Why You Need doola Total Compliance for Your Business

Let’s set the record straight once and for all!

Depending on your situation you may not have to pay US taxes, but you will 100% be required to file taxes with the IRS every year regardless.

All US LLCs and C-Corps are required to file taxes with the IRS each and every year.

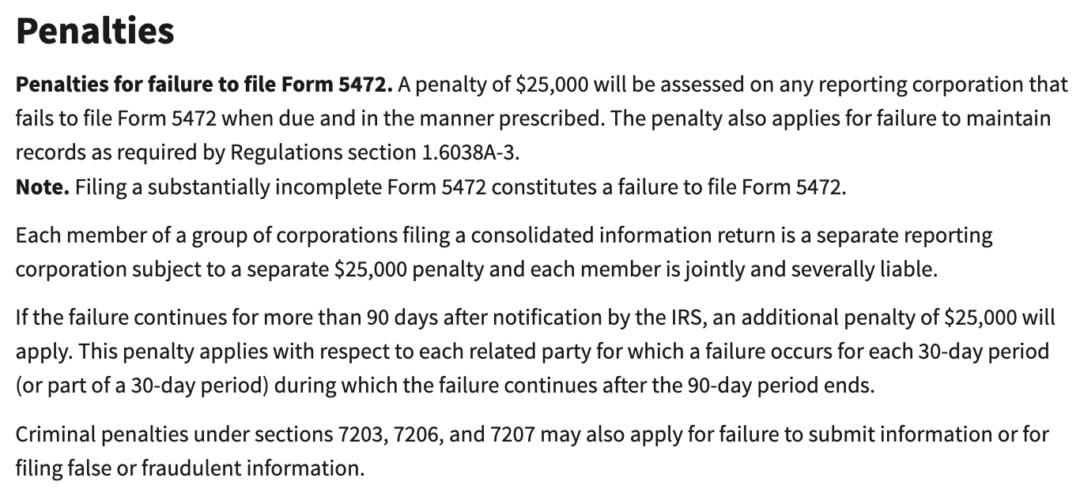

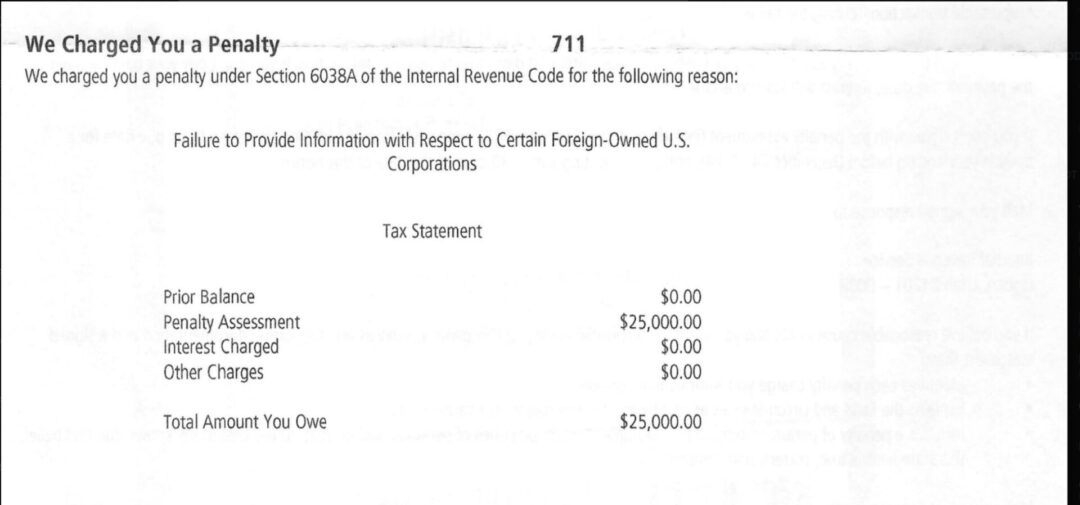

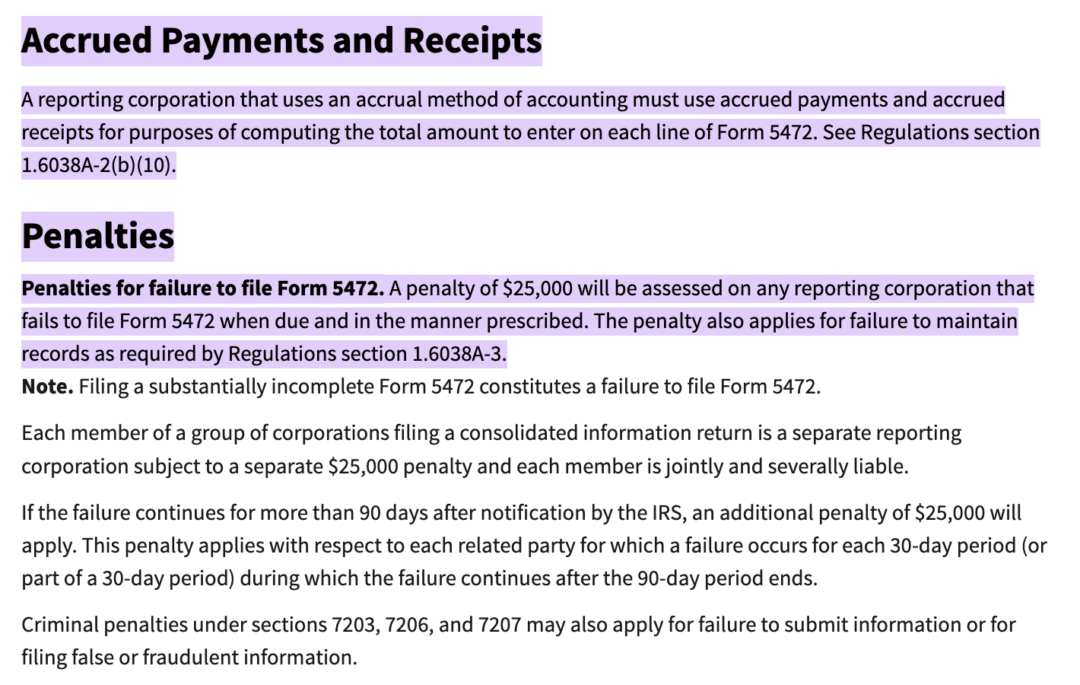

Per the IRS, penalties for failure to file tax forms can be as high as $25,000:

Let’s state this one more time because it’s very important:

Your company may also be liable for non-compliance penalties & late fees which can reach up to $25,000 + interest if these forms are not filed correctly.

doola is here to help you avoid these penalties and stay 100% compliant.

This is why we built an All-in-One business compliance solution.

Introducing the Total Compliance package which includes:

- Formation

- EIN

- Registered Agent

- Bookkeeping Tools

- Annual State Filings

- Federal Tax Filings

- Dedicated Account Manager

- and much more!

Grow your business and let doola handle your business compliance needs.

Focus on what you do best, while doola handles the rest.

How much does the Total Compliance plan cost? Is it worth it?

