparation to expert advice, we provide the guidance you need to navigate tax season with ease.

Business loans or closure

We’ll help you organize the financial documents required to secure loans or smoothly close your business.

Why doola

Falling behind on business taxes is stressful

Get dedicated supports from experts

Let us handle the hard work. Your dedicated team will guide you every step of the way, with a personal point of contact and regular updates to keep you connected.

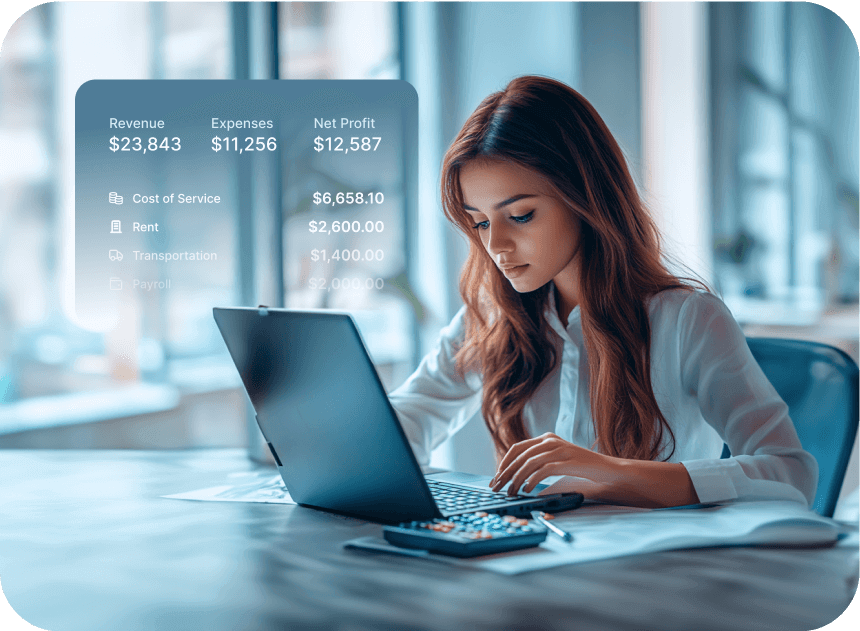

Fast, accurate, and tax-ready books

Behind on your books and tax filings? Whether it’s a few years or more, our expert team will work with you to identify what’s needed and help gather documents, so your books are up to date and IRS-compliant—taking the guesswork out of your finances!

Lower the risk of IRS late filing fees and interest charges

Feeling overwhelmed by IRS letters and years of unpaid taxes? Up-to-date financials are key to reducing your tax penalties. We’ll provide a Year-End Financial Package for every year of catch-up bookkeeping, helping you get back on track, filed, and worry-free.

Stay on top of your bookkeeping without the hassle

Once you’re caught up, leave the bookkeeping to our experts and streamlined software, so you can relax and keep your attention on building your business.

Take control of your finances

Without doola

- Behind on bookkeeping and tax filing

- Late penalties and fees

- Notices from the IRS

- Missed opportunities for tax savings

With doola

- Up to date, accurate financials

- Back taxes filed

- Full IRS compliance

- Complete peace of mind

How it works

Step 1

Get a free consultation

Falling behind on taxes can feel overwhelming, but you don’t have to face it alone. Our experts are here to guide you through the process.

Step 2

Assess what you owe

We’ll provide insight into the IRS’s records so you can see exactly what’s due and avoid any surprises.

Step 3

We handle your bookkeeping

Accurate financials are the key to getting back on track. Our team works with your dedicated bookkeeper to upload documents and reconcile your books.

Step 4

Tax-ready financials from experts

After we complete your bookkeeping, we’ll review your year-end financial packages together and provide everything you need to file.

Step 5

Ongoing bookkeeping in our hands

Transition to our dedicated bookkeeping service to keep your finances organized. We’ll provide monthly statements and insights to help you grow your business.

Trusted by 10,000+ U.S. business owners

Exceptional Service

Great company. Very clear and precise with the services provided. Extremely helpful customer success people will help you through the whole process, which is already very simple and very well explained.

Sr Gonzalo Cozzi

Professionalism on Steroids

If you are looking for a customer-centric agency with extraordinary communication, professionalism, and speed, there is no alternative to doola (and I’ve tried several others). Price-service relation is unbeatable. One of the few internet companies I am really enthusiastic about.

ADK

Beyond 4-Stars

I don’t know how anyone can even put a 4-star review… doola really gets you the same things just at a better quality, speed, and price. If doola had a supermarket, I would buy from there. If doola had a university, I would study there. Just an amazing company.

Maxim Kraynyuchenko

FAQs

What is dedicated bookkeeping?

With dedicated bookkeeping, a human bookkeeper will get to know your business, bring your books up to date, and do your book for you, start to finish.

What tasks does my bookkeeper perform?

Your bookkeeper will categorize your transactions, reconcile your accounts, generate your financial statements and close your books for tax time by working with you. While occasional input from you may be needed for specific transaction categorizations, we aim to make the bookkeeping process as effortless as possible for you.

How much does dedicated bookkeeping cost?

Dedicated bookkeeping is billed annually and cost $1999.

I’m behind on my bookkeeping and taxes. Can you help me get caught up?

If you’ve fallen behind on your bookkeeping and taxes, our specialized Catch-Up Bookkeeping service is designed to help you get back on track. We’ll assist with organizing and updating your financial records, ensuring everything is accurate and compliant.

Still have a question?

Book a demo with an expert from doola, today.

Join thousands of online businesses growing faster

Book a demo with our friendly team of experts.

Try our Bookkeeping Software free for 30 days.