Language:

How to set up an LLC in Dubai (UAE)

Have you ever wondered if you can start an LLC from Dubai? In this article, we'll show you exactly how to register a US-based LLC from the UAE.

Are you looking to set up an LLC in Dubai or the United Arab Emirates (UAE)? While you can’t form an LLC in Dubai, you can form a US-based LLC for your UAE company and operate it remotely from Dubai.

In this article, we’ll show you how to do just that. We’ll cover the cost of forming a Limited Liability Company (LLC), what you should start doing, and how our service can help you get everything set up quickly and easily. So if you’re ready to get started, read on!

What is an LLC?

An LLC is a Limited Liability Company. It’s a business structure that allows the distinctions between corporations and partnerships. It’s a popular business entity option for entrepreneurs in the US because an LLC has members rather than shareholders, and its members share its profits and losses.

One or more people can form an LLC. The members of an LLC are not liable for the company’s debts and liabilities. The member’s assets are protected if the LLC goes into debt.

An LLC is a flexible business structure to suit various businesses’ needs. For example, an LLC can be used to hold real estate or to operate a business.

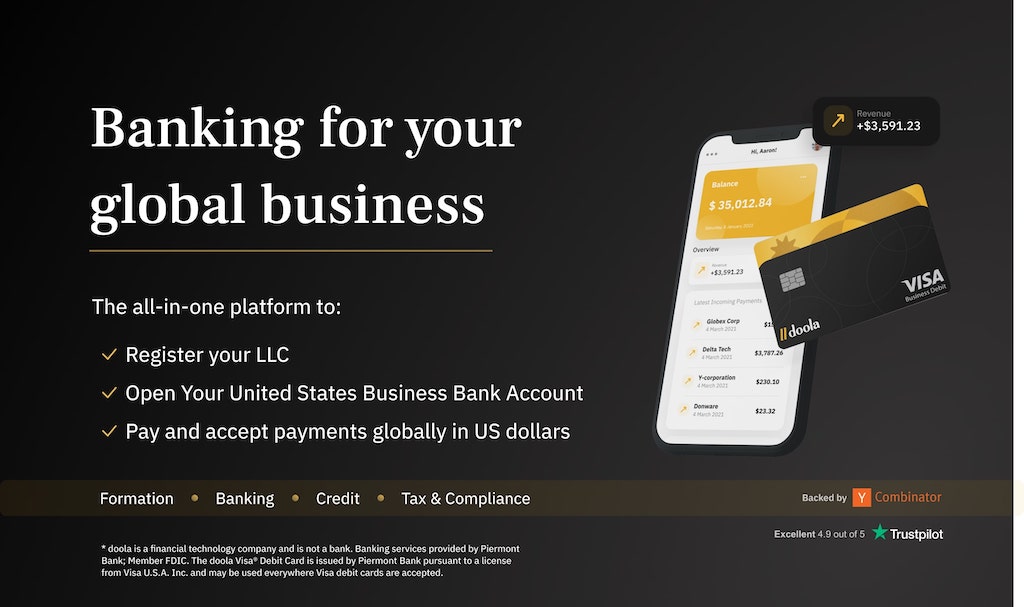

You might consider an LLC formation if you have business activities in Dubai / UAE. Our service doola can help you set up an LLC remotely without being a U.S. resident.

Cost to form a Dubai LLC

While setting up an LLC in Dubai, you may wonder about the cost. While you can’t form an LLC in Dubai directly, you can use a service like doola to form a US-based LLC for your Dubai company and operate it from Dubai. Our service costs $197 + Wyoming state fees ($100), for a total of $300 for a remote company setup experience.

“The things that you probably think less about wanting to do are making legal filings, or registering your company. Having someone like doola take care of that really does save your time and allows you to focus on the higher value pieces that can really drive your business going forward.” — Zach Ranen, founder of RAIZE, Based in New York

Using our service is of an LLC without being a U.S. resident. We would handle all paperwork and file for you, so you can focus on the things you love. Plus, we have a team of experts available to answer any questions you may have along the way.

If you’re ready to start, feel free to learn more about our incorporation process.

Six steps to setting up an LLC in Dubai

Setting up an LLC in Dubai, there are a few steps you’ll need to follow.

1. Come up with a name for your LLC

Choosing a company name for your LLC is essential in the business setup process. All official correspondences will carry your chosen name, so it’s important to choose a professional name that reflects the business you’ll be conducting.

Setting up an LLC requires a few considerations:

- It’s important to check with the Dubai Department of Economic Development to ensure the name you want is available and not already in use.

- The name must include “Limited Liability Company” or “LLC” to indicate that it is a legal entity.

- Avoid using words that might be considered offensive or suggestive in any way.

To establish an LLC, you must name it, and you can begin setting up your company by visiting doola our team can help you with all the paperwork and steps necessary to get your business up and running quickly and smoothly.

2. LLC company formation with an RA (Registered Agent)

When forming an LLC in Dubai / UAE, you’ll need a Registered Agent (RA) — regardless of the type of business activity you engage in. The R.A. is responsible for receiving and forwarding important legally required documents on behalf of the LLC.

According to the secretary of state, every LLC must have a registered agent who lives where it was created and agrees to take official notice on behalf of your business. This registration ensures that you, as the owner, are notified when a legal summons or tax-related documents arrive at your company.

Suppose you have family members or friends living within the state. In that case, they may register as your registered agent – but only if they agree to publicly provide their contact information and work at least five days per week.

After reading this, you can learn more about a registered agent and whether it would benefit your situation as an international founder.