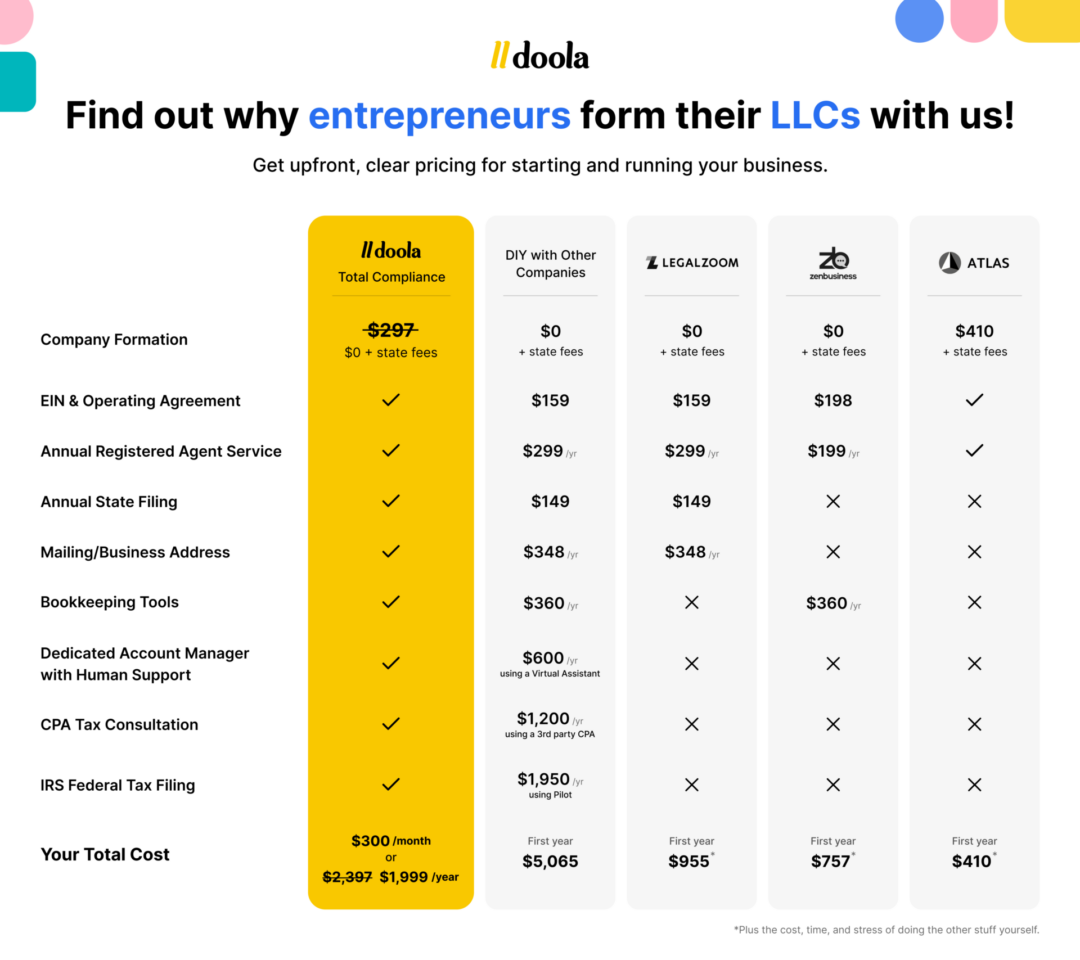

doola’s Total Compliance plan is priced at just $300/month + one-time state formation fees, or you can save $1600 and pay only $1999/year + one-time state formation fees.

But wait, it gets even better: doola is tax deductible and pays for itself in months.

Taxpayers can deduct $5,000 of startup costs and $5,000 of organizational costs in the year in which the business begins.

These expenses have to be accounted for in the business books of account to be eligible as a tax expense & the receipts of the same also need to be saved and maintained. Not accounting for these transactions can lead to this benefit being fully missed.

Examples:

1. Startup Costs – Costs incurred to prepare to enter into the trade or business, to secure suppliers and customers, and to obtain certain supplies.

2. Organizational Costs – Legal and accounting fees, costs of state filings, expenses of meeting with members, directors, shareholders, or partners.

You can see in the chart below which calculates the increased cost and stress it would take for you to do it yourself.

Why go through the headache of stacking multiple platforms when you can save money and accomplish all your needs in one place with doola’s All-in-One solution?

You might be wondering, what do you get for paying $300/month or $1999/year?

Save Time, Money and Stress

Our Total Compliance plan includes everything your new US business will need to stay legal and compliant with the US government, at a fraction of the cost, compared to alternatives or doing it on your own.

This plan includes the following services:

- Company Registration/Formation

- Top Priority Filing

- Name Availability Search

- Operating Agreement/Corporate Bylaws & other company formation documents

- EIN (Tax ID) from the IRS

- EIN Expedited Included

- Usually costs $300 additional + it will save you 4-5 weeks in your setup process

- Guidance in opening a US Business Bank Account

- Guidance in opening a US Payment Gateway

- Registered Agent Service

- Required service as per US laws for 1 year

- US Virtual Business Address

- To use for client communication and opening of a US bank account for 1 year

- US Mailbox Service

- To receive documents at your business address for 1 year

- US Mail Scan Service

- To scan and share the documents received for your LLC for 1 year

- Digital Document Access for 1 year

- A dedicated Account Manager for 1 year

- Annual State Reminders for 1 year

- Annual State Filing

- State fees have to be paid by you

- doola Books

- Self Serve bookkeeping tool with invoicing tools

- 4 CPA tax consultations/year

- IRS Business Tax Reminder

- IRS Business Tax Filing

What is the value of the Total Compliance Plan?

You’re not thrown to the wolves after forming your company.

We’ve heard time and time again from founders that after they formed their company, they would feel like they had been left to fend for themselves with zero guidance of what’s next.

They didn’t want a checklist of things to do… they wanted a partner that could guide them, and do it for them.

Our Total Compliance package does just that!

It helps you start and maintain your business. While we take care of all the unsexy, yet critical back-office work required to keep your business 100% compliant.

And you get a dedicated account manager, along with quarterly CPA consultations so you have a trusted partner with you, each and every step of the way.

Can I upgrade later? Or should I start with Total Compliance?

The majority of founders who work with doola start with Total Compliance. And that’s because the most expensive mistake you can make as an entrepreneur is oftentimes the “cheap” or “easy” decision.

Most founders also start with Total Compliance because staying compliant, and the consequences of not being 100% compliant, is a Type 1 decision:

Jeff Bezos from Amazon talks about Type I and Type II decisions:

Type 1 Decisions: “Some decisions are consequential and irreversible or nearly irreversible – one-way doors – and these decisions must be made methodically, carefully, slowly, with great deliberation and consultation. If you walk through and don’t like what you see on the other side, you can’t get back to where you were before. We can call these Type 1 decisions.”

Type 2 Decisions: “But most decisions aren’t like that – they are changeable, reversible – they’re two-way doors. If you’ve made a suboptimal Type 2 decision, you don’t have to live with the consequences for that long. You can reopen the door and go back through. Type 2 decisions can and should be made quickly by high judgment individuals or small groups.”

The takeaway here is that from day 0, it is critical to set up your business for success and handle all of your compliance needs.

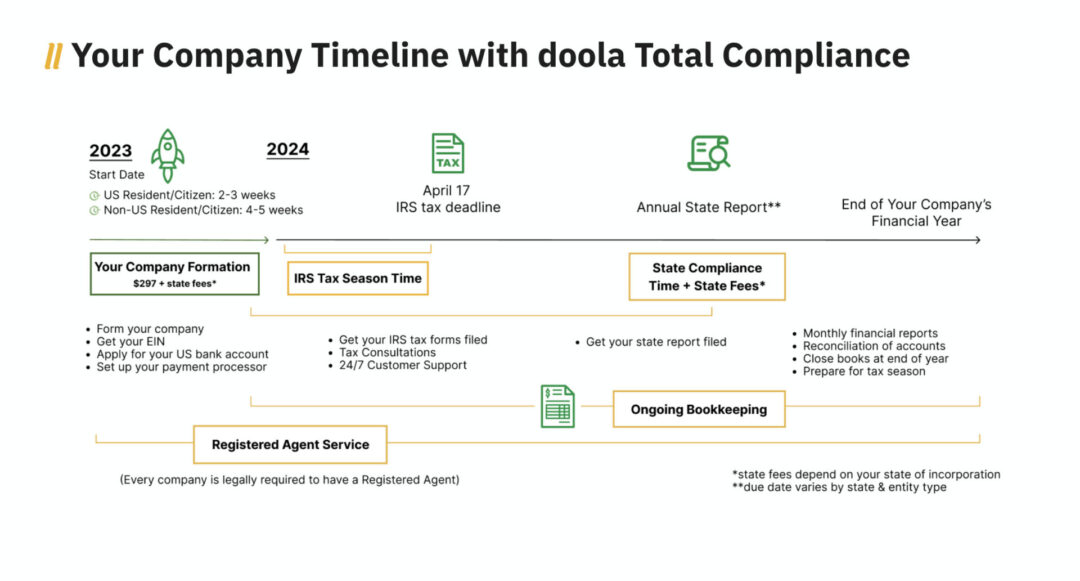

And the truth is, your compliance needs are ongoing and start from day 0. Check out this visual which walks through all of your compliance requirements, and how doola can help you satisfy them, year over year, with doola Total Compliance.

Our Total Compliance plan helps both USA and International Founders save a lot of stress & avoid more than $25,000 in penalties, late fees, and interest as it ensures the following:

1. Your company is active and in good standing with the State.

2. Your company is not at risk of dissolution.

3. Your company is not liable for non-compliance penalties & late fees which can go up to $25,000 + interest.

4. Your track record in the US is clean and you can build good credit in the US which can help you acquire a loan or a US credit card.

5. Your company can do business stress-free and more professionally, as we take care of all your taxes and compliance filing burden.

We have seen founders from around the world become liable to pay very high fees, by making simple tax mistakes and taking on the risk of not being compliant with the IRS.

Subscribing to doola’s Total Compliance plan takes the load off your shoulders and gives you the peace of mind that you have a full-scale team working non-stop!

At doola we not only help you start and grow your company, but we also make sure to keep your LLC in good standing and compliant with the law.

What additional fees do I have to pay?

There are state fees upon formation and annual state fees (which doola can file for you as part of our annual filing process).

Every U.S. LLC and C-Corp is subject to state fees.

These are paid directly to the state you are forming your company in. doola does not make any money from these state fees.

You can see our full guide here on state filing + recurring fees by each state.

Do I actually have to file and pay US taxes? What are the fees for not filing taxes?

Depending on your situation you may not have to pay US taxes, but you will 100% be required to file taxes with the IRS each and every year.

Your company may also be liable for non-compliance penalties & late fees which can reach up to $25,000 + interest if these forms are not filed correctly.

doola is here to help you avoid these penalties!

We have also put together a comprehensive guide of all of the required tax filings for your company depending on your type of business and where you live.

Here are four of the most common types of filings:

Also check out our comprehensive guide on Effectively Connect Income on doola University!

Are my State and Federal tax filings handled by doola?

As a client of our Total Compliance plan, we will handle the two most important annual compliance filings for your company:

1. State Annual Report:

- We will send you a reminder when the State Annual Report must be completed and we will carry out the necessary filings to ensure that your business remains legal and in good standing year after year.

- That’s right we remind you and do it for you!

2. IRS Business Tax Filing:

- By being part of the doola’s ecosystem, you have access to a dedicated CPA for the year!

- We save you time and money while giving you a quick resolution for your questions/transactions.

Likewise, you can always reach out if you have any questions tax-related and we will get you the answers you need.

Furthermore at the time of tax filings, your dedicated CPA will get in touch with you, prepare your filings, and file your returns quickly and accurately.

You do not have to spend time finding a reliable CPA or pay for any extra consultation with a CPA at the last minute.

Are there any discounts on the Total Compliance plan?

You can get access to our Total Compliance services at just $300 per month.

And here’s the best part – you can always upgrade to the annual plan of $1999 and lock in the $1600 annual discount by paying the difference.

I still have questions, can I talk to someone?

Absolutely. You can schedule a free consultation with the doola team, today.

I have an existing business, can I migrate it to doola?

You can migrate your existing business to doola and schedule a free consultation with us to make sure that you are fully covered with all of your compliance needs for a seamless migration.