3. Get a physical mailing address in the U.S.

If you’re forming an LLC in Dubai / UAE, you’ll need a physical mailing address in the United States. You can’t use a P.O. Box as your registered address, so you’ll need to find a physical address that you can use. One can try a few approaches to this.

One option is to use a friend or family member’s address. This person will need to be willing to act as your Registered Agent (RA) and forward any important documents they receive on your behalf. If you choose this option, make sure you have a way to check your mail regularly, as your R.A. may not be able to hold onto it for long periods. Also, be aware that LLC documents are public records. So for privacy reasons, it’s best not to use a home address to file your LLC with.

Another option is to use a commercial mail-forwarding service. These companies will provide you with an address in the U.S. and forward any mail they receive on your behalf. This can be a convenient option, but it can also be more expensive than using a friend’s or family member’s address.

That’s where doola stands out because we provide an easy, less expensive way to get a real address through one of our partners.

4. Get your EIN

The section explains how to get your EIN. First, you must have a physical mailing address in the United States to form an LLC in Dubai / UAE. You can use a friend’s or family’s address or a commercial mail-forwarding service, but I wouldn’t advise.

You will need an EIN to open an LLC in Dubai / UAE. In the United States, the EIN is a nine-digit number assigned by the IRS for tax purposes. To get an EIN, you must file Form SS-4 with the IRS. The filing process can be completed online, by mail, phone, or fax. Let doola do the work for you by getting your EIN for you! In the absence of a Social Security Number, regardless of whether you’re a U.S. citizen or a non-resident, doola can help.

5. Apply for a U.S. business bank account

You must have a U.S. business bank account to open an LLC in Dubai / UAE. Once you have your EIN, you can apply for a U.S. business bank account. You’ll need to provide the bank with your EIN and basic information about your business. The bank will then review your application and decide whether or not to approve it. If

You won’t need to visit any U.S. bank in-person – because you can open it from the comfort of your own home! We know the struggle of looking for the perfect bank; we’ve done all the research and vetting already, so you don’t have to! Let doola help you find your U.S. business bank account today!

6. Set up your payment processor(s)

Assuming you want a section discussing setting up payment processors for an LLC in Dubai:

If you are setting up an LLC in Dubai, you will need to set up a payment processor to accept clients’ payments. There are a few different payment processor options, so you must choose the one that best suits your needs.

One option for a payment processor is PayPal. PayPal is a popular choice for businesses because it is easy to use and accepted by many businesses worldwide. To set up a PayPal account, you must create an account on the PayPal website, and then you can connect your bank account or credit card with your PayPal account. Once your bank account or credit card is linked, you can accept clients’ payments. Learn about your options for setting up a U.S. PayPal account for your business on our website!

Another option for a payment processor is Stripe. Stripe is similar to PayPal because it is easy to use and is accepted by many businesses worldwide. To set up a Stripe account, you must create an account on the Stripe website and then link your bank account or credit card to your Stripe account. Once your bank account or credit card is linked, you can accept clients’ payments.

So, you live outside of the U.S.? Find out how you can still create a US Stripe account, what options you have, and find the perfect plan. doola can make it happen.

There are also several other options for payment processors, so be sure to research your options before choosing one. Whichever payment processor you choose, set up your account before starting your LLC so you can start accepting payments from clients immediately.

LLC in Dubai takes how long to get set up?

Interest in setting up a USA LLC from Dubai has recently increased. There are several reasons for this, including that a USA LLC can offer greater flexibility and stability than other business structures. Setting up a USA LLC from Dubai is not as difficult as some might think, and in most cases, it is simple to complete, with only a few quick steps.

The first step is to give your LLC a name. This name must be unique and not be confused with any other business entity. Once you have chosen a name, you must register it with the Department of State. The next step is to obtain an Employer Identification Number (EIN) from the IRS. This number will be your company’s tax identification number when filing taxes and opening bank accounts.

After registering your LLC and obtaining an EIN, you must draft operating agreements. These agreements outline your LLC’s foreign ownership structure and how members share the profit and loss. Once you have drafted your operating agreement, you must file it with the state where your LLC is registered.

Depending on the state where your LLC is registered, additional steps may be required to get your business up and running. In most cases, however, setting up a US LLC from Dubai can be done relatively easily and without much hassle.

Getting LLC set up takes a lot of time, so there is no one-size-fits-all answer to this question. An LLC from Dubai can vary depending on several factors. However, the process typically lasts from a few days to a few weeks.

While it may seem like a lot of work to set up an LLC in Dubai, it is quite simple using the doola service. Follow the steps outlined above, and you’ll have your LLC set up in no time!

Task requirement

If you’re considering starting an LLC, it’s important to know the annual tax filing requirement. LLCs are required to file a yearly tax return with the IRS. The tax returns for the year just ended are due on April 15, four months after the end of the year, regardless of when the year ends. For example, if your firm’s fiscal year ended on December 31, your tax return would be due on April 15. Failing to file an annual return can result in late filing fees and penalties, so it’s important to keep up with this requirement. If you’re unsure how to file your LLC’s annual tax return, you can consult an accountant or tax attorney for help.

Conclusion

Setting up an LLC in Dubai is a great way to expand your business into the UAE. The process is pretty straightforward, and it’s possible to do it all online. Entirely online. You can set up your LLC with a few clicks and be ready to do business in Dubai.

Thanks for reading! This guide has helped you better understand the process of establishing an LLC in Dubai. Contact us if you have any questions; we’ll be happy to help.