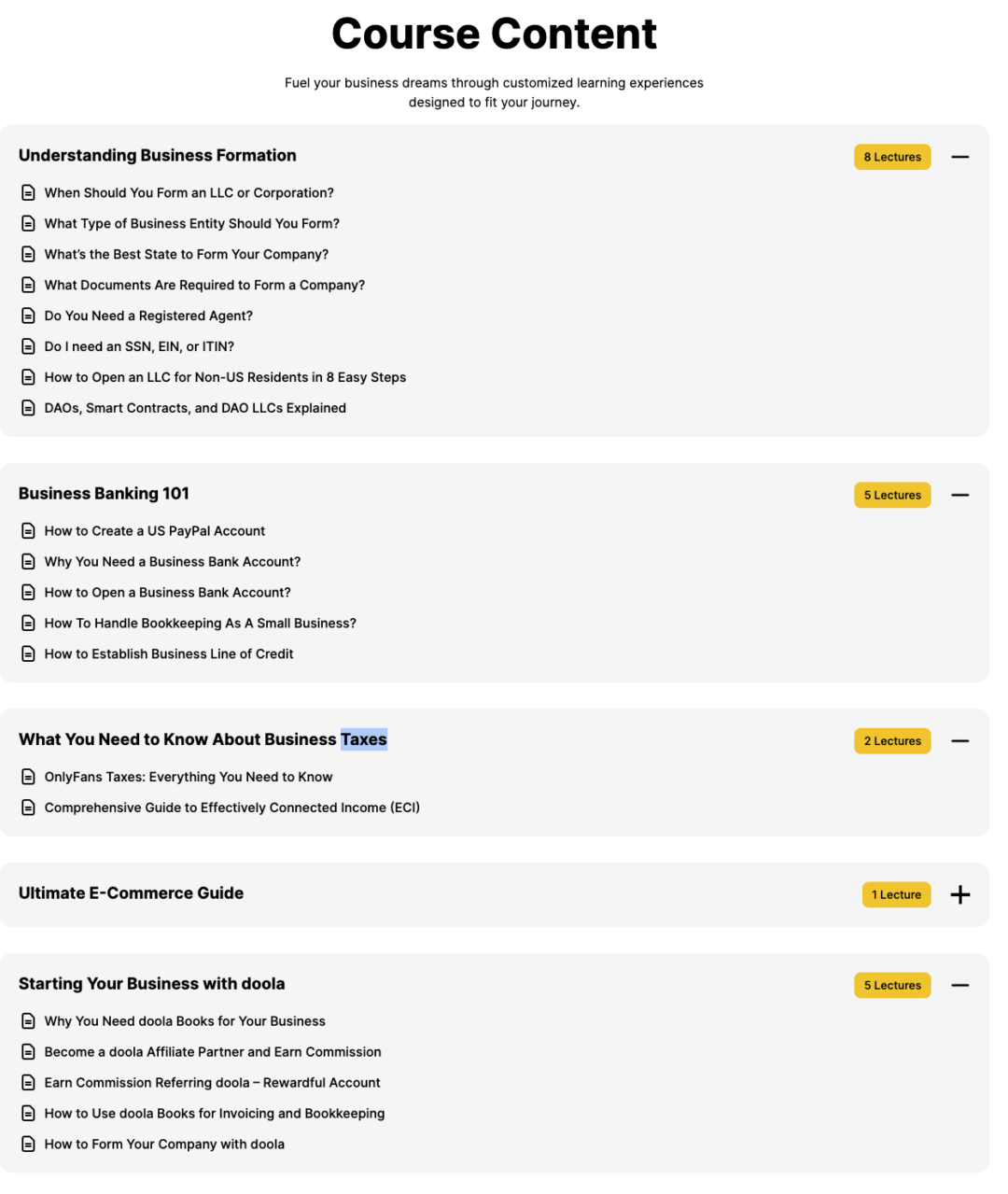

I still have questions on formation, banking, taxes and using doola.

No sweat, we know this can be confusing!

Check out doola University where have custom built courses to walk you through every step of the process.

How do I get started?

If you have any questions, you can schedule a free consultation or you can also watch this video on How to Get Started with doola, and be up and running in less than 10 min.

Keep reading

Get started with doola and launch your US business

Turn your dream idea into your dream US business, today